GBPUSD plunged below $1.19, while AUDUSD lost 1.9% as traders damped riskier assets and rushed towards greenback following Fed Chair Powell's hawkish comments. During his testimony in front of Congress Powell said that the Fed might need to increase interest rates more than forecast to combat inflation. Elsewhere, the Bank of England is seen increasing rates by a further 25 bps this month, before ending the current tightening cycle. Board member Catherine Mann had warned on Tuesday that the pound could be vulnerable to Federal Reserve and European Central Bank hawkish outlooks. Powell’s remarks drove money markets to bet on a 50 bps interest rate hike this month, compared to prior expectations of a softer 25bps. The yield on the US 10-year Treasury note briefly jumped above 4.0%, which put additional pressure on precious metals. Gold retreated to support at $1820, while silver plunged nearly 4.0% to $20.25 mark.

GBPUSD fell sharply and is currently testing key support at 1.1860, which is marked with lower limit of the 1:1 structure, 200 SMA (red line) and 38.25 Fibonacci retracement of the downward wave started in June 2021. Should break lower occur, downward move may deepen towards October 2022 highs at 1.1650. Source: xStation5

SILVER is losing over 5.0% on a weekly basis and is approaching psychological support at $20.00 which coincides with 200 SMA (red line). Source: xStation5

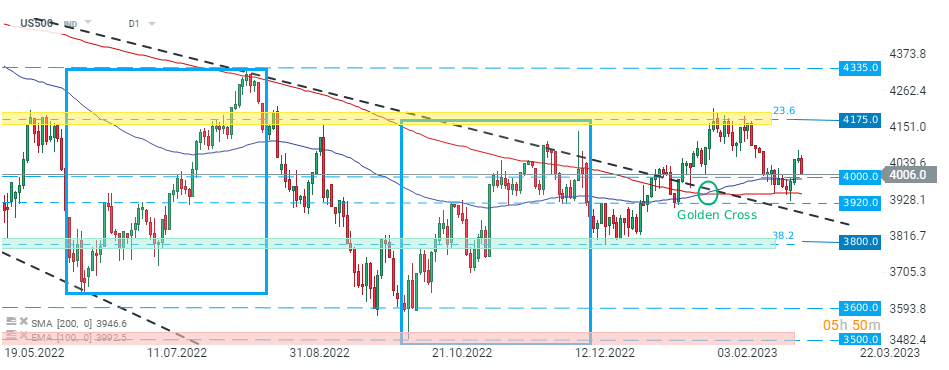

US500 also retreated sharply and is approaching key support at 4000 pts. Source: xStation5

The US dollar is the strongest G10 currency on Tuesday. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.