- Expected Growth in the AI and Data Center Segment: Forecasts indicate revenues of approximately $4.14 billion (+17.6% YoY), driven by EPYC processors and MI350/MI450 chips; key partnerships with OpenAI and Oracle further emphasize the strategic importance of AI for the company.

- Stability in the Client and Gaming Segment: The Client & Gaming segment is expected to generate around $3.6 billion (+29% YoY), supported by the popularity of Ryzen Zen 5 processors, RDNA 4 graphics cards, and SoC solutions for consoles.

- Investments in Technological Development: Planned R&D spending of nearly $2 billion and CapEx of approximately $220 million are aimed at supporting innovation and maintaining long-term competitive advantage.

- Expected Growth in the AI and Data Center Segment: Forecasts indicate revenues of approximately $4.14 billion (+17.6% YoY), driven by EPYC processors and MI350/MI450 chips; key partnerships with OpenAI and Oracle further emphasize the strategic importance of AI for the company.

- Stability in the Client and Gaming Segment: The Client & Gaming segment is expected to generate around $3.6 billion (+29% YoY), supported by the popularity of Ryzen Zen 5 processors, RDNA 4 graphics cards, and SoC solutions for consoles.

- Investments in Technological Development: Planned R&D spending of nearly $2 billion and CapEx of approximately $220 million are aimed at supporting innovation and maintaining long-term competitive advantage.

Introduction

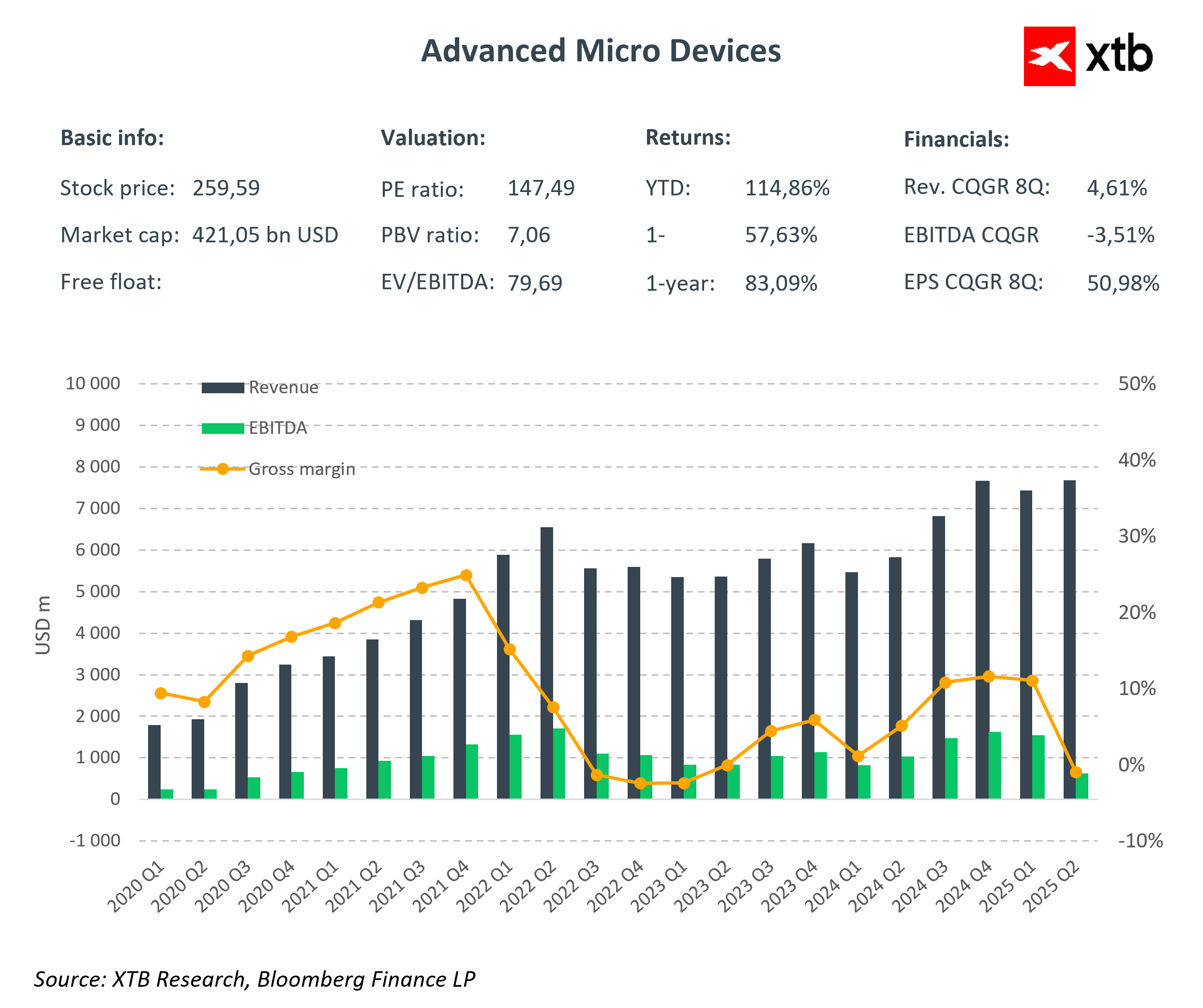

Advanced Micro Devices, known as AMD, is publishing its quarterly report for the third quarter of 2025 today, which will be released after the market closes. The report will provide investors with key insights into the company’s development, with a particular focus on the rapidly growing artificial intelligence accelerator segment. Over the past two months, AMD has signed significant agreements with OpenAI and Oracle for the delivery of large volumes of its latest AI chips, highlighting the growing importance of this area in the company’s strategy and confirming its ability to effectively compete with the market leader, Nvidia. This is laying the foundation for a long-term investment cycle in the semiconductor industry, projected through 2030.

In the third quarter, the data center segment is expected to generate approximately $4.14 billion in revenue, while total company revenue is projected at around $8.74 billion, with a gross margin of 54%. Planned capital expenditures reach $220 million, and research and development spending is close to $2 billion, reflecting AMD’s commitment to innovation and maintaining technological leadership. The new MI450 chip could provide a significant boost for future growth, while stable results in traditional servers and the client and gaming segments support positive expectations for the report.

Key Financial Highlights (Q3 2025)

-

Revenue: approximately $8.74 billion (+28% YoY)

-

Earnings per share (EPS): $1.17 (+27% YoY)

-

Gross margin: approximately 54%

Data Center Segment:

-

Revenue: approximately $4.14–4.2 billion (+17.6% YoY)

-

Growth is driven by EPYC processors and MI350/MI450 chips. Increased MI450 production supports further expansion.

Client & Gaming Segment:

-

Revenue: approximately $3.6 billion (+29% YoY)

-

Strong results driven by Ryzen Zen 5 processors, RDNA 4 graphics cards, and SoC solutions for consoles.

Embedded Segment:

-

Revenue: approximately $889–927 million (-25% YoY)

-

Decline due to a slowdown in the telecom and industrial sectors, but investment in FPGA and IoT continues.

-

Capital Expenditures (CapEx): approximately $219–220 million

-

R&D: nearly $2 billion

-

Free Cash Flow: approximately $1.28 billion

-

Adjusted Operating Income: approximately $2.15 billion

-

Adjusted Operating Margin: approximately 24.8%

Q4 2025 Forecast

-

Revenue: $9.2 billion

-

Gross Margin: approximately 51.5%

-

CapEx: $902.3 million

Market Expectations and Stock Performance

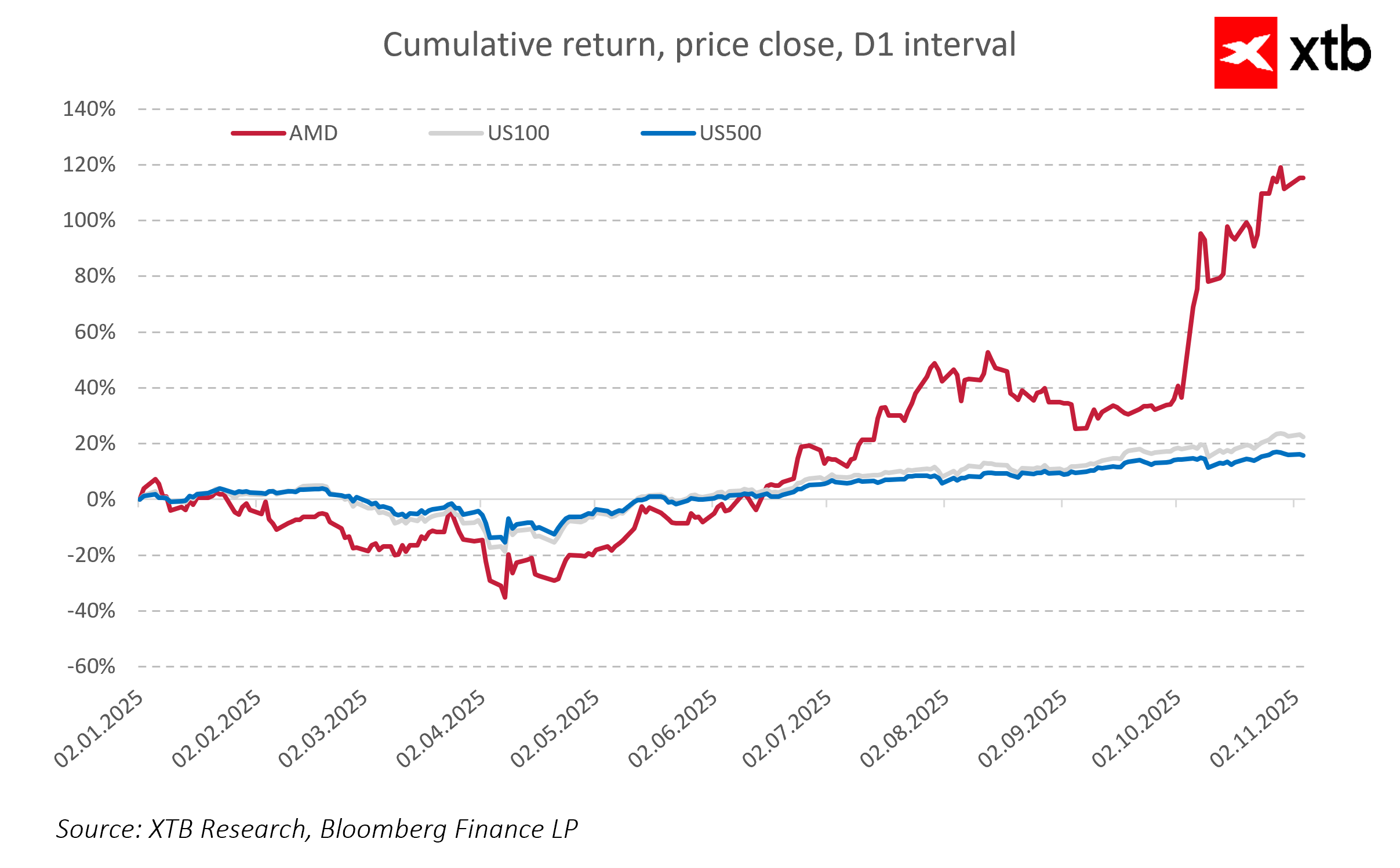

AMD shares are trading near all-time highs, surpassing $250, reflecting a significant increase in the company’s value this year. Investors are closely monitoring whether the company will meet its projections, especially in the key AI and data center segments, where competition with Nvidia is particularly intense. Traditional PC and gaming markets remain stable and continue to provide an important source of revenue.

Strategic Outlook

AMD is focused on strengthening its leadership position in AI and data centers through the development of MI350 and MI450 chips and EPYC processors. Partnerships with companies such as OpenAI, Oracle, and Microsoft enable the rapid deployment of new solutions and the capture of additional market share. The client and gaming segment continues to play a key role in revenue diversification, supported by the popularity of Ryzen Zen 5 processors, RDNA 4 graphics cards, and SoC solutions for consoles. Significant investments in research and development aim to maintain technological leadership and competitiveness.

Risks and Challenges

Key risks include export restrictions to China, which could limit sales in the AI and data center segments. Fluctuations in demand in the gaming and PC markets may affect financial results, and the high stock valuation increases sensitivity to negative news.

Macroeconomic and Market Context

AMD’s operations depend on global macroeconomic factors, including inflation, currency fluctuations, and geopolitical tensions, particularly regarding export restrictions between the U.S. and China. The semiconductor market remains highly competitive, with Intel dominating the CPU segment and Nvidia maintaining an advantage in AI and data centers. Regulatory and political decisions will significantly influence the company’s future prospects.

Conclusion

The third-quarter 2025 report will be a critical test of AMD’s ability to sustain dynamic growth in the high-potential AI and data center segments while maintaining stability in PC and gaming markets. Meeting forecasts, effectively managing geopolitical and cost-related risks, continuing technological development, and leveraging strategic partnerships will be key to maintaining AMD’s position as a leading player in the semiconductor industry.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.