Cryptocurrencies are the worst performing asset class during the European morning trading. Digital assets are being pressured by a number of factors. While some of those are not new and have been reported last week, combination of them all looks to be denting moods among crypto investors. Firstly, US President Biden signed a $550 billion infrastructure bill that includes new requirements on crypto taxation. Secondly, the Chinese National Development and Reform Commission said that it is exploring options for levying punitive energy prices on companies and households that defy ban on industrial-scale cryptocurrency mining. Last but not least, the US financial watchdog remains reluctant when it comes to spot Bitcoin ETFs. SEC rejected spot Bitcoin ETF application from VanEck at the end of last week. However, SEC continues to green light Bitcoin futures ETFs.

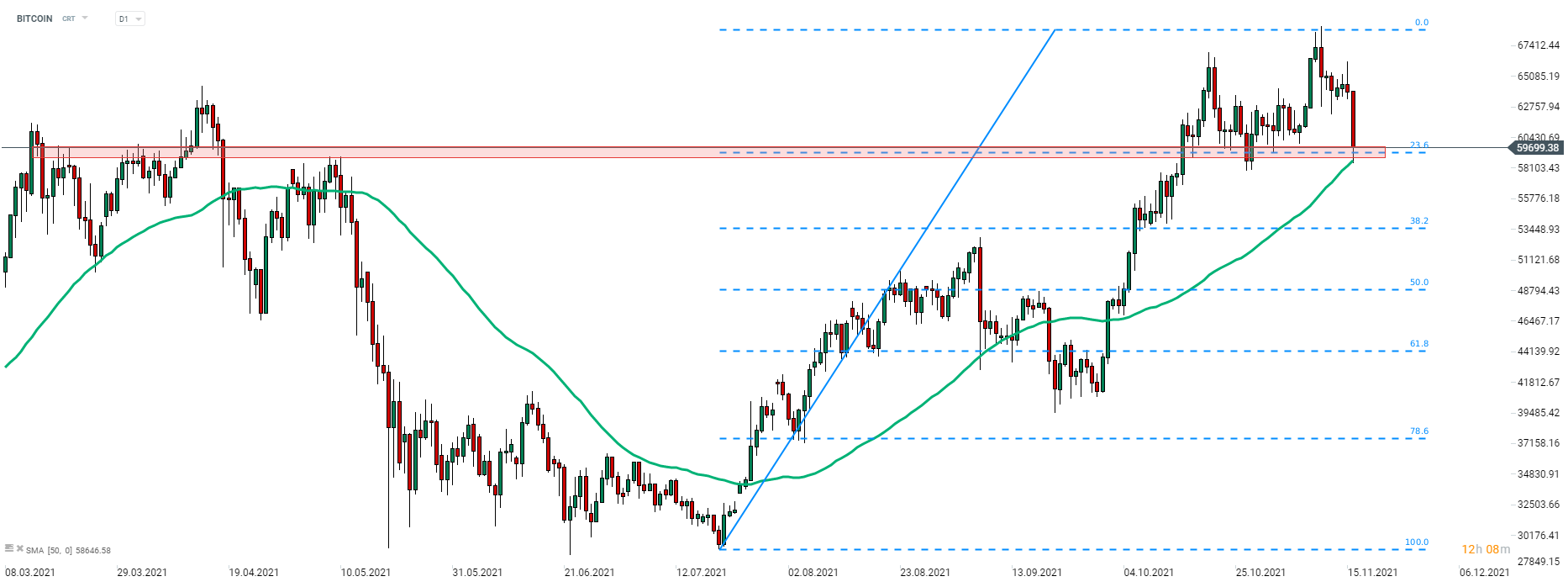

Declines can be spotted all across the cryptocurrency market today with some coins - like LITECOIN, EOS or BITCOIN CASH - dropping more than 10%. While Bitcoin is holding quite firm compared to other cryptos, it still trades over 6% lower on the day. The most famous digital currencies dipped below the $60,000 mark for the first time in two weeks today. Daily low reached near $58,500 - the lowest level since late-October. However, declines were halted at the 50-session moving average (green line) and the coin has subsequently climbed back above the 23.6% retracement of recent upward move.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.