Bitcoin is trading down nearly 2.5% today and retreating below the $36,500 area. At the same time, cryptocurrencies Algorand and Polygon are losing nearly 8% lower, while Ethereum slips below the psychological $2,000 mark and is trading at $1,960. The downward pressure comes at a time when sentiment on Wall Street is weakening, with the US100 index retreating from annual highs at 16,000 points. The futures contract on US dollar (USDIDX) are trading lower today, but this is not helping cryptocurrencies.

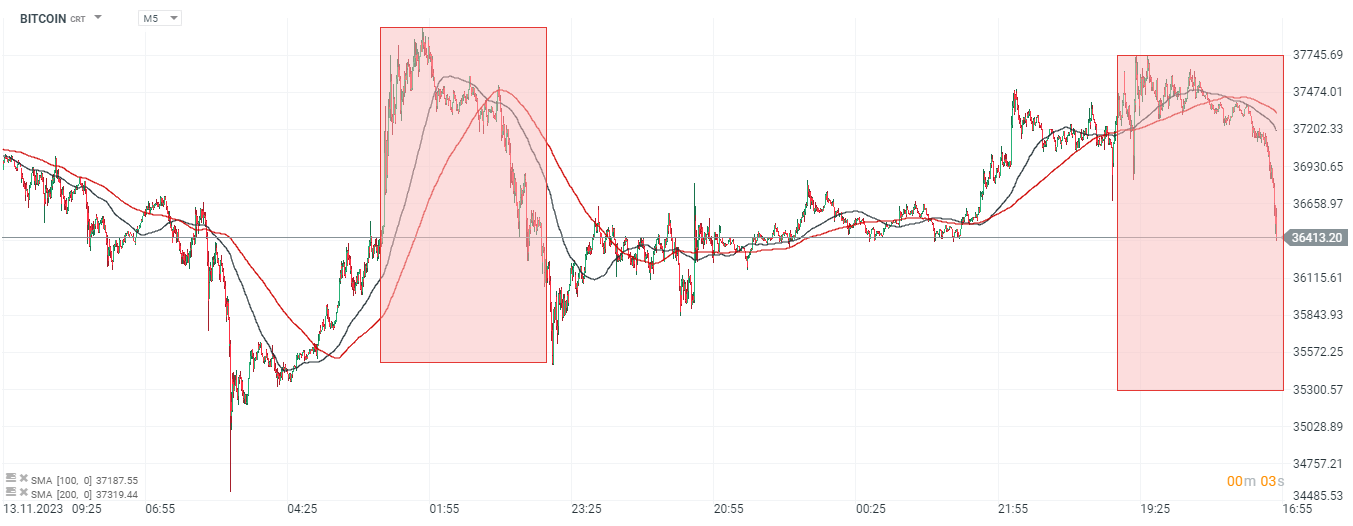

- Supply pressure appeared once again, after Bitcoin reached the $37,700 level, which may indicate a bearish triple top pattern for biggest cryptocurrency

- Short-term support levels worth watching are primarily $35,000 - $35,500 where, according to on-chain data, a significant number of transactions have been concluded in recent weeks (volume concentration).

- A potential 10% drop around $33,000 could even lead to a test of the area around $31,000, as there is very little investor transactions numbers during last weeks and lower volume concentration between those levels.

Bitcoin charts (H4, M30, M5)

If we look at recent market geometry patterns, the possible range of Bitcoin's dynamic correction is around $35,500. At this level we can expect stronger support, also supported by the lows of the previous downward structure. Source: xStation5

Source: xStation5

On the broader 4-hour interval, Bitcoin's price stopped at the 100-session average (SMA100, black). Source: xStation5

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

🚨Bitcoin crashes 4% to $69k📉Sell-off on Ethereum and Ripple

Chart of the day: BITCOIN 40% below recent peak 🚨 Eroding fundamentals risk selling spiral 📉

Daily summary: Nasdaq hits nearly two-month low, USD gains momentum, crypto deep in red (04.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.