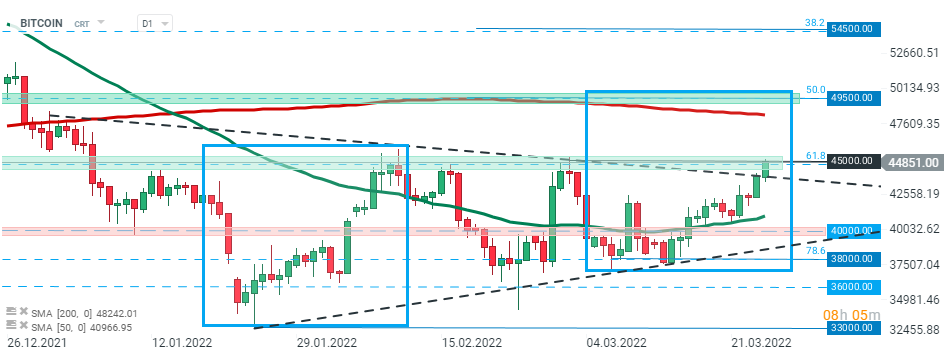

Bitcoin price is on the front foot this week despite the ongoing war and bulls hope that the relief rally may turn into a broader uptrend. The crucial thing will be to see whether BTC bulls will be able to decisive break above key resistance at $45,000 which managed to reject price each time it has been tested since the beginning of the year.

However some on-chain metrics suggest that sellers did not lay down their weapons. Rising buyers activity seems to have liquidated quite a bit of short positions, however the on-chain volume and number of daily active addresses (DAA) do not reflect bullish momentum.

Since the beginning of March DAA dropped to 0.95 million from 1.09 million. The on-chain volume also showed no large fluctuations and remains at the level of 30 billion. Source: Santiment

Since the beginning of March DAA dropped to 0.95 million from 1.09 million. The on-chain volume also showed no large fluctuations and remains at the level of 30 billion. Source: Santiment

Meanwhile Russia's energy chief said Russia is taking into consideration the possibility of allowing China and Turkey to pay for energy in Bitcoin. He said those countries could begin paying for energy in Russian Rubles, Chinese Yuan, Turkish Lira — or even Bitcoin (BTC) — rather than the international standard US dollar.

If Bitcoin manages to close on the daily chart above $45,500, this may signal a potential breakout from the consolidation zone. In this scenario price may be heading towards next key resistance around $49500which is marked upper limit of the 1:1 structure and 50% Fibonacci retracement of the upward wave launched in July 2021. On the other hand, if sellers manage to regain control, then another downward impulse towards psychological support at $40,000 may be launched. Source: xStation5

If Bitcoin manages to close on the daily chart above $45,500, this may signal a potential breakout from the consolidation zone. In this scenario price may be heading towards next key resistance around $49500which is marked upper limit of the 1:1 structure and 50% Fibonacci retracement of the upward wave launched in July 2021. On the other hand, if sellers manage to regain control, then another downward impulse towards psychological support at $40,000 may be launched. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.