Fed cuts rates by 25 bps to 3.75% in line with Wall Street expectations. Vote in favor of policy decision was 9-3, with Miran preferring a half-percentage-point cut and Goolsbee and Schmid preferring no cut..

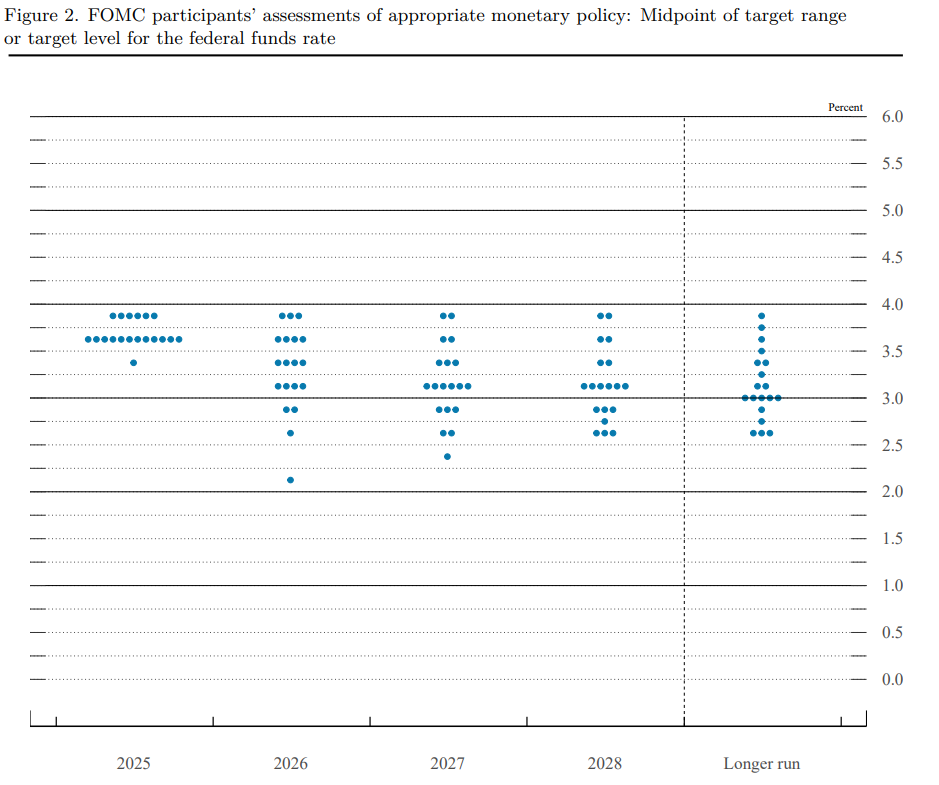

In first reaction to data futures on Nasdaq 100 (US100) gain. Fed median projection maintains 25 bps of rate cuts in 2026; seven officials penciled in no rate cuts for 2026. Four Fed members signalled in two quarter-point cuts for 2026. Fed policymakers see end-2026 PCE inflation at 2.4% (vs. 2.6% prior); core at 2.5% (vs. 2.6%). Projections show wide divergence of views for the path of rates in 2026 and beyond.

- Fed median unemployment projection 4.5% in '25, 4.4% in '26.

- Fed median projection shows rates at 3.1% by the end of 2028.

- Unemployment edged up through September.

- Fed median projection shows rates at 3.4% in '26, 3.1% in '27.

- Median GDP projection at 1.7% in 2025, 2.3% in 2026.

- Fed will buy $40 billion of treasury bills over the next 30 days and consider the extent and timing of additional adjustments.

- Four officials see at least three-quarter-point cuts for 2026.

- Pace of future reserve management purchases likely to be significantly reduced.

- Initial Treasury bill buying to be elevated 'for a few months'; Fed ends operational limit on standing overnight repo operations.

Fed Projections

- Fed Median Rate Forecast (Next 3 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Next 2 Yrs): 3.125% (Forecast 3.125%, Previous 3.125%)

- Fed Median Rate Forecast (Current): 3.625% (Forecast 3.625%, Previous 3.625%)

- Fed Median Rate Forecast (Next Yr): 3.375% (Forecast 3.375%, Previous 3.375%)

- Fed Median Rate Forecast (Long Run): 3% (Forecast 3.125%, Previous 3%)

Federal Reserve signals uncertainty about the outlook remains elevated with 'attentive to risks on both sides of mandate', downside risks to employment have risen. However, the US economy is expanding at moderate pace; job gains have slowed, and unemployment has edged up. Inflation has risen from earlier in the year and remains elevated.

Source: xStation5

Source: Federal Reserve

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.