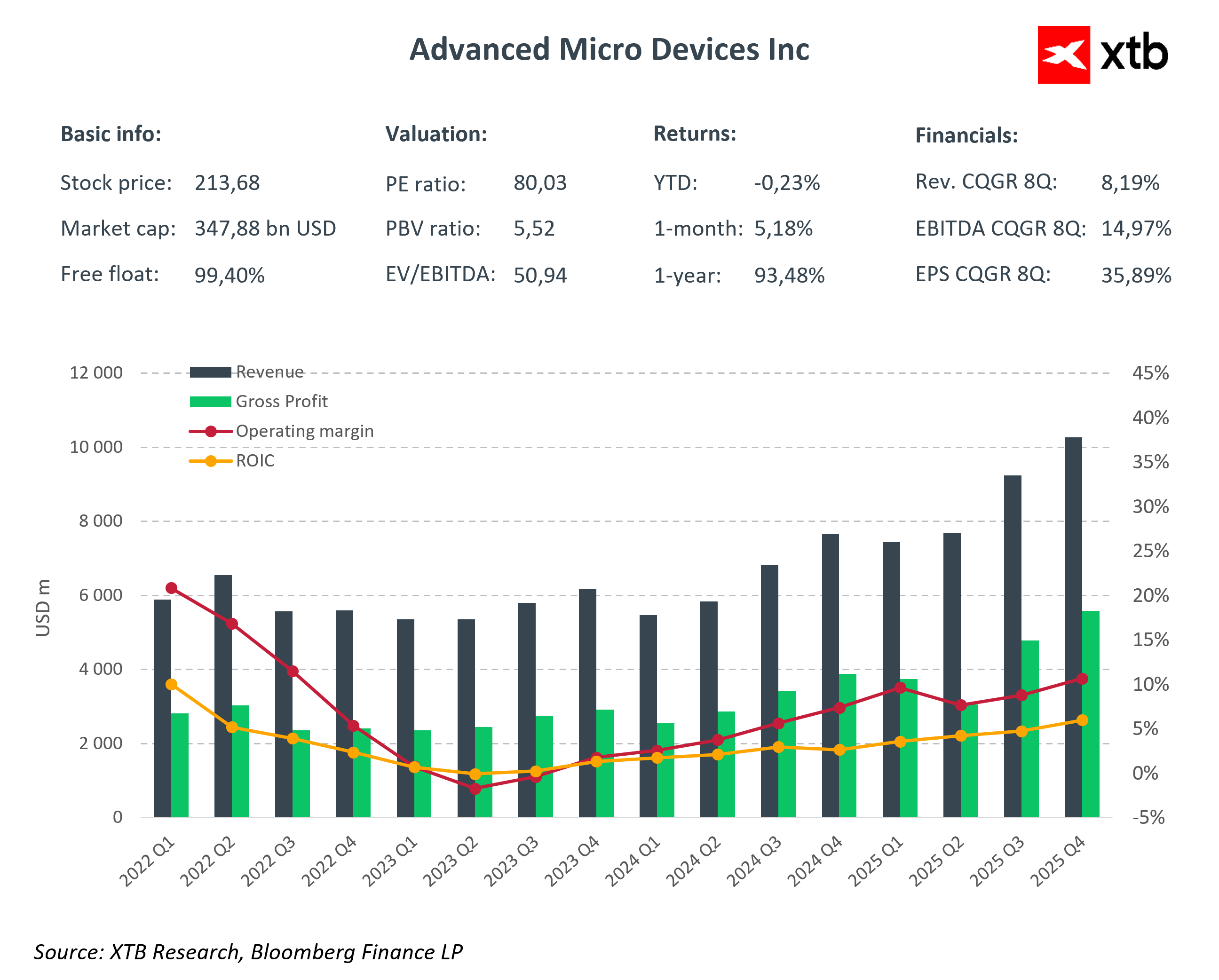

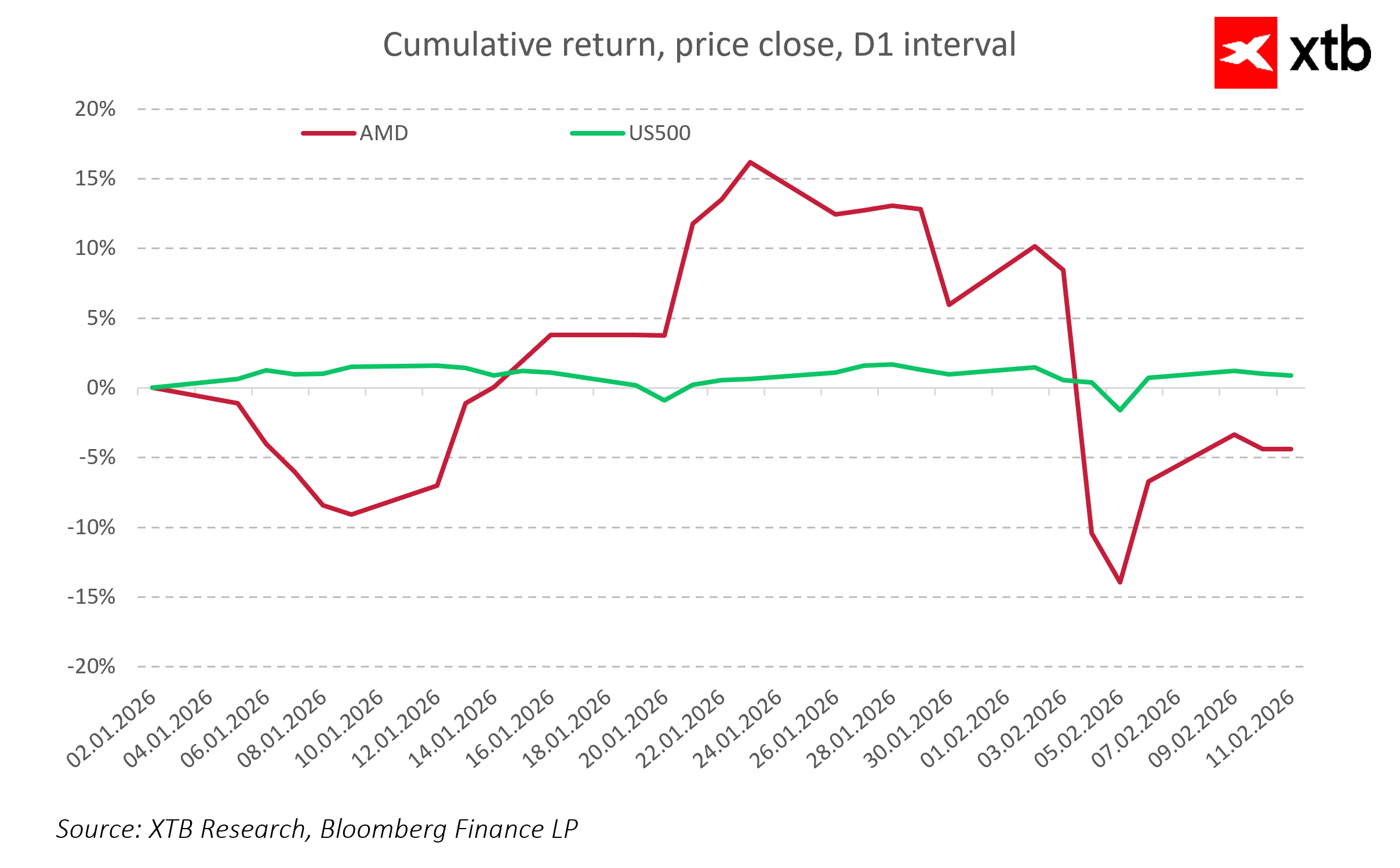

Advanced Micro Devices is increasing its involvement in India by partnering with Tata Consultancy Services to compete with Nvidia in the artificial intelligence infrastructure segment. The Helios project aims to support large AI workloads in enterprises and data centers by offering scalable infrastructure ready for large-scale operation. From a market perspective, AMD shares may react both to the potential benefits of expansion in the growing AI segment and to the risks associated with implementation costs and uncertainty about customer acceptance of the platform.

The new infrastructure allows companies to deploy advanced AI systems faster, but the success of the project depends not only on technology, but on the ability of TCS and AMD to effectively integrate and launch the systems in real-world conditions. The costs of building and maintaining such data centers are high, and competitors in India, most notably Nvidia, already have a strong position in this segment. As a result, markets may react cautiously, especially if the pace of implementation proves slower than expected or if there are difficulties in customer adoption of the technology.

In addition, AMD's expansion is taking place in the context of India's growing importance on the global AI scene. The country is attracting the attention of global technology leaders and politicians, and growing investment in local data centers and AI infrastructure shows that India is becoming a key strategic market. This means potentially greater opportunities for companies ready to quickly implement their solutions, but also risks associated with strong competition and growing market expectations.

For investors, the Helios project is an example of how leadership in the AI segment does not come solely from chips themselves, but from a comprehensive approach to large-scale technology implementation. In the coming quarters, it will be worth watching the pace of the project's implementation, customer response, and competition from Nvidia, as these factors will largely determine whether AMD's expansion will bring measurable financial results or become a costly experiment in the growing but demanding AI market segment.

US500 rebounds slightly after the sell-off 🗽 US earnings season confirms profit expansion

Daily summary: The Market recovers losses and awaits rate cuts

IBM Goes Against the Tide: Three Times More Entry-Level Employees

US OPEN: The market looks for direction after inflation data

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.