The cryptocurrency market has seen a rebound after new sanctions imposed on Russia turned out to be less severe than feared. Also rumors regarding the commencement of the negotiation process between Russia and Ukraine are also supporting the market sentiment. On-chain metrics suggest that the overall health of the BTC market is recovering quickly.

- The uptick in on-chain volume suggests that the relief rally is likely to continue.

Massive spikes in on-chain volume may indicate that accumulating process started. Source: Santiment

Massive spikes in on-chain volume may indicate that accumulating process started. Source: Santiment

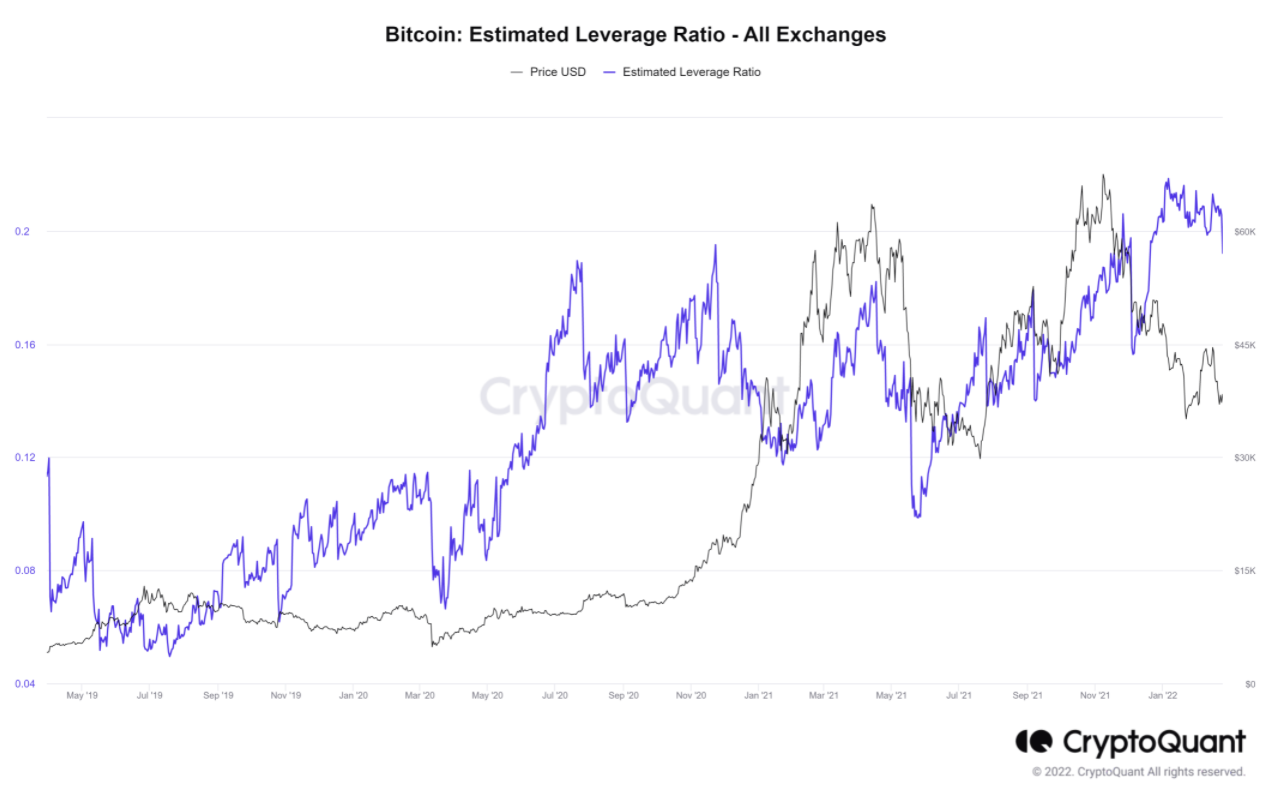

- Estimated leverage ratio of Bitcoin price fell from record high of 0.218 to 0.192 which indicates that price may continue to move higher at least in the short-term perspective.

Recent 12% slump indicates that the market is less coiled after the flash crash and that bulls can now take over. Source: CryptoQuant

Recent 12% slump indicates that the market is less coiled after the flash crash and that bulls can now take over. Source: CryptoQuant

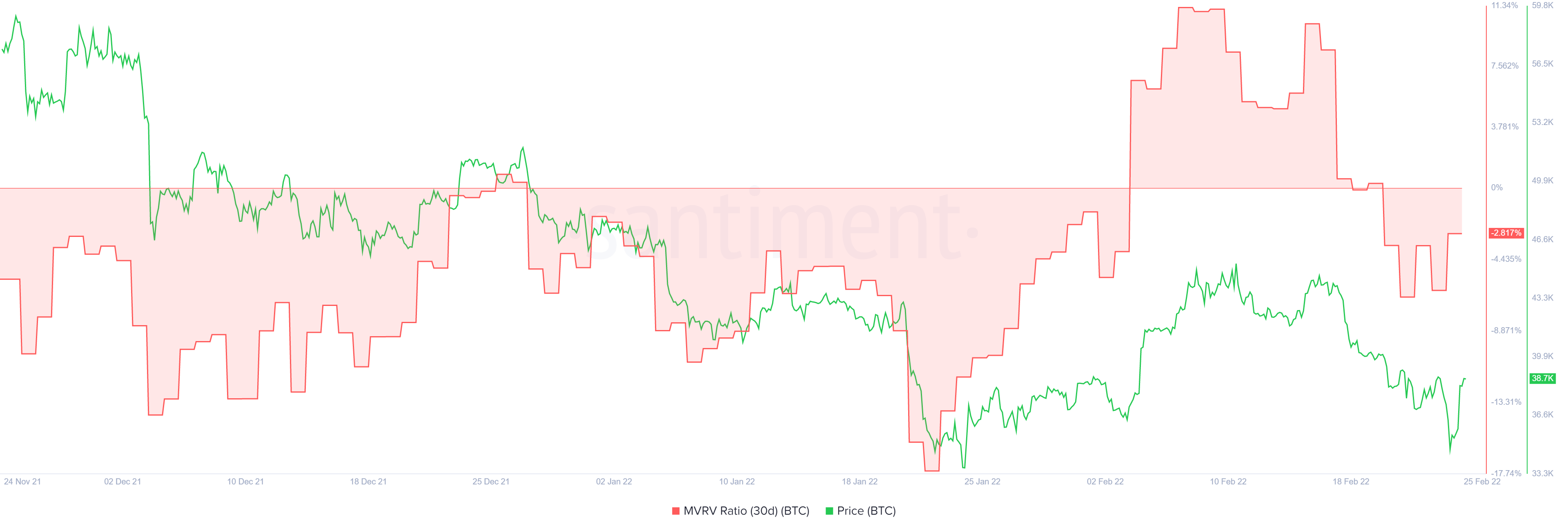

- The 30-day Market Value to Realized Value (MVRV) model which shows the average profit/loss of investors that purchased BTC over the past month has risen from -6.8% to -2.8% over the past three days, which is another bullish sign.

The 30-day MVRV is approaching zero line which may point out that many traders could have bought the dip and profited from it. Source: Santiment

The 30-day MVRV is approaching zero line which may point out that many traders could have bought the dip and profited from it. Source: Santiment

Also digital asset investment products recorded inflows totaling US$109m last week despite recent price weakness and negative impact from the Russian aggression on Ukraine.

- The latest data marks the 5th week of inflows. Bitcoin saw the largest inflows totaling US$89m last week, the highest since December 2021.Source: CoinShares

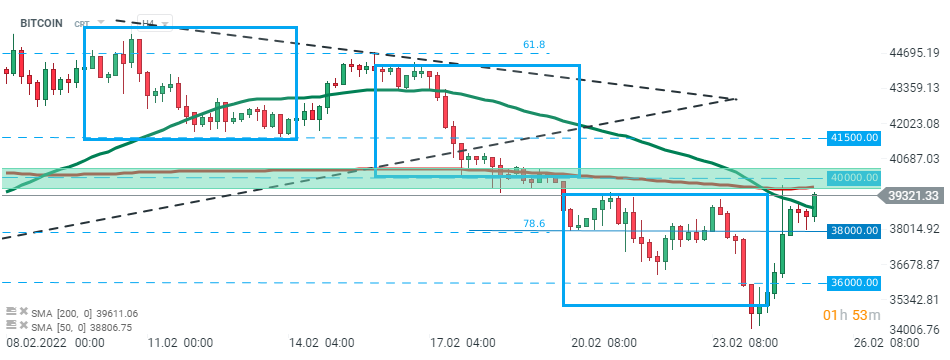

Bitcoin price managed to break above resistance at $38,000 and is currently approaching major resistance at $40,000. Source: xStation5

Bitcoin price managed to break above resistance at $38,000 and is currently approaching major resistance at $40,000. Source: xStation5

Nevertheless one needs to remember that the situation in Ukraine is still tense. From one side Russian troops reached Ukraine's Capital Kyiv, however Russian local media is bringing up hopes for negotiations and talks between Russia and Ukraine. RIA Novosti is reporting that the Russian delegation could consist of defense and foreign ministry officials. Also NATO will hold a virtual meeting today in the Ukraine and any statements coming from this meeting may significantly impact market sentiment.

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.