• The S&P Global US Manufacturing PMI fell to 46.2 in December from 47.7 in November, well below market forecasts of 47.7 flash estimates showed. Today's manufacturing data pointed to the biggest contraction in factory activity since May of 2020, driven by subdued demand and a faster fall in output. New orders declined at one of the sharpest paces since the 2008-09 financial crisis and sufficient stocks of inputs and a further reduction in new orders led to the sharpest contraction in purchasing activity in over two-and-a-half years. Also, the level of work-in-hand fell at one of the sharpest rates since 2009, as sales contracted and delayed material deliveries arrived. Lower levels of incomplete work and muted demand led to broadly unchanged employment. On the price front, an improvement in supplier delivery times, muted demand for inputs and lower prices for fuel and metals led to the slowest rise in cost burdens since July 2020. Finally, business confidence was the highest in three months.

• The S&P Global US Services PMI plunged to 44.4 in December from 46.2 in the previous month, below analysts' estimates of 46.5, a preliminary estimate showed. The latest data signaled the fastest pace of contraction in the service sector for four months, and among the quickest since 2009, led by a further solid decrease in new orders. In addition, the rate of job creation was the second-slowest since September 2021, due to the non-replacement of voluntary leavers and reports of lay-offs. At the same time, pressure on capacity waned further, as backlogs of work fell at a solid pace. On the price front, input cost inflation was the lowest since October 2020, while selling prices rose the least for over two years. Finally, business confidence was among the weakest in two years as firms highlighted concerns regarding inflation, hikes in interest rates and dwindling demand.

Today’s PMI figures are another sign of potential recession. Source: Bloomberg via ZeroHedge

Today’s PMI figures are another sign of potential recession. Source: Bloomberg via ZeroHedge

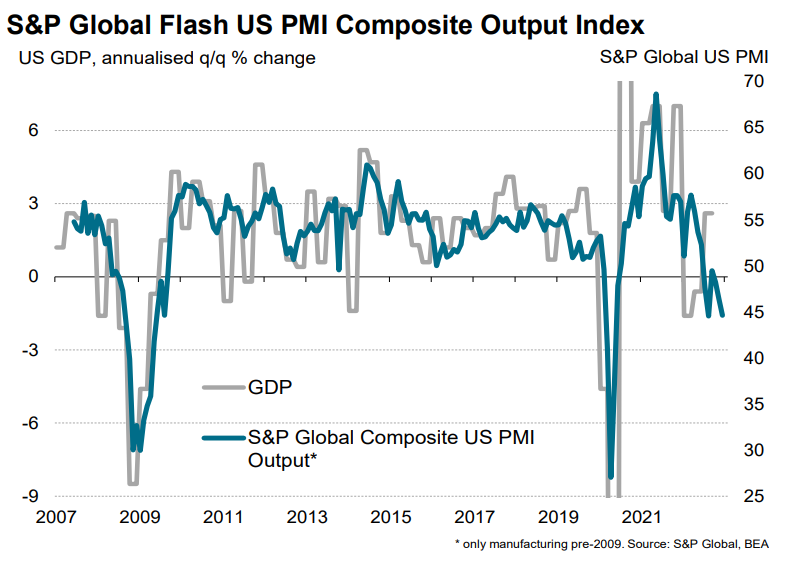

“Business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualized rate of around 1.5%. Jobs growth has meanwhile slowed to a crawl as firms across both manufacturing and services take a much more cautious approach to hiring amid the slump in customer demand," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. Source: S&P Global

On the one hand, today's data indicate that aggressive FED hikes are having the intended effect on inflation, but on the other hand, readings stay below 50, which indicate that the threats of a recession are becoming even more apparent.

EURUSD saw relatively small reaction to today’s data releases. The most popular currency pair continued to trade around 1.0630 level. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.