The beginning of a new trading week is marked with big price moves on a number of assets, with cryptocurrencies and precious metals drawing the most attention. Bitcoin surges 7% and trades above $67,000 mark for the first time since November 2021, while gold gains 1.6% and is on its way to book the first close above $2,100 per ounce in history!

The main driver of the cryptocurrency rally are still-strong inflows into Bitcoin spot ETFs. Introduction of ETFs made Bitcoin investments available to a broader range of investors. Bitcoin demand generated by those funds is said to be outstripping supply, creating an environment for gargantuan price gains. Meanwhile, gold continues the strong upward impulse triggered on Friday by release of disappointing US manufacturing ISM index for February. Weak US data triggered a 'dovish' reaction in the markets with USD dropping and precious metals gaining.

However, there is also a factor that may be supporting both BITCOIN and GOLD at the start of a new week. Fitch ratings agency downgraded credit rating of the New York Community Bancorp (NYCB.US) to the junk level. Fitch said that weakness recently disclosed by the bank caused it to re-evaluate NYCB's capital adequacy as well as its exposure to commercial real estate. Meanwhile, Moody's ratings agency said that NYCB may be forced to further increase provisions for bad loans over the next two years amid its exposure to commercial real estate.

Issues at NYCB have been in the making for a while, but the downgrade to a 'junk' rating highlights how bad things are already. Having said that, at least part of today's move higher in GOLD and BITCOIN can be driven by increased demand for safe havens amid risk of another banking collapse in the United States.

Rally on BITCOIN shows no signs of easing. Coin broke above the $67,000 mark today, although it has pulled back below it later, and is trading less than 3% below all-time highs from November 2021. Source: xStation5

Rally on BITCOIN shows no signs of easing. Coin broke above the $67,000 mark today, although it has pulled back below it later, and is trading less than 3% below all-time highs from November 2021. Source: xStation5

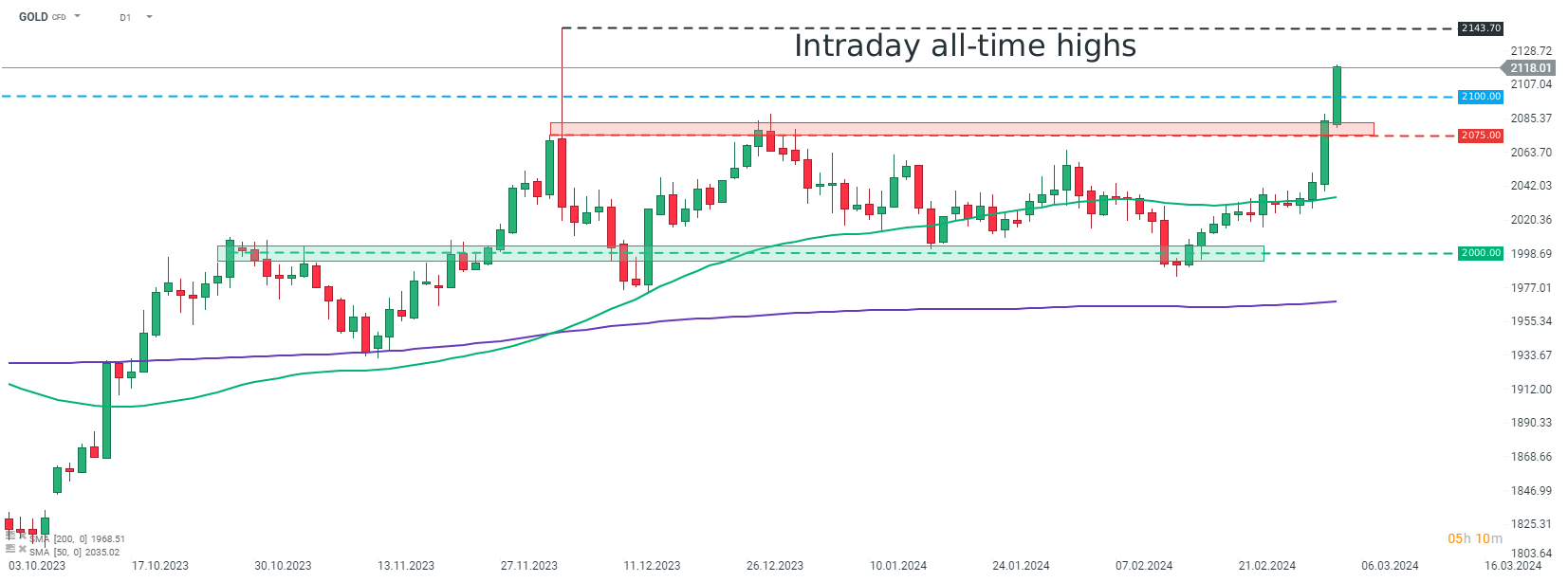

GOLD is on the way to the first close above $2,100 per ounce in history! However, precious metal still trades around 1% below its intraday all-time highs reached in December 2023. Source: xStation5

GOLD is on the way to the first close above $2,100 per ounce in history! However, precious metal still trades around 1% below its intraday all-time highs reached in December 2023. Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.