Minutes from the latest ECB meeting have just been released, however, it did not cause any major moves on the markets because the sentiment was affected by Lagarde's earlier comments.

Here are key takeaways from the document:

- Many members expressed preference for raising the benchmark ECB interest rates by 75 basis points.

- Some argued that raising interest rates by less than 75 basis points would send the wrong message and run the danger of being seen as being at odds with the 2% inflation target.

- Compromise was in some ways seen as broadly equivalent to raising rates by 75 basis points at the present meeting.

- The suggestion by ECB's Lane to increase the ECB interest rates by 50 basis points was backed by the vast majority of members.

- The present 2025 projection might be viewed as not considerably different from 2%.

- Some participants said they would prefer to reduce the number of APP more quickly.

- It was felt that over the long term, the risks to the fundamental inflation estimates could be more fairly assessed.

- A 50 basis point hike at the current meeting would allow the Governing Council to tighten monetary policy for a longer period of time.

- A notable change in the external environment was the recent strengthening of the euro, which would probably mean slightly lower inflationary pressures for the euro region in the future.

Earlier ECB president Lagarde provided additional hawkish comments. Lagarde said that inflation is way too high and warned ECB doubters to "revise their positions''. Lagarde reassured that the ECB will stay the course with rate hikes. She also pointed out that inflation expectations are not de-anchoring and reaffirmed the central bank's resolve to keep tightening policy further.

As one can see, there is little left of the dovish tone which was sparked by rumors regarding possible rate cuts. On the other hand, EUR weakens slightly, which is caused by rising yields in the US. At the same time, yields in Germany are also growing strongly.

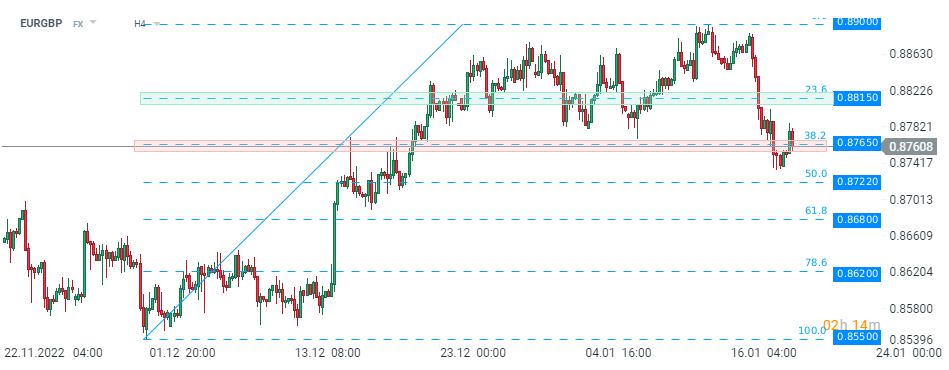

EURGBP barely reacted to the today’s ECB Minutes. Pair is testing local support at 0.8765. Source: xStation5

EURGBP barely reacted to the today’s ECB Minutes. Pair is testing local support at 0.8765. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.