AMD, the biggest competitor to Nvidia in the production of data center and AI-related chips, while being highly competitive on price, has published its financial results for Q2 2025:

-

Revenue: Q2 2025: $7.69bn, vs. consensus of $7.43bn; Q2 2024: $5.84bn, YoY dynamics: +32%

-

Adjusted EPS (non-GAAP): Q2 2025: $0.48, vs. consensus of $0.49; Q2 2024: $0.69, YoY dynamics: –30%

-

EPS (GAAP): Q2 2025: $0.54; Q2 2024: $0.16, YoY dynamics: +238%

-

Adjusted Operating Profit: Q2 2025: $897m, vs. consensus of $903m; Q2 2024: $1.26bn, YoY dynamics: –29%

-

Net Profit (non-GAAP): Q2 2025: $781m; Q2 2024: $1.13bn, YoY dynamics: –31%

-

GAAP Gross Margin: Q2 2025: 40%; Q2 2024: 49%; a decrease of 9 pp

-

Non-GAAP Gross Margin: Q2 2025: 43%, vs. consensus of 54.1%; Q2 2024: 53%; a decrease of 10 pp

-

CAPEX: Q2 2025: $282m, vs. consensus of $176m; Q2 2024: $154m; an increase of 83%

-

R&D Expenses: Q2 2025: $1.89bn, vs. consensus of $1.72bn; Q2 2024: $1.58bn; an increase of 20%

Business Segments

-

Data Center: $3.2bn (+14%) – demand for EPYC, but slowed down by the embargo on MI308 GPUs for China.

-

Client: $2.5bn (+67%) – a record quarter thanks to new Ryzen processors.

-

Gaming: $1.1bn (+73%) – a strong rebound, with demand for Radeon cards and consoles.

-

Embedded: $824m (–4%) – the only segment to be in the red.

Forecast for Q3 2025 vs. expectations:

-

Revenue: $8.7bn ± $0.3bn (consensus: $8.37bn)

-

Non-GAAP gross margin: approx. 54% (consensus: 54.1%)

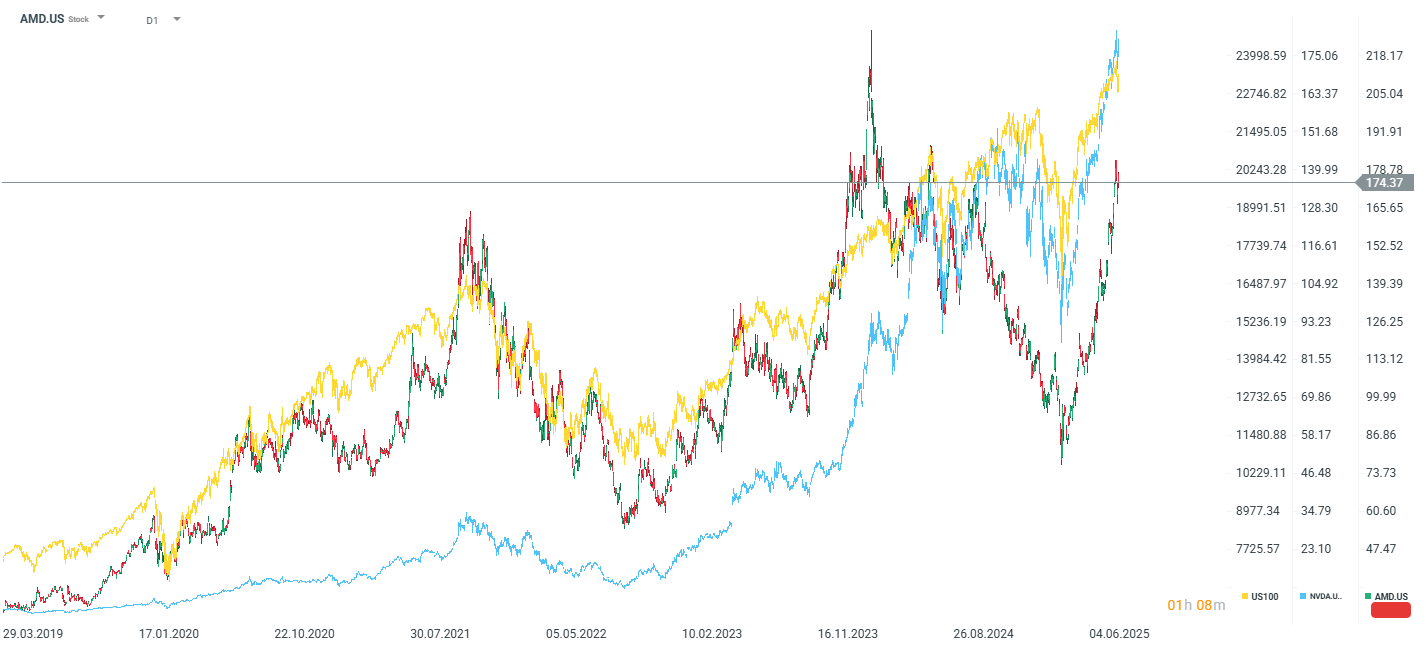

AMD loses nearly 4% after results

The company shows a non-GAAP EPS that is significantly lower than last year. There is also a decline in operating profit and margin. The sharp drop in margin is caused by one-time write-downs related to restrictions on exporting AI GPUs to China. However, this situation has a chance of changing in the near future. Nevertheless, the market is still wondering whether the restrictions on exports to China will lead to significant operational costs for the company. High CAPEX and R&D expenses are raising investor concerns about pressure on lower cash flows in the coming quarters. Despite good revenue results and an optimistic forecast for Q3, the current assessment has focused on short-term problems related to margins and uncertainty regarding China. In the initial reaction, shares lost over 5%, but the loss has now been reduced to just under 4%. The company's shares are approximately 30% below their historical highs, but have rebounded by about 130% since the low in early April.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.