Beyond Meat (BYND.US) stock dropped over 10.0% during today's session after the maker of plant-based meat substitutes posted weak quarterly results and issued disappointing financial outlook as it expects a temporary disruption of US retail growth.

- Company recorded quarterly loss per share at $1.27 vs. 71 cents expected,

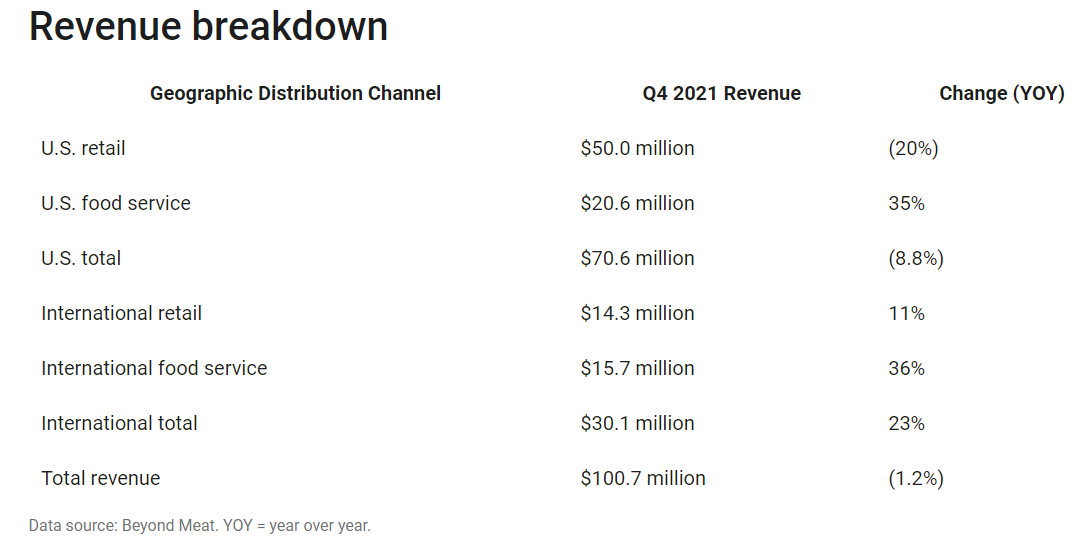

- Revenue of $100.7 million came in below analysts estimates of $101.4 million,

- U.S. grocery sales plunged 19.5% to $50.00 million due to lower demand, increased discounts, loss of market share and five fewer shipping days compared with the year-ago period.

US retail sales was the only category which recorded a decline in revenues. However this category is the largest of the four, therefore has the biggest impact on the company's overall performance. Source: Beyond Meat via Motley Fool

US retail sales was the only category which recorded a decline in revenues. However this category is the largest of the four, therefore has the biggest impact on the company's overall performance. Source: Beyond Meat via Motley Fool

- Costs increased as the company decided to use more expensive co-manufacturing facilities rather than its own manufacturing plants for production. This move also increased transportation and logistics fees. “This allocation was the right decision, given the long-term importance of the supported projects,” believes CEO Ethan Brown,

- "During the case of 2021, we experienced intense increased competition during the period when the size of the prize did not expand," he added.

- Gross margin of 14.1% was well below the 24.4% estimate. Brown said investment in employees, infrastructure and operations in the U.S., Europe and China “weighed heavily on operating expenses and gross margin” in the quarter.

- For full-year 2022, the company expects revenue in the range of $560 million to $620 million, an increase of 21% to 33% year over year, while analysts expected revenue growth of 37%.

- Last year, the company made significant headway in foodservice, with the launch of KFC Beyond Fried Chicken and an expanded pilot for McDonald’s McPlant burger, made with the Beyond Burger plant-based patty.

- However, due to increasing competition from other companies, investors should pay attention to announcements regarding market share. If retail sales continue to decline, it could mean serious problems for the company.

Beyond Meat (BYND.US) stock fell sharply to the new all-time low at $41.22 although buyers managed to erase most of today's losses. Source: xStation5

Beyond Meat (BYND.US) stock fell sharply to the new all-time low at $41.22 although buyers managed to erase most of today's losses. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.