The major cryptocurrency is trying to hold the $28,000 level amid weaker stock market sentiment and general risk aversion. On-chain data indicates that in the medium term the upward momentum may be maintained although a correction after impressive gains in Q1 2023 seems likely.

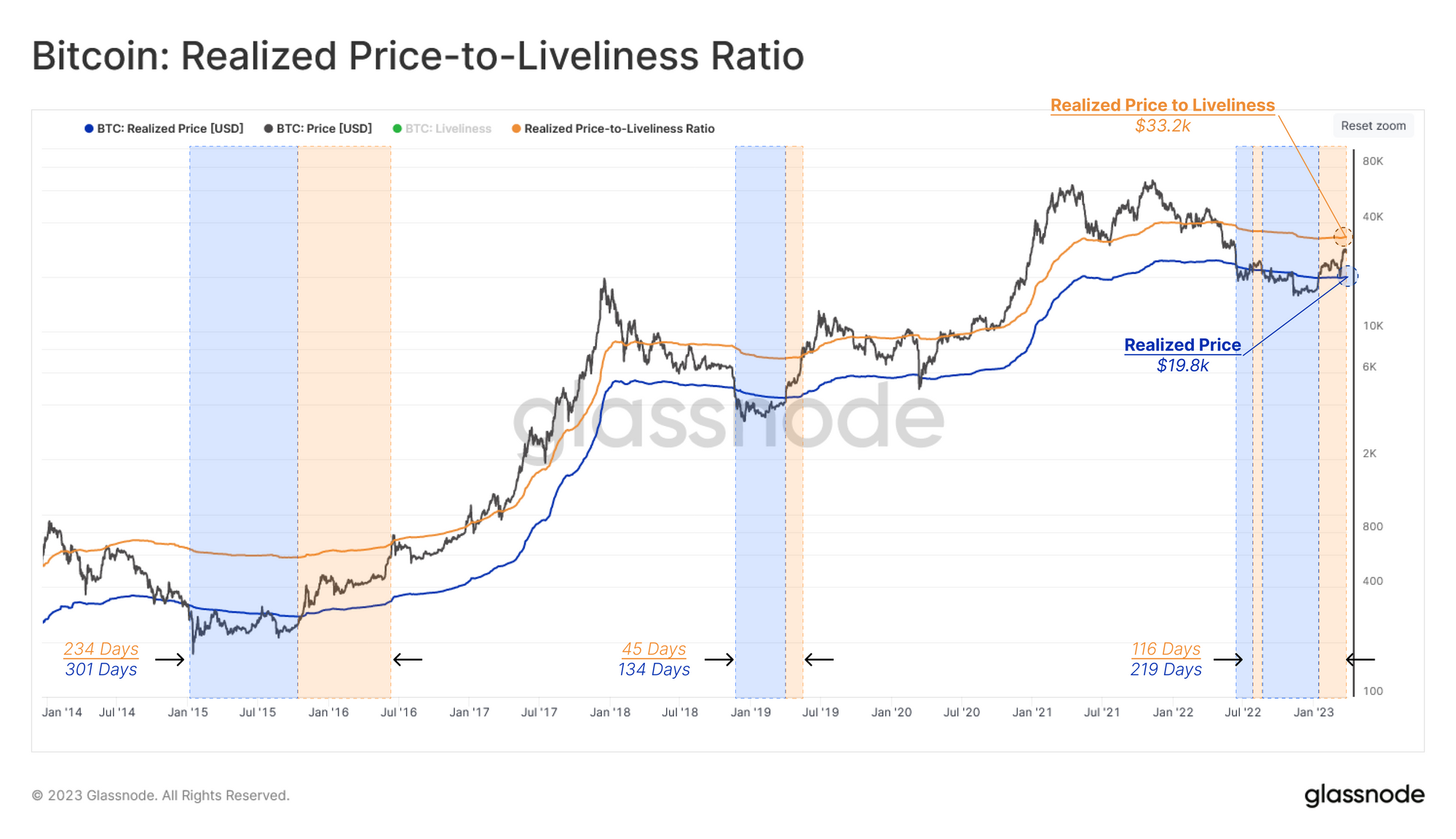

Bitcoin's spot price is currently well above the average blockchain BTC purchase price i.e. Realized Price (around $19,800). According to Glassnode, the cryptocurrency market is currently in a key transition phase between a bull market and a bull market. The upper limit of this phase is marked by the Realized Price to Liveliness Ratio in the vicinity of $33,000, which could be an important resistance level. Source: Glassnode

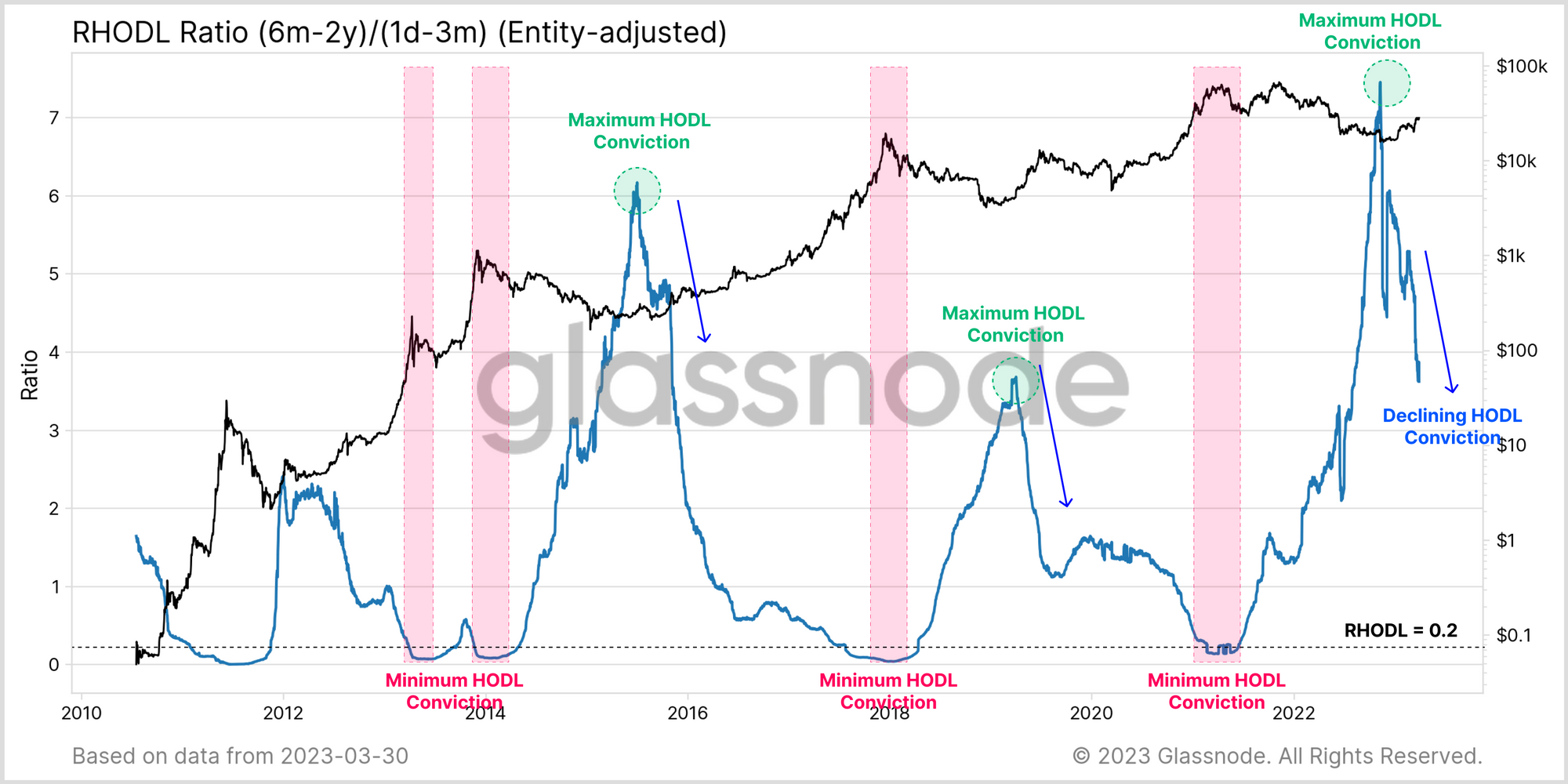

The ratio compares the value of BTC held by long-term investors in one cycle (6m-2y) to short-term holders (1d-3m). The structure of the RHODL indicator indicates a sharp change in trend that began with the collapse of FTX, with BTC sold by long-term investors to a new group of buyers. The sudden drop in the index in earlier cycles was seen as a turning point. Source: Glassnode The indicator measures the change in supply based on the length of time BTC is held in portfolios. It is positive (green) when BTC 'ages' at a faster rate (low propensity to sell) and negative (red) when the rate of sales exceeds the accumulation and conviction rate of HODLers. The period of spending was relatively short-lived (the collapse of FTX) and we again see a green color advantage with more than 60,000 BTC added to HODLers' balances per month. Source: Glassnode

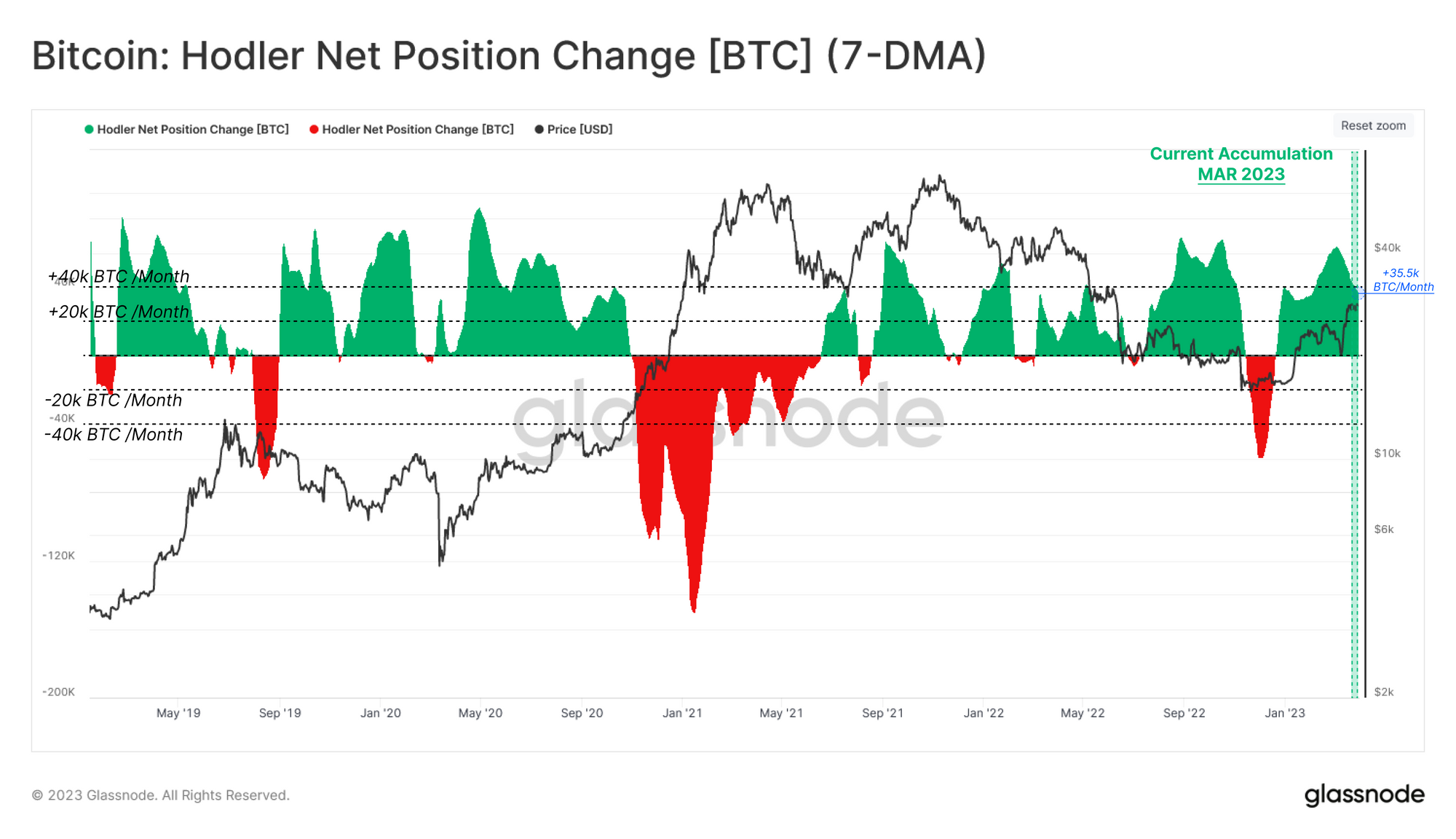

The indicator measures the change in supply based on the length of time BTC is held in portfolios. It is positive (green) when BTC 'ages' at a faster rate (low propensity to sell) and negative (red) when the rate of sales exceeds the accumulation and conviction rate of HODLers. The period of spending was relatively short-lived (the collapse of FTX) and we again see a green color advantage with more than 60,000 BTC added to HODLers' balances per month. Source: Glassnode

Bitcoin chart, H1 interval. The price measures the main short-term support level, which is set by the SMA200 (red line), near $28,000. Source: xStation5

Bitcoin chart, H1 interval. The price measures the main short-term support level, which is set by the SMA200 (red line), near $28,000. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.