- US stock futures trade at record highs

- Tesla (TSLA.US) stock fell 2% despite upbeat quarterly earnings

- Alphabet (GOOGL.US) and Microsoft (MSFT.US) due to report after market close

US indices launched today's session little changed, near record highs as investors await Fed's monetary policy decision on Wednesday. The Central Bank is expected to keep its dovish tone and reinforce it will do whatever is necessary to shore up the US economy and tapering is not expected anytime soon. Market participants also gear up for earnings reports from Microsoft and Alphabet which will be released today after the closing bell.

US2000 is currently testing major resistance at 2305.3 pts. Should break higher occur, then upward move may be extended to the next resistance at 2372.2 pts. However in case buyers will fail to uphold momentum, then nearest strong support lies at 2248 pts. Source: xStation5

US2000 is currently testing major resistance at 2305.3 pts. Should break higher occur, then upward move may be extended to the next resistance at 2372.2 pts. However in case buyers will fail to uphold momentum, then nearest strong support lies at 2248 pts. Source: xStation5

Tesla (TSLA.US) stock fell more than 2.0% in the premarket after the electric vehicle maker posted mixed quarterly figures. Tesla reported quarterly earnings of 93 cents per share, while analysts expected earnings of 79 cents per share. Revenue came in slightly below market estimates. Company’s figures were supported by sales of environmental credits as well as liquidation of some of its bitcoin holdings.

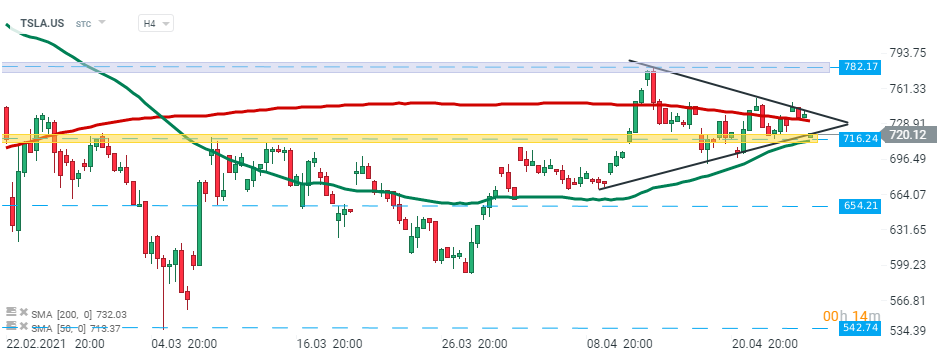

Tesla (TSLA.US) stock dropped 2% in premarket and is currently testing the lower limit of the triangle formation. Should break lower occur then another downward impulse towards support at $654.21 could be launched. On the other hand, if buyers will manage to halt decline here, then upward move may accelerate towards resistance at $782.17. Source: xStation5

Tesla (TSLA.US) stock dropped 2% in premarket and is currently testing the lower limit of the triangle formation. Should break lower occur then another downward impulse towards support at $654.21 could be launched. On the other hand, if buyers will manage to halt decline here, then upward move may accelerate towards resistance at $782.17. Source: xStation5

United Parcel Service (UPS.US) stock jumped nearly 7% in premarket after the company posted better than expected quarterly figures. The delivery service company earned $2.77 per share, compared to an analyst's expectations of $1.72 a share. Revenue also beat market estimates. Company registered a 14% increase in volume from a year earlier, with small- and medium-sized businesses contributing significantly to that increase.

General Electric (GE.US) stock fell nearly 3% in premarket after the company reported quarterly profit of 3 cents per share, compared to the 1 cent a share consensus estimate. Revenue figures disappointed, but free cash flow came in above market estimates.

Hasbro (HAS.US) shares fell 0.5% in the premarket after the toymaker posted mixed quarterly figures. Company's earnings of $1.00 per share came in well above Wall Street projections of 65 cents a share, however revenue came in shy of estimates as TV and movie productions related to its toys were delayed by the pandemic.

3M (MMM.US) stock fell more than 1% in premarket after despite the fact that company posted upbeat quarterly figures. Company earned $2.77 per share, above market estimates of $2.29 a share. Revenue also beat market expectations as the pandemic continued to drive demand for personal safety products.

⌚Boletín Diario de Mercados

Acción de la semana – Lam Research Corp (16.10.2025)

Salesforce sube un 8 % tras presentar un ambicioso pronóstico de ingresos a largo plazo📈

Latam Airlines Colombia busca alcanzar el 30% del mercado con expansión y nuevas rutas

"Este informe se proporciona sólo con fines de información general y con fines educativos. Cualquier opinión, análisis, precio u otro contenido no constituyen asesoramiento de inversión o recomendación en entendimiento de la ley de Belice. El rendimiento en el pasado no indica necesariamente los resultados futuros, y cualquier persona que actúe sobre esta información lo hace bajo su propio riesgo. XTB no aceptará responsabilidad por ninguna pérdida o daño, incluida, sin limitación, cualquier pérdida de beneficio, que pueda surgir directa o indirectamente del uso o la confianza de dicha información. Los contratos por diferencias (""CFDs"") son productos con apalancamiento y acarrean un alto nivel de riesgo. Asegúrese de comprender los riesgos asociados. "