Apple shares (AAPL.US) are up 4% today, making them the strongest-performing component of the major U.S. indices. Recently, several research firms have upgraded their ratings on the company, citing strong product-related catalysts — including the launch of the iPhone Air, the upcoming iPhone 20 next year, and new AI-powered products. The most recent upgrade came from Melius Research, which sees upside potential to $260 per share for the Cupertino-based giant.

- Despite the rally, Apple shares still trade 15% below their previous highs near $260. The latest quarterly results showed a 10% year-over-year increase in sales — the strongest growth since December 2021.

- Sales in China rose 4% YoY, surprising the market and beginning to contribute not only to overall growth but also to a shift in investor sentiment toward Apple’s business prospects in the region.

- Apple is set to unveil new AI features in its products, while iPhone sales grew 13% YoY in the latest quarter. Meanwhile, Mac sales came in 10% above market expectations, reaching $8 billion for the quarter.

- The company is also likely to avoid Trump-era tariffs, thanks to its pledge to invest $600 billion in U.S.-based manufacturing over the next four years.

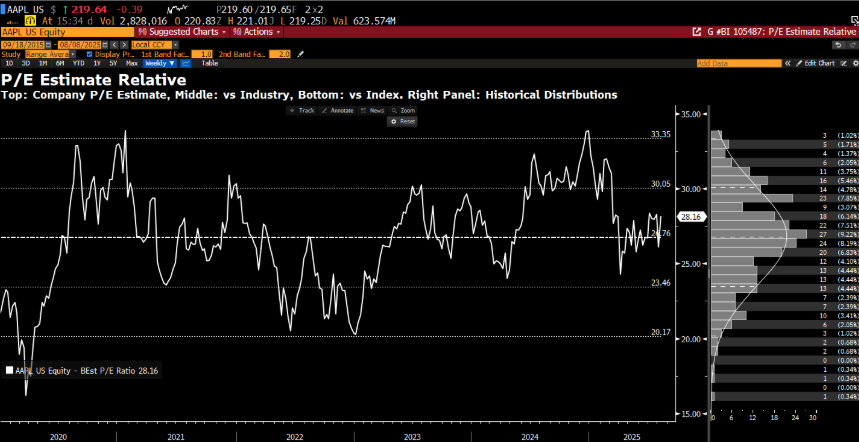

Both net income and revenue came in over 5% above Wall Street estimates, and it appears a significant portion of customers may still be waiting to purchase Apple products to test out the upcoming AI functionalities. On the one hand, this presents a notable opportunity to improve margins and monetize high-margin services. On the other hand, if the new features disappoint, Apple could struggle to maintain its status as a growth stock — especially with a price-to-earnings ratio hovering around 30.

From a historical perspective, Apple’s valuation is currently around its long-term average, while the company still faces multiple growth catalysts: improved sales in China, robust demand for the iPhone, a packed product pipeline, and AI innovations.

Source: Bloomberg Finance L.P.

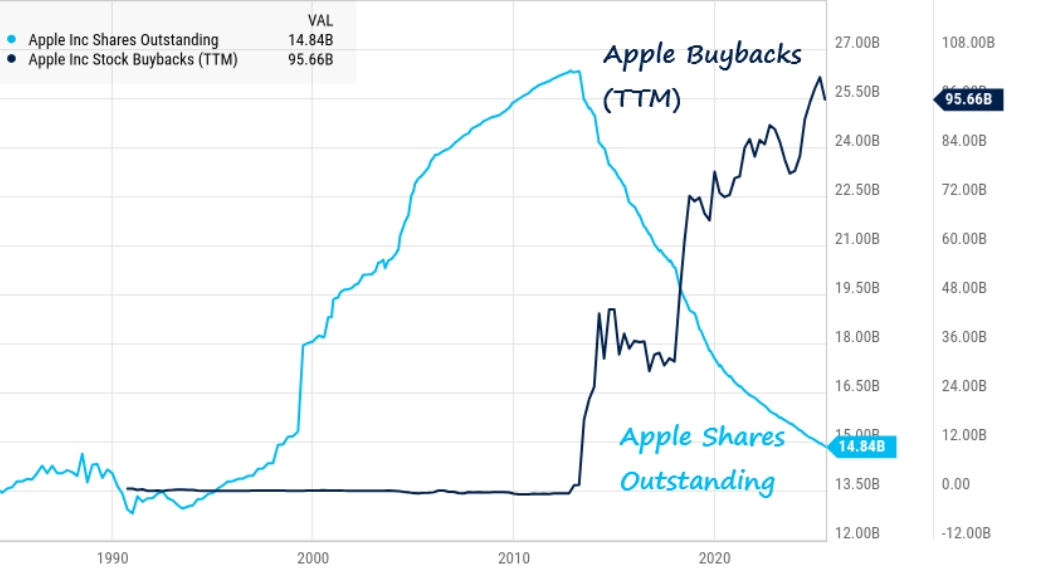

Apple continues its consistent share buyback strategy, gradually reducing the number of shares in circulation.

Source: Charlie Bilello, X

Today’s rally in Apple shares is helping drive the US100 index to 24,700 points.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.