- Bitcoin failed to break out below resistance set by SMA 200

- Long-term holders accumulate the "king of cryptocurrencies"

Last week brought a slight deceleration of bullish sentiment in the cryptocurrency market. Bitcoin halted its gains just above $48,000 and began a corrective move towards $45,000. However, this period was full of large purchases by major institutions, including: MacroStrategy or Luna Foundation Guard. Bitcoin is becoming used and seen as a form of hedge against uncertain times. Favorable to this trend is the ever advancing utility of tokens, among other things, for securing algorithms.

- Exchanges are witnessing a significant outflow of cryptocurrencies with an intensity estimated at 96,000 BTC per month.

- The total supply of Bitcoin this month reached 19 million units. About 9.52% of the total BTC supply remains to be "dug up". It is estimated that the last of the BTC supply will be completely released within 118 years. Approximately 918 BTC is currently being mined daily.

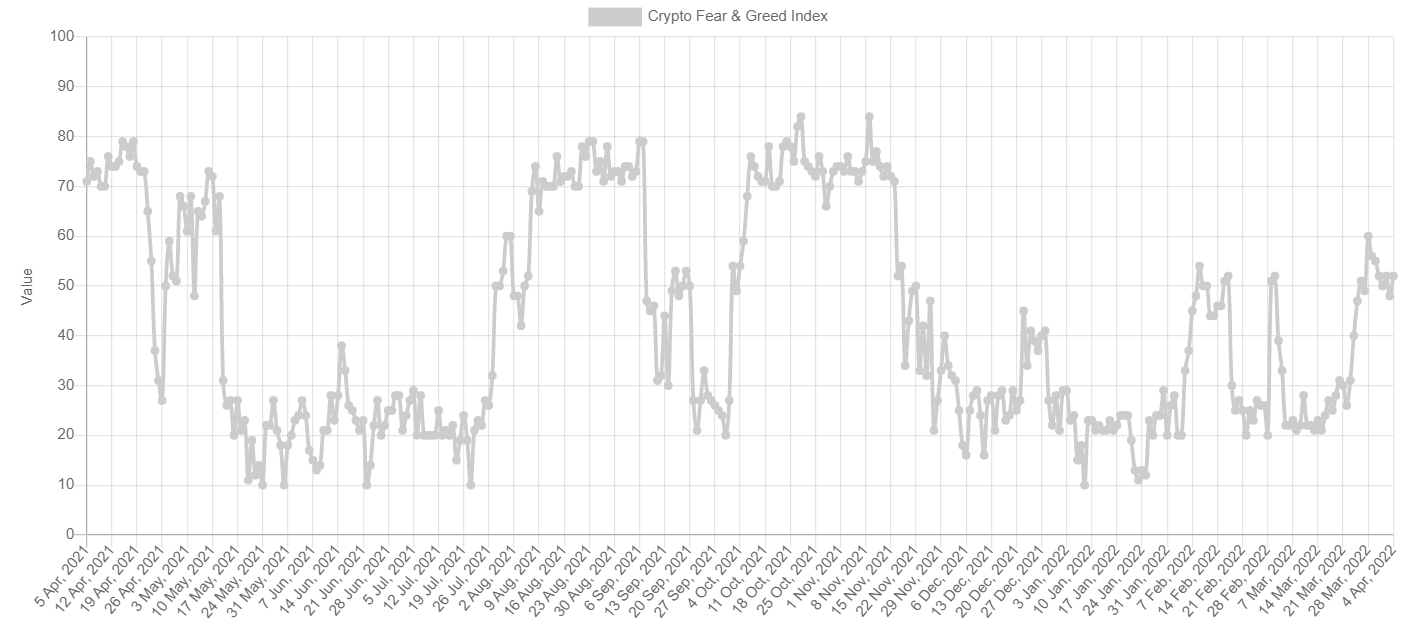

The fear and greed index has fallen from its highest level reached last week since November 2021. Source: alternative.me

BITCOIN chart, D1 interval. BTC broke out above the limits near $45,000, which was the barrier of local peaks from February 2022. The upward movement was continued up to the area of $48,000, where the 200-day moving average (gold line) runs. The demand side failed to break out of this limitation permanently and a downward-corrective impulse is currently underway. Currently, the most important supports for the price of the "king of cryptocurrencies" are the areas between $44,000 and $45,000. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.