Danish pharmaceutical company, Bavarian Nordic (BAVA.DK) is trading up more than 3% today and climbing near the highs of early August. It's hard to find justification for this other than yesterday's announcement by the World Health Organization (WHO), which approved an initial $135 million package to accelerate and coordinate the fight against a potential increase in global monkeypox (mpox) virus infections. The WHO program aims to prevent and fund prevention, both on the part of scientists and collaborating institutions.

- News of the virus is creating elevated, speculative volatility in the stocks of companies that stand to profit from the sale of vaccines such as Bavarian, Emergent BioSolutions (EBS.US) and Moderna (MRNA.US) and Biontech (BNTX.US), which are only in the approval stage for their mRNA products.

- African regulators and health ministry officials estimate that about 200,000 doses are currently available, of the vaccine against the 10 million needed. So far, Bavarian has donated about 15,000 doses to Africa, while Emergent has donated 50000.

- The most difficult situation is in Africa, in the Congo region, although in relation to the population the number of cases is still relatively small. So far, the virus has also been detected in Sweden and the Philippines.

Bavarian has told the African Center for Disease Control and Prevention (CDC) that it is capable of delivering 10 million doses of the vaccine by the end of 2025 and about 2 million doses, later this year. By some experts, the Bavarian vaccine is touted as safer, against Emergent. The National Institute of Allergy and Infectious Diseases, will hold a conference on August 29-30 on mpox research and control of virus expansion.

Bavarian Nordic (D1 interval)

The stock has traded almost twice as high since the 2023 minima. Driving valuations are, among other things, expectations for increased demand and production of mpox vaccines.

Source: xStation5

Historically, Bavarian Nordic's shares have been characterized by high volatility, and the last five years can hardly be described as exceptionally successful for the company. However, there have been isolated price spikes in which Bavarian's shares have gained 2 and more than 3 times.

Source: xStation5

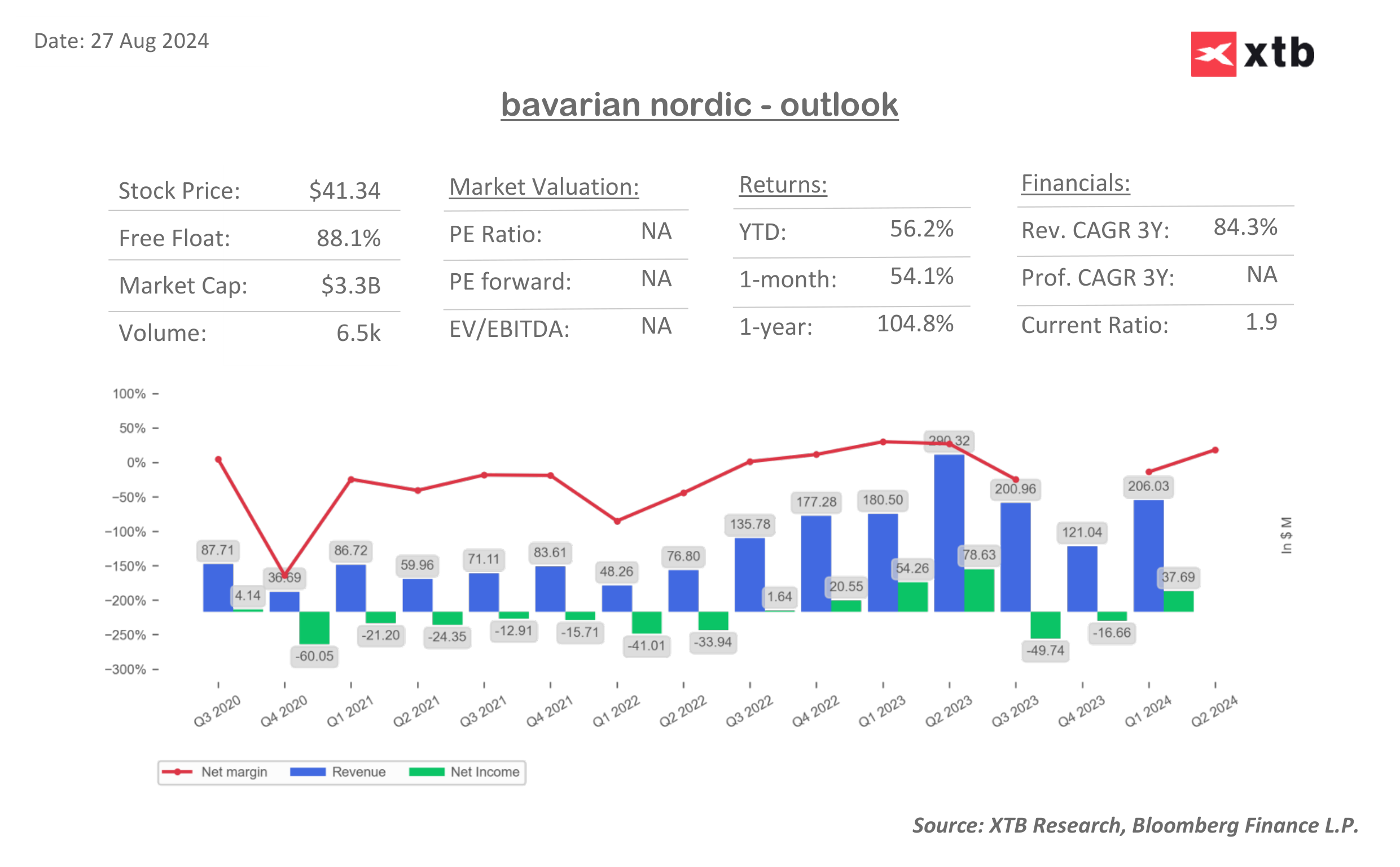

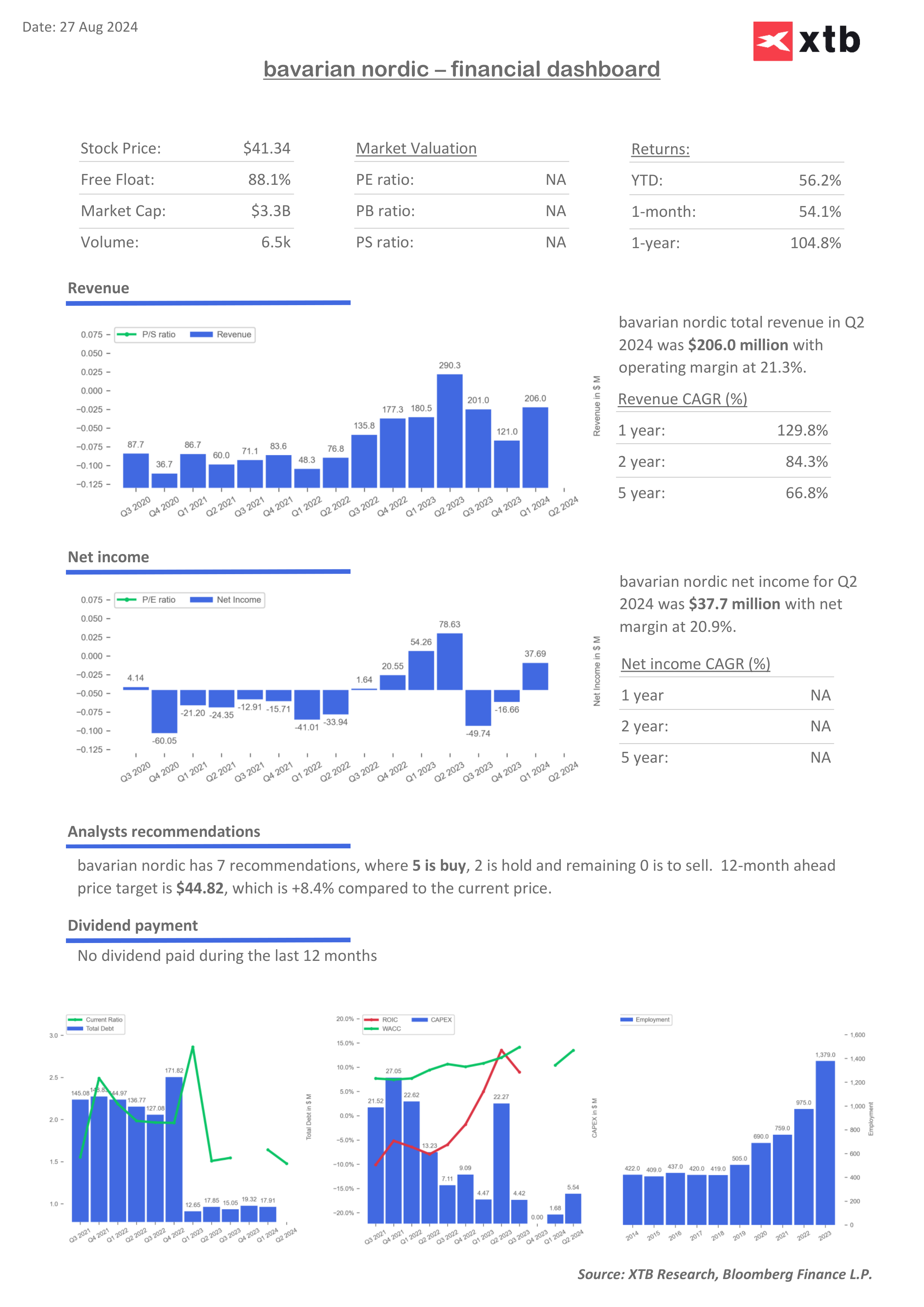

Revenues, earnings and financial multiples dashboards of Bavarian Nordic

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.