U.S. technology companies reported their Q4 2025 results after the Wall Street close today. Most companies (Tesla didn't) beat consensus estimates on both earnings and revenue, supporting the US100, which recovered losses following Powell’s remarks. After the releases, Meta Platforms and Tesla are up more than 4%, Microsoft is down nearly 3%, and IBM is up almost 7%.

Source: xStation5

Meta Platforms: Q4 2025 results (META.US; up 4% after-hours)

-

EPS: $8.88 vs $8.19 est. vs $8.02 a year ago

-

Revenue: $59.89B vs $58.42B est.

-

Advertising revenue: $58.14B vs $56.79B est.

-

Family of Apps revenue: $58.94B vs $57.47B est.

-

Family of Apps operating income: $30.77B vs $30.0B est.

-

Total operating income: $24.75B, +5.9% y/y

-

Reality Labs revenue: $955M vs $962.7M est.

-

Reality Labs operating loss: $6.02B vs $5.8B est. (loss)

-

Commercial remaining performance obligation (cRPO): $625B

-

Q1 revenue guidance: $53.5B–$56.5B vs $51.27B est.

-

2026 capex guidance: $115B–$135B vs $110.62B est.

Source: xStation5

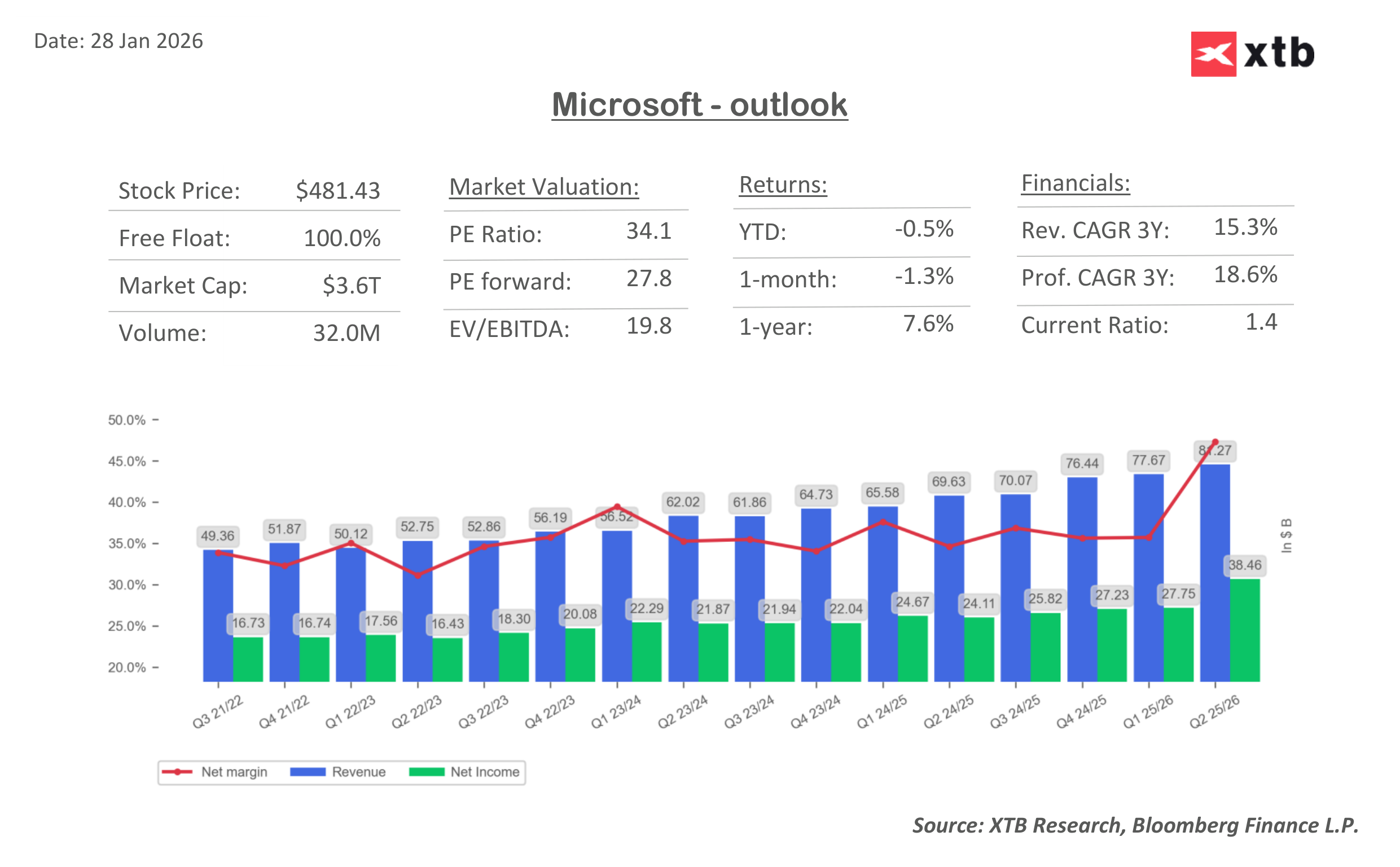

Microsoft: Q2 2026 results (MSFT.US; down 3% after-hours)

-

Adjusted EPS: $4.14 vs $3.92 est.

-

Revenue: $81.27B vs $80.31B est.

-

-

Intelligent Cloud revenue: $32.91B vs $32.39B est.

-

Azure & other cloud services (ex-FX): +38% vs +38% est.

-

Productivity and Business Processes revenue: $34.12B vs $33.45B est.

-

More Personal Computing revenue: $14.25B vs $14.33B est.

-

Commercial remaining performance obligation (cRPO): $625B

-

Microsoft 365 (commercial seats): +6%

-

Operating income: $38.28B vs $36.55B est.

-

Capital expenditures (CAPEX): $29.88B vs $23.78B est.

-

Revenue at constant currency: +15% vs +14.3% est.

-

Source: xStation5

Source: Bloomberg Finance L.P., XTB Research

Tesla: Q4 2025 results (TSLA.US; up 4% after-hours)

-

Adjusted EPS: $0.50 vs $0.45 est.

-

EPS: $0.24 vs $0.66 a year ago

-

Revenue: $24.90B vs $25.11B est.

-

Operating income: $1.41B vs $1.32B est.

-

Gross margin: 20.1% vs 17.1% est.

-

Free cash flow (FCF): $1.42B vs $1.59B est.

Source: xStation5

IBM: Q4 2025 results (IBM.US; up 7% after-hours)

-

Operating EPS: $4.52 vs $4.28 est.

-

Revenue: $19.69B vs $19.21B est.

-

Software revenue: $9.03B vs $8.82B est.

-

Consulting revenue: $5.35B vs $5.38B est.

-

Free cash flow (FCF): $7.55B vs $6.85B est.

-

FY revenue outlook (constant currency): above +5% vs +4.12% est.

-

FY FCF outlook: expected to increase by about $1B y/y

Source: xStation5

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.