Donald Trump’s decision to allow the export of Nvidia H200 chips to China, subject to a 25% tariff, has sparked a strong reaction on both sides of the Pacific. While formally it represents a partial opening to the world’s largest semiconductor market, Chinese authorities have decided to hold shipments at the border. For financial markets, this is a clear signal that the technological rivalry between the U.S. and China has entered a phase of heightened uncertainty, where administrative decisions increasingly have a direct impact on global supply chains and technology company valuations.

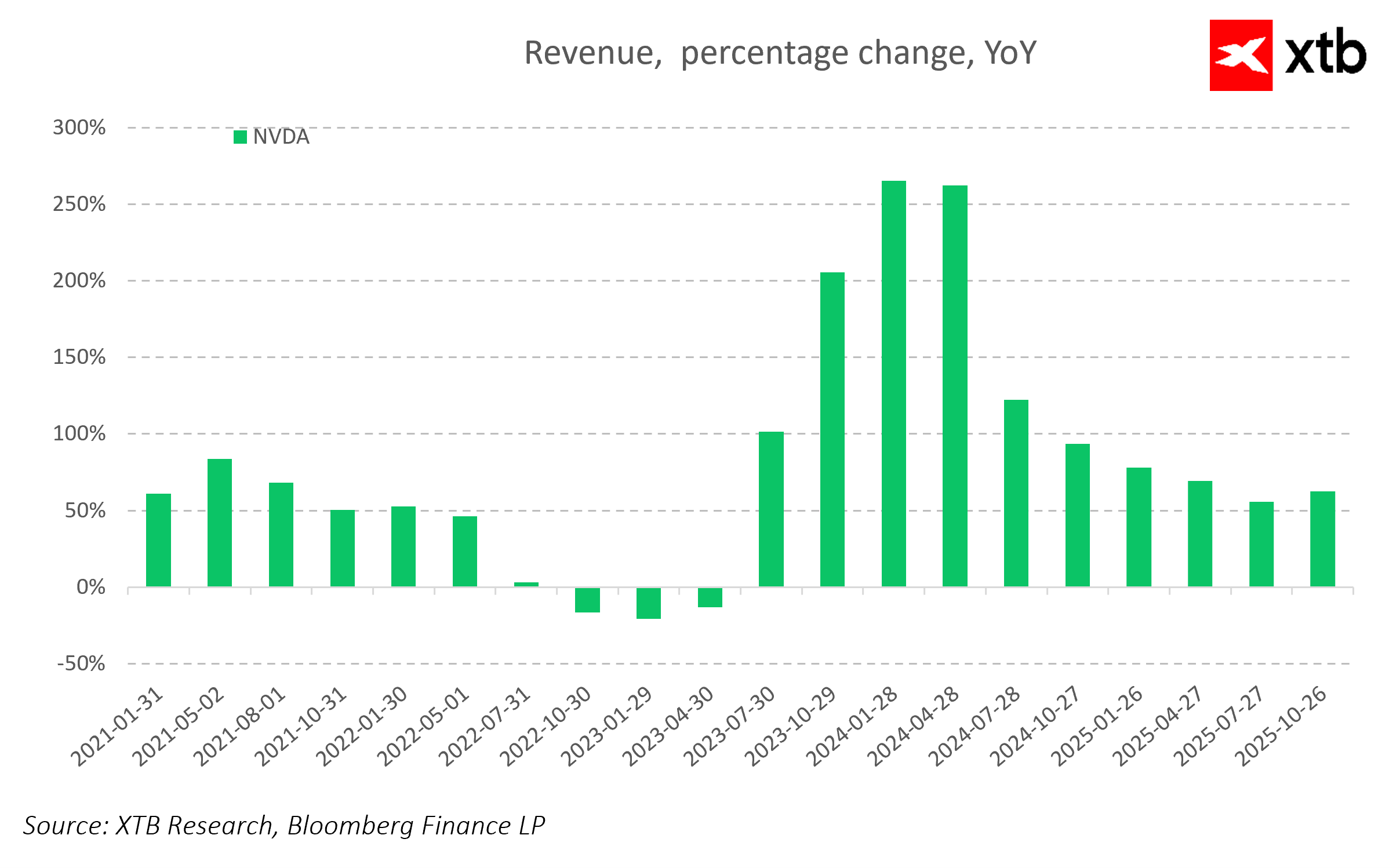

From Nvidia’s perspective, the stakes are contracts worth tens of billions of dollars. Chinese technology firms, responsible for roughly 30% of global demand for AI infrastructure, reportedly placed orders exceeding 2 million H200 chips, while the company’s available supply is currently estimated at around 1 million units. This means that declared demand significantly exceeds current production capacity. The new H200 chip offers up to six times the computing power of the H20, which was previously designed as a version compliant with export restrictions. Despite this technological advantage, Chinese customs authorities were instructed that the chips cannot be imported.

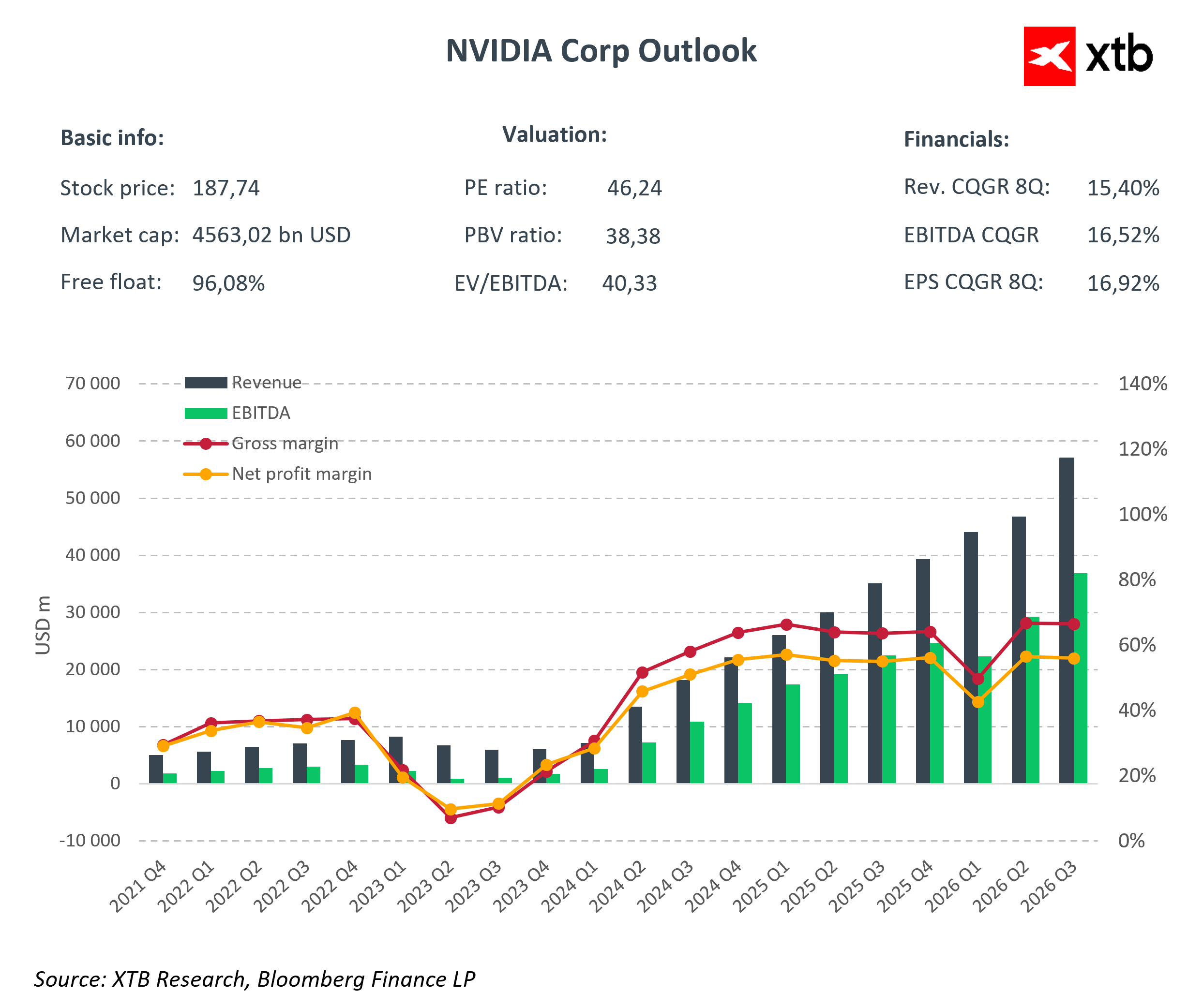

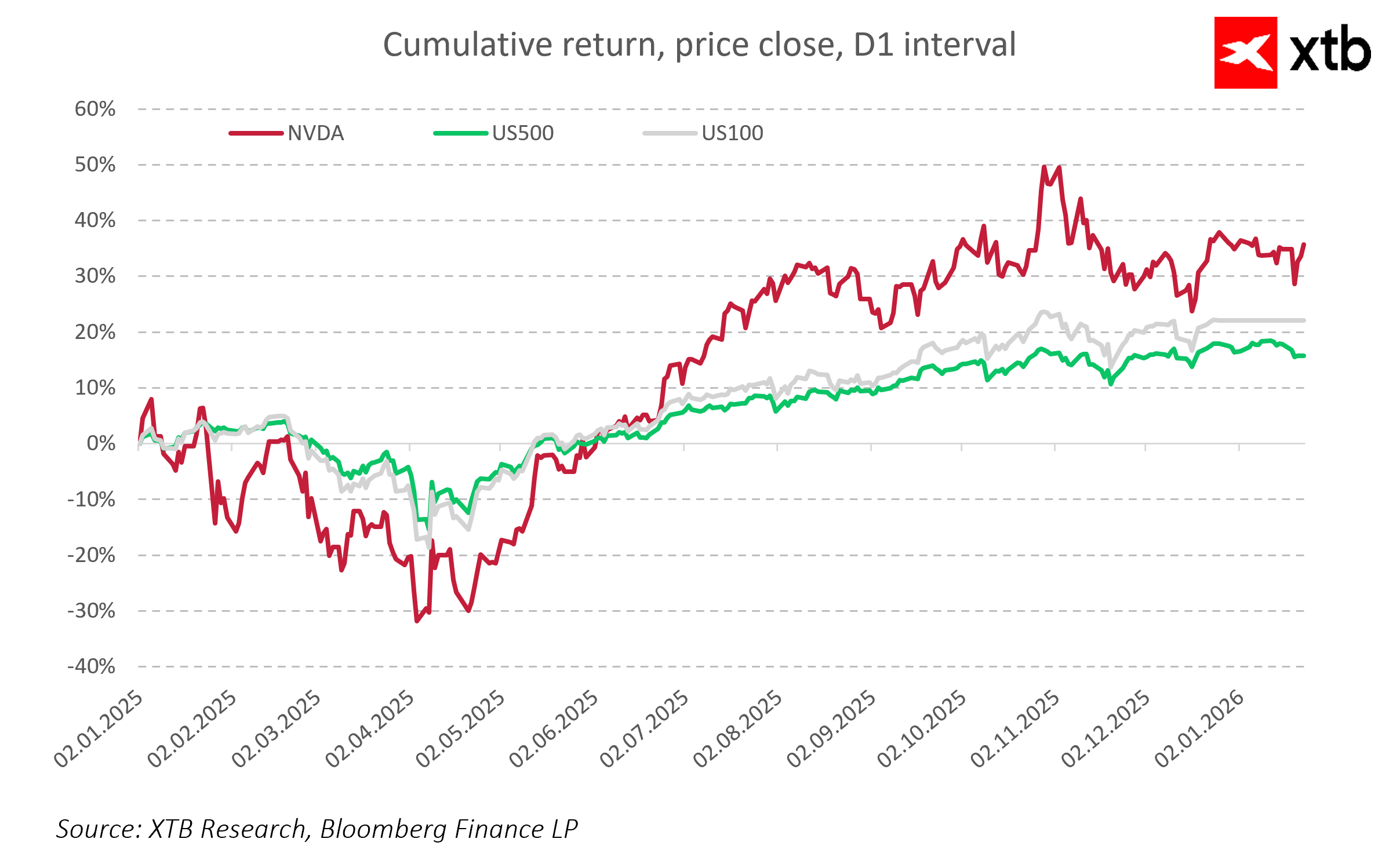

From a market perspective, the dispute over the H200 highlights a growing paradox in Nvidia’s valuation. The company benefits from unprecedented global demand for AI computing power, yet an increasing portion of its story depends on political decisions rather than purely operational fundamentals. Any signal of a potential easing or tightening of restrictions on China immediately affects sentiment toward the tech giant’s stock and the broader basket of AI-related companies. As a result, the regulatory risk premium rises, and traditional valuation models increasingly need to incorporate geopolitical scenarios, not just revenue and margin trajectories.

The dispute has also quickly moved into the realm of U.S. domestic politics. Pressure is building in Congress to increase oversight of exports of advanced AI technologies to China, reflected in the ongoing work on the AI Overwatch Act. Supporters of the regulation warn that selling chips of this class could strengthen China’s technological capabilities in strategic areas of artificial intelligence. Opponents, however, caution that excessive legislative intervention could weaken the competitiveness of U.S. semiconductor manufacturers and limit their operational flexibility globally.

For the broader technology market, the H200 conflict may serve as another signal to selectively reduce exposure to China and shift capital toward jurisdictions seen as more regulatory stable. Institutional investors have been factoring in the risk of gradual decoupling in the semiconductor and AI infrastructure sectors for several years, and the Nvidia case shows that even seemingly compromise solutions, such as tariffs or volume limits, can in practice lead to situations where the product does not reach the end customer for reasons unrelated to actual demand.

In this context, Nvidia CEO Jensen Huang’s January visit to Shanghai takes on significance beyond business symbolism. The presence of the company’s leader, whose products today account for a substantial portion of global computing power used in AI development, underscores the nature of the new technological confrontation. Its essence is no longer solely about tariffs and sanctions, but about control over algorithms, access to data, and the direction of technological development, which increasingly determines the global balance of power.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.