- Bitcoin is up more than 1%, approaching the $125,000 mark.

- Ethereum gains nearly 3.5%, moving toward $4,700 — its highest level since September 18.

- A stronger U.S. dollar isn’t stopping the rally.

- Bitcoin is up more than 1%, approaching the $125,000 mark.

- Ethereum gains nearly 3.5%, moving toward $4,700 — its highest level since September 18.

- A stronger U.S. dollar isn’t stopping the rally.

Cryptocurrencies are trading higher today, and the latest CryptoQuant analysis points to rising Bitcoin demand along with a declining share of unrealized profits among investors, which helps to limit selling pressure.

One of the main drivers behind this trend is spot market demand, which has been growing since July and now exceeds 62,000 BTC per month. Such expansion is considered a key prerequisite for larger market rallies, a pattern previously observed in late 2020, 2021, and 2024.

Large wallets (so-called “whales”) are also contributing to this upward momentum. Their combined holdings are now increasing at an annual rate of 331,000 BTC, compared with 255,000 BTC in Q4 2024 and 238,000 BTC at the beginning of Q4 2020. Data suggests that accumulation remains above the long-term trend and is far from exhaustion levels. This situation contrasts sharply with 2021, when whale balances declined by around 197,000 BTC. On-chain data from CryptoQuant indicates that selling pressure from large addresses has weakened.

Source: xStation5

Net inflows into cryptocurrencies are also increasing, while institutional demand via U.S.-based ETFs could further support the market in the coming months. During the same quarter last year, ETFs expanded their holdings by 213,000 BTC, marking a more than 70% year-over-year increase.

Source: CryptoQuant

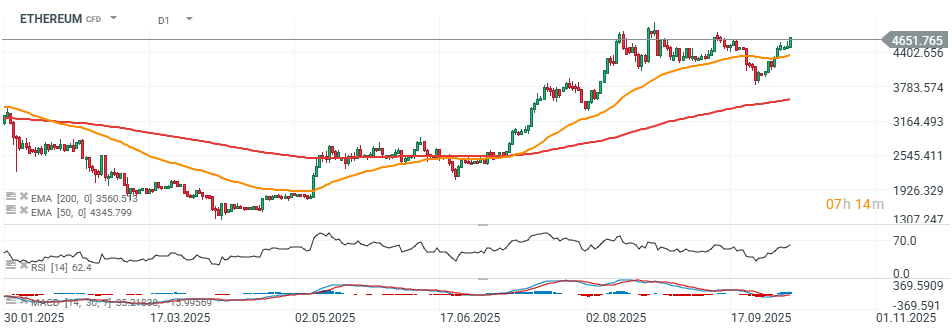

Ethereum (D1 timeframe)

The ETH price is rising today to levels not seen since the second half of September. If the upward move continues, the next key target could be around $4,800, matching this year’s highs.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.