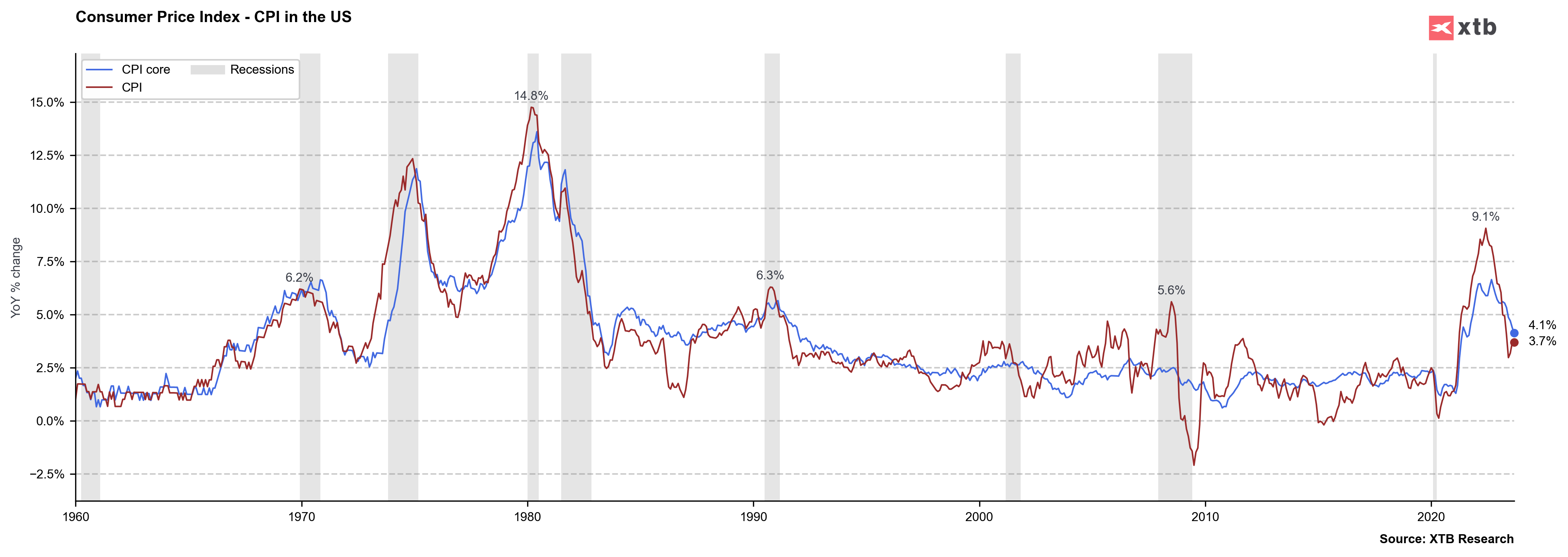

US CPI reading for September y/y: 3,7% vs 3,6% exp and 3,7% previously

- US CPI reading for September m/m: 0,4% vs 0,3% exp and 0,7% previously

US Core CPI reading for September y/y: 4,1% vs 4,1% exp and 4,3% previously

- US Core CPI reading for September m/m: 0,3% vs 0,3% exp and 0,3% previously

US Initial jobless claims: 209 k vs 210 k exp. and 207 previously

- US contiuned jobless claims: 1702 mln vs 1676 mln exp and 1664 mln previously

Slightly higher than expected US CPI reading may be a signal to Fed that's still to early to end the rate hike cycle and the situation will be safer if interest rates will increase at least once more time (maybe the sooner, the better until strong economy is a mandate to do that). At the same time 'negatively' surprise is very little and inflation cooled off strongly in US economy, what's more and important - the core reading is lower in line with expectations. US jobless claims number was slightly higher but the job market is still very tight (despite higher reading of continued jobless claims). USDIDX gains after the US inflation data and we can see sellers pressure on US100.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

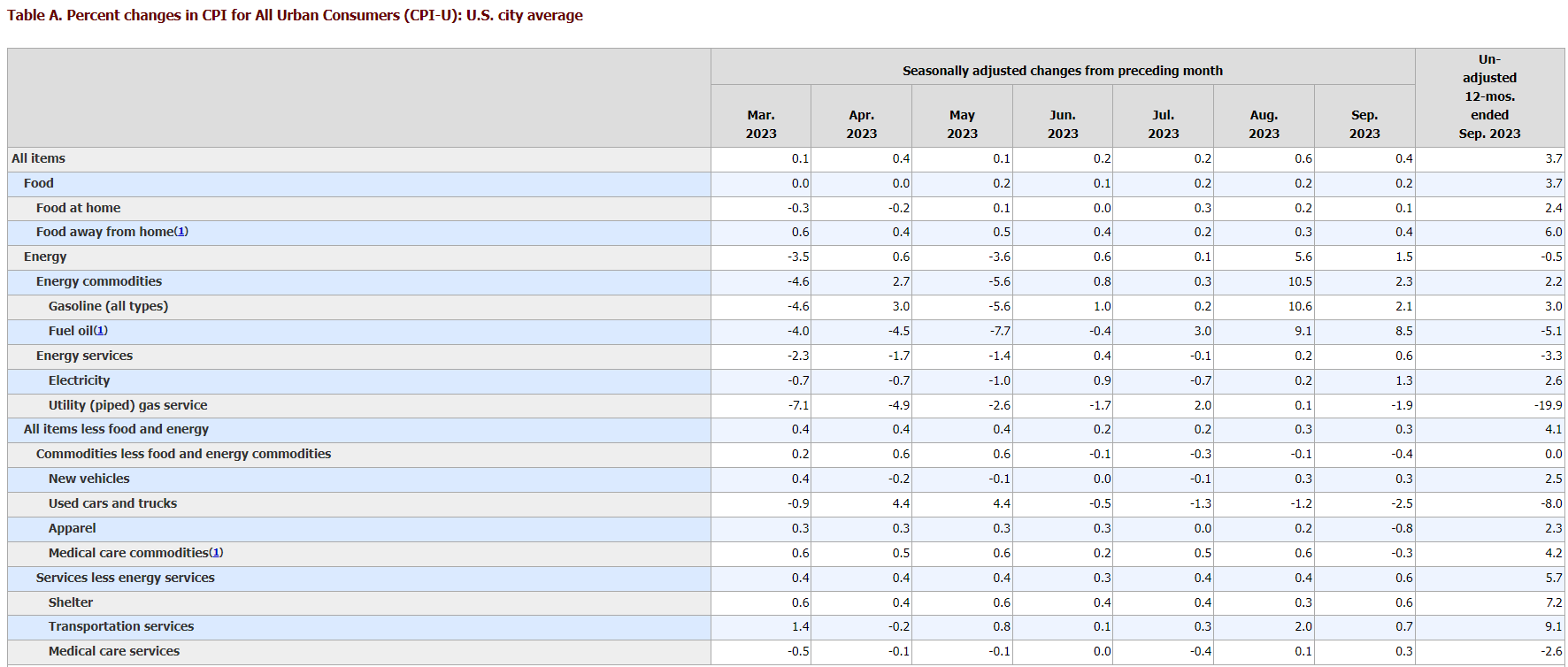

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

Higher services (especially transportation and shelter data may be a litte negative surprise for the markets. Source: BLS

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.