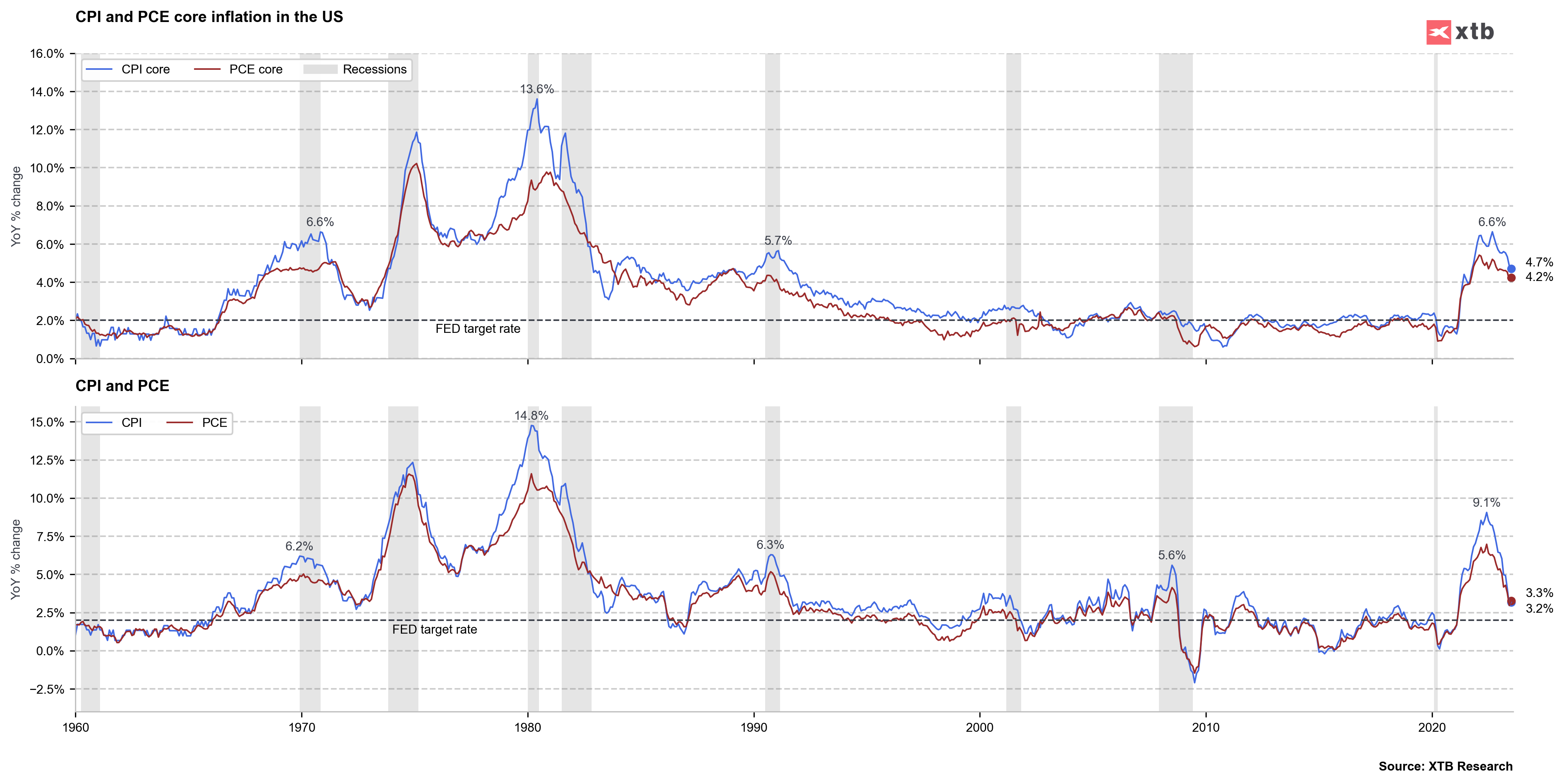

US Core PCE Price index y/y: 4,2% exp. 4,2% vs 4,1% previously

US PCE Price index: 3,3% exp. 3,3% vs 3% previously

US PCE Price index m/m: 0,2% exp. 0,2% vs 0,2 previously

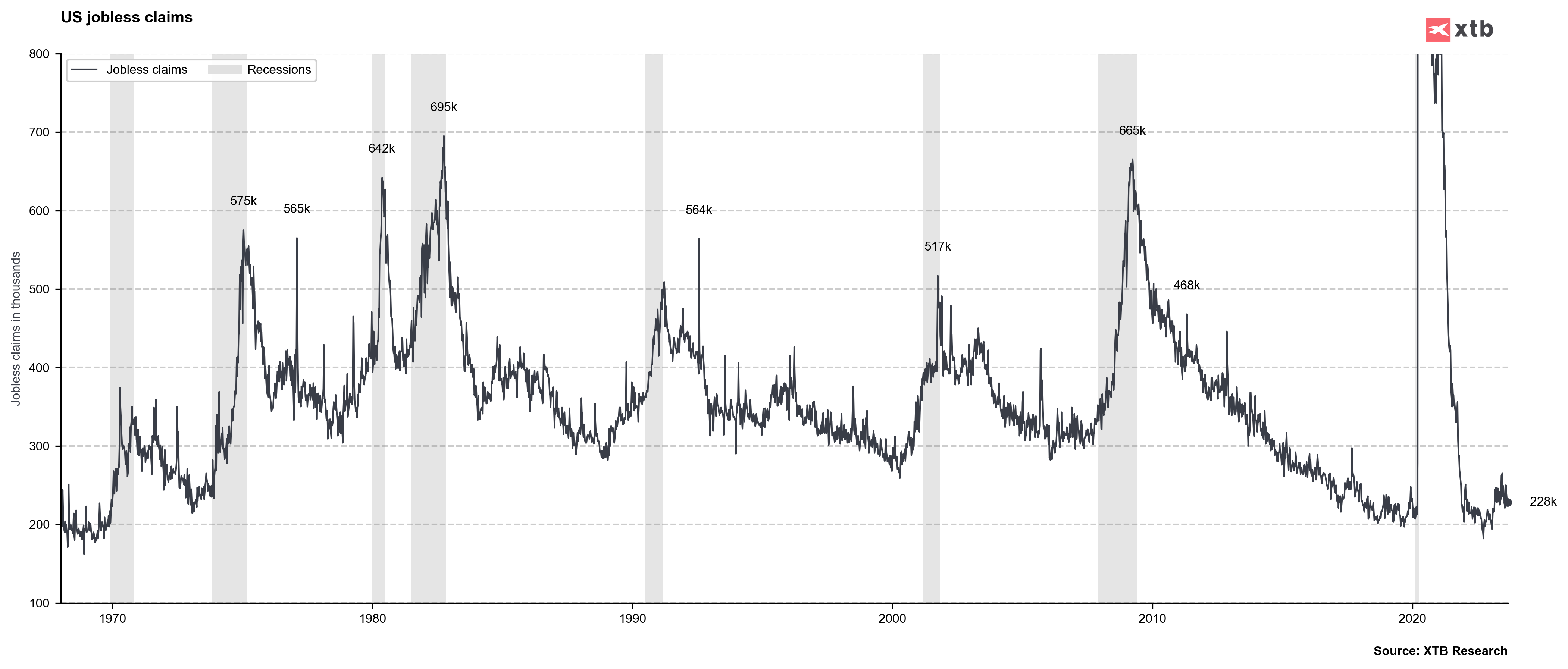

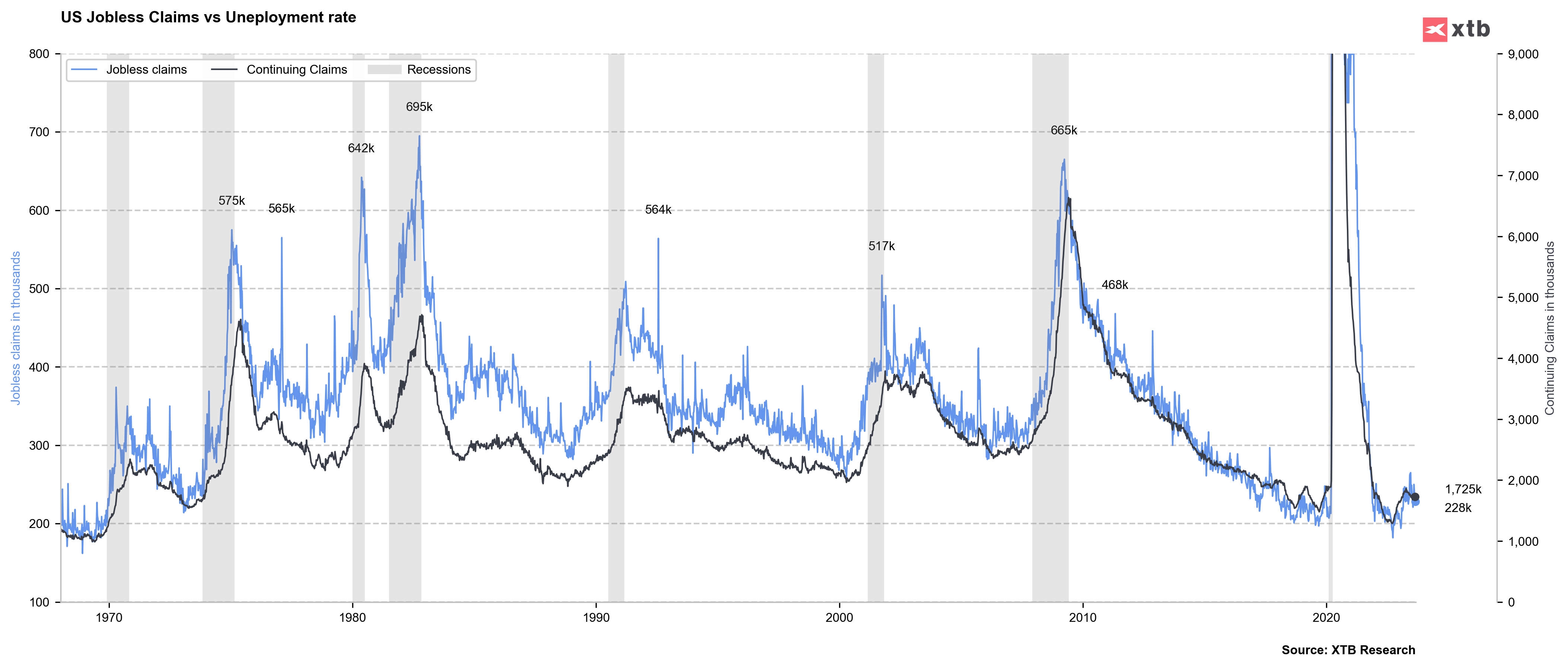

US Initial jobless claims: 228k exp. 235 k vs 230 k previously

US Continued jobless claims: 1,725 mln exp. 1,706 mln vs 1,702 mln previously

US Personal income m/m: 0,2% exp. 0,3% vs 0,3% previously

US Personal consumer spending m/m: 0,8% exp. 0,7% vs 0,5% previously

US Real Personal Consumption m/m: 0,6% exp. 0,5% vs 0,4% previously

In first reaction after new US data US500 falls down slightly but reading was quite good for the stock market. Lower claims signalize that job market is still strong and important for Fed PCE data came in line with Wall Street expectations (July PCE inflation was higher than in June due to underlying y/y factors). At the same time real US personal consumption is slighlty higer than expected and faster than before (0,6% vs 0,4% previously). It's worth noting that Challenger report (layoffs) today came in 75,151 reading vs 23,697 expected. Tomorrow's US Non-farm payrolls (NFP) report will be the most important reading this week.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Economic calendar: Key U.S. data to shift focus from geopolitics (22.01.2026)

Market Wrap: Wall Street and Europe lose ground; markets await Trump in Davos🛣️

What next for interest rates in the UK❓ Tobacco and airfare drive up prices in the economy 📈

Economic calendar: Trump’s speech in Davos and Wall Street earnings 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.