Advanced Micro Devices (AMD.US), US semiconductor company, is trading around 9% lower today after reporting Q1 2023 earnings yesterday after session close. Company's results were slightly better than expected with adjusted EPS coming in at $0.60 (exp. $0.56) and revenue reaching $5.35 billion (exp. $5.30 billion). However, on an unadjusted basis, AMD reported a net loss of $139 million, or $0.09 per share. Also, revenue - although slightly higher than expected - was 9% year-over-year lower.

AMD reported a 65% sales drop in a unit that sells PC processors - from $2.1 billion in Q1 2022 to $0.74 billion in Q1 2023. Data center segment generated $1.295 billion in sales - more or less flat compared to $1.293 billion in Q1 2022. Gaming segment, that includes GPUs, saw sales drop from $1.88 billion to $1.76 billion. On a positive note, segment including sales of chips for networking saw sales surge from $0.59 billion in Q1 2022 to $1.56 billion now. However, this increase can be explained by acquisitions that AMD made in the segment.

AMD provided a lackluster outlook for the current quarter, projecting sales at around $5.3 billion in Q2 2023. This is below $5.48 billion suggested by analysts' median estimate. Nevertheless, company executives said they expected growth in the second half of 2023 as markets for PC and servers improve. Company expects that the bottom in PC processor business was reached in Q1 2023 and now sales should start to slowly improve.

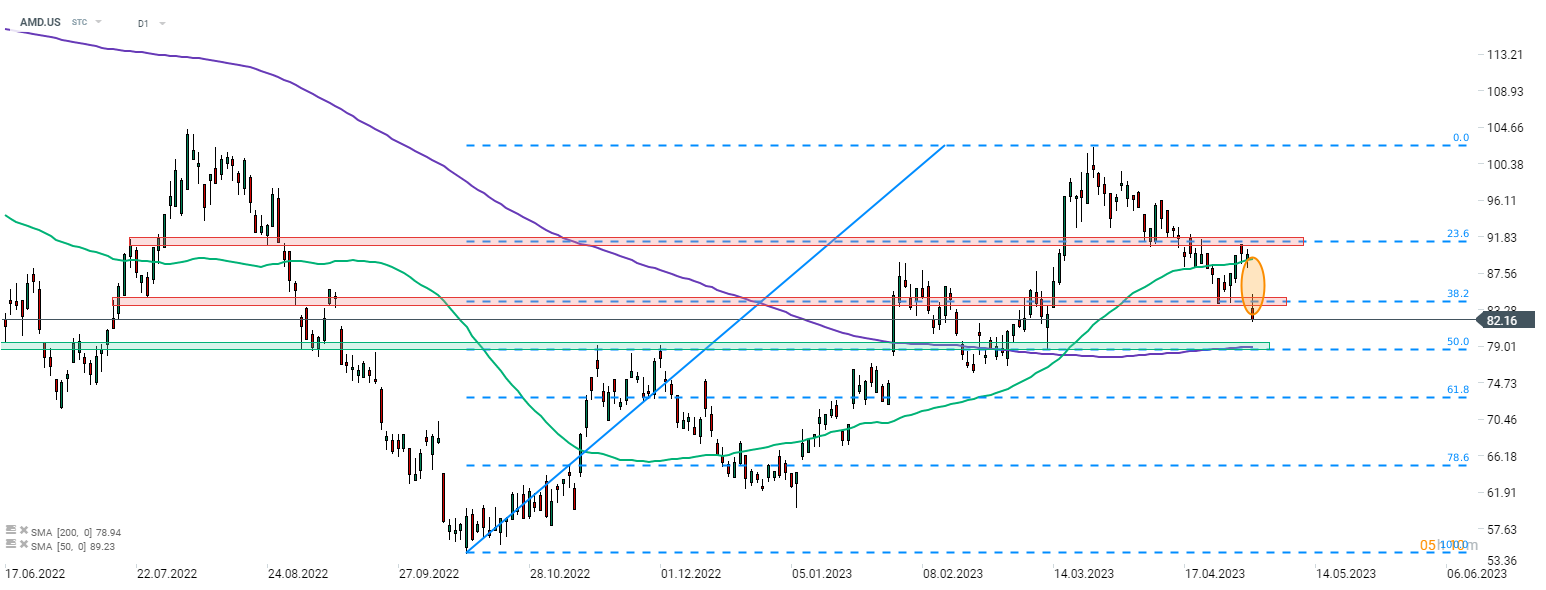

In spite of slightly better-than-expected results, AMD is trading around 9% lower today as Q2 2023 outlook disappointed. Stock launched today's trading with a big bearish price gap and is trading below price zone marked with 38.2% retracement of recent upward impulse. The next potential support zone to watch can be found in the $79.00 area, where 200-session moving average and 50% retracement can be found.

AMD.US at D1 interval. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.