- Inflation in US below expectations

- Inflation in US below expectations

14:30 - USA CPI (Consumer inflation) for September:

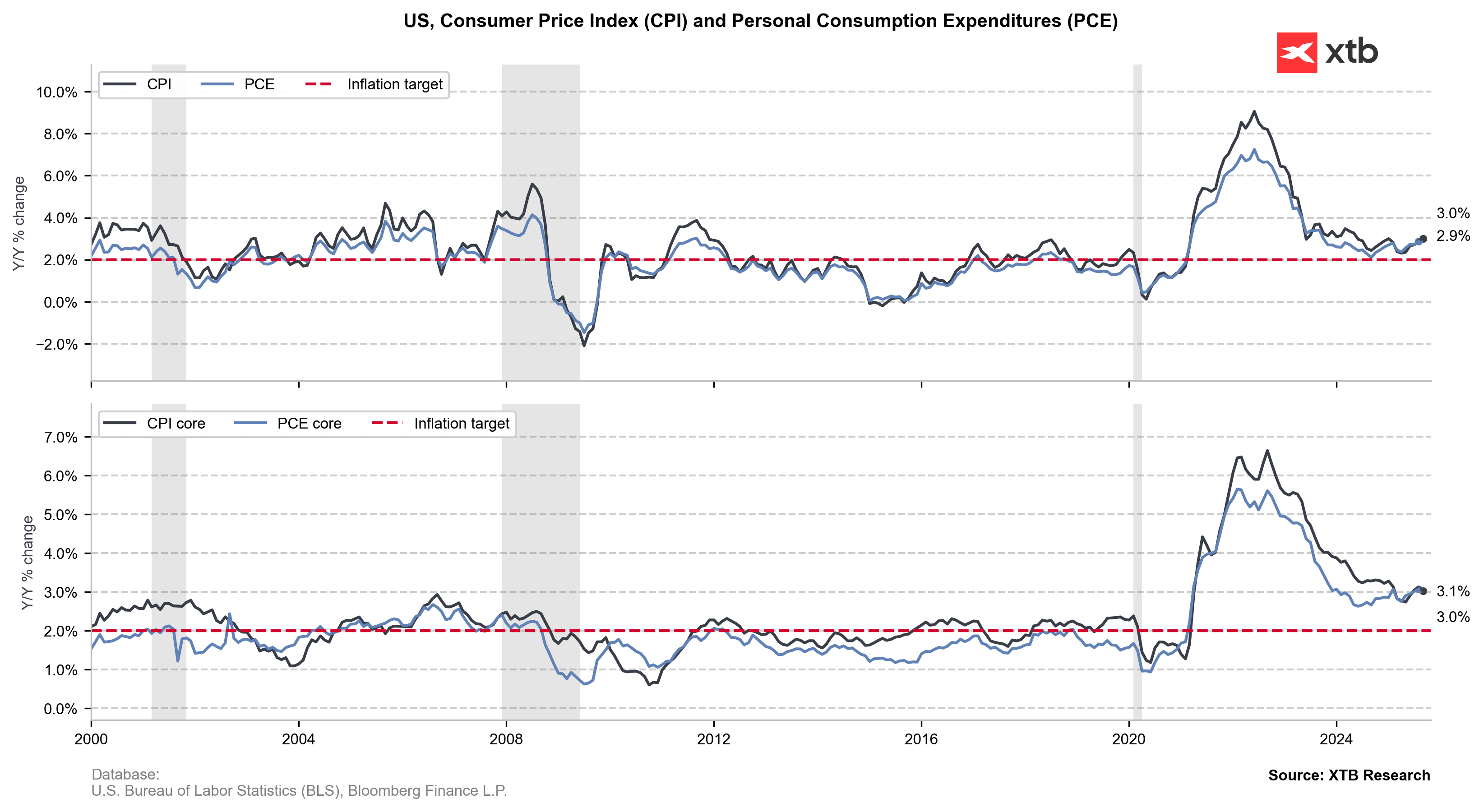

Core CPI YoY: 3% (Expected: 3.1%, Previous 3.1%)

Core CPI MoM: 0.2% (Expected: 0.3%, Previous: 0.3%)

CPI YoY: 3% (Expected: 3.1%, Previous 2.9%)

CPI Mom: 0.3% (Expected: 0.4%, Previous 0.4%)

The CPI reading from the USA presented lower than expected, signaling disinflation in the US economy. Both the annual and monthly indicators fell 0.1% percentage points below consensus. Structure of changes is ambiguous is as follows:

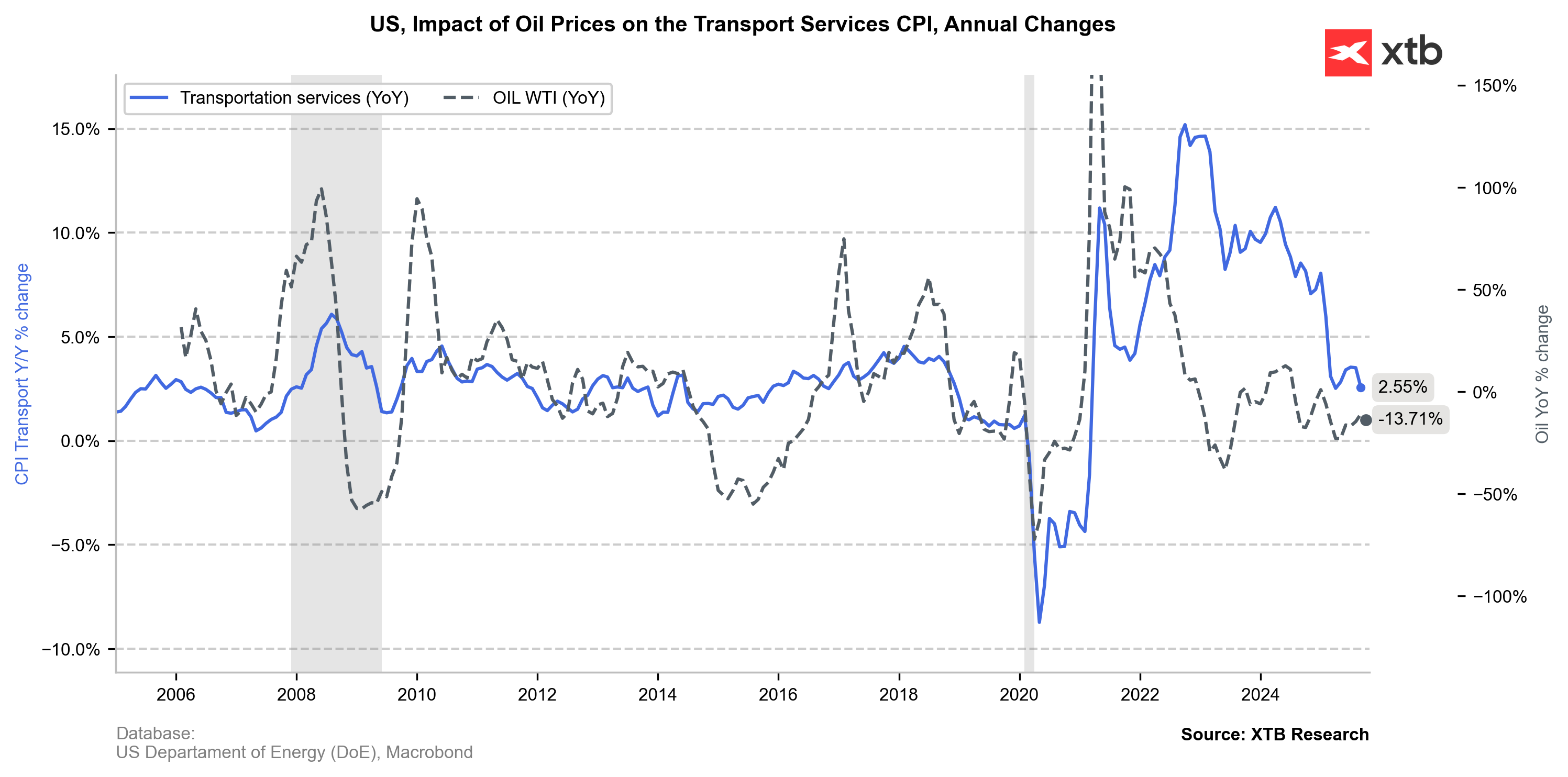

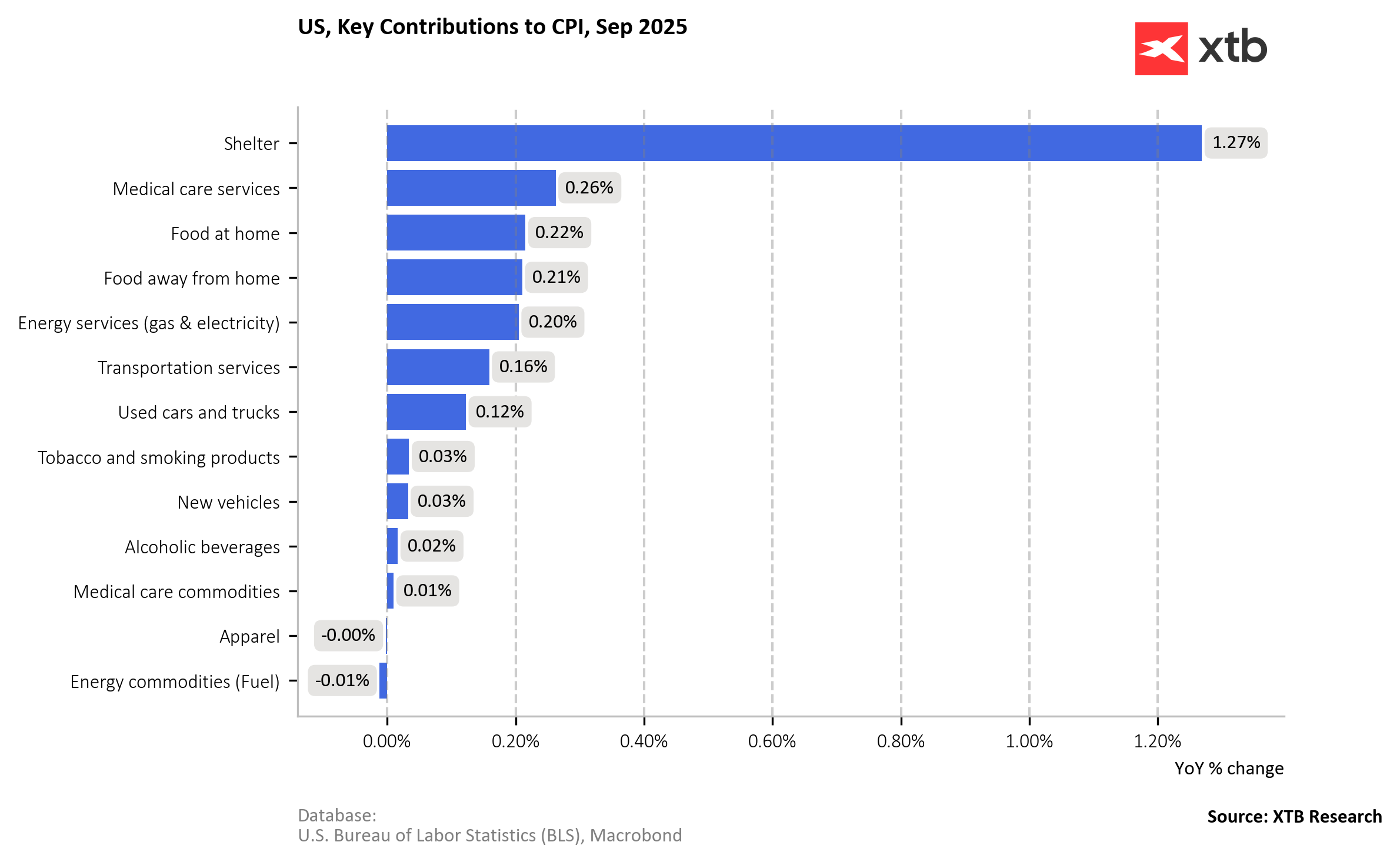

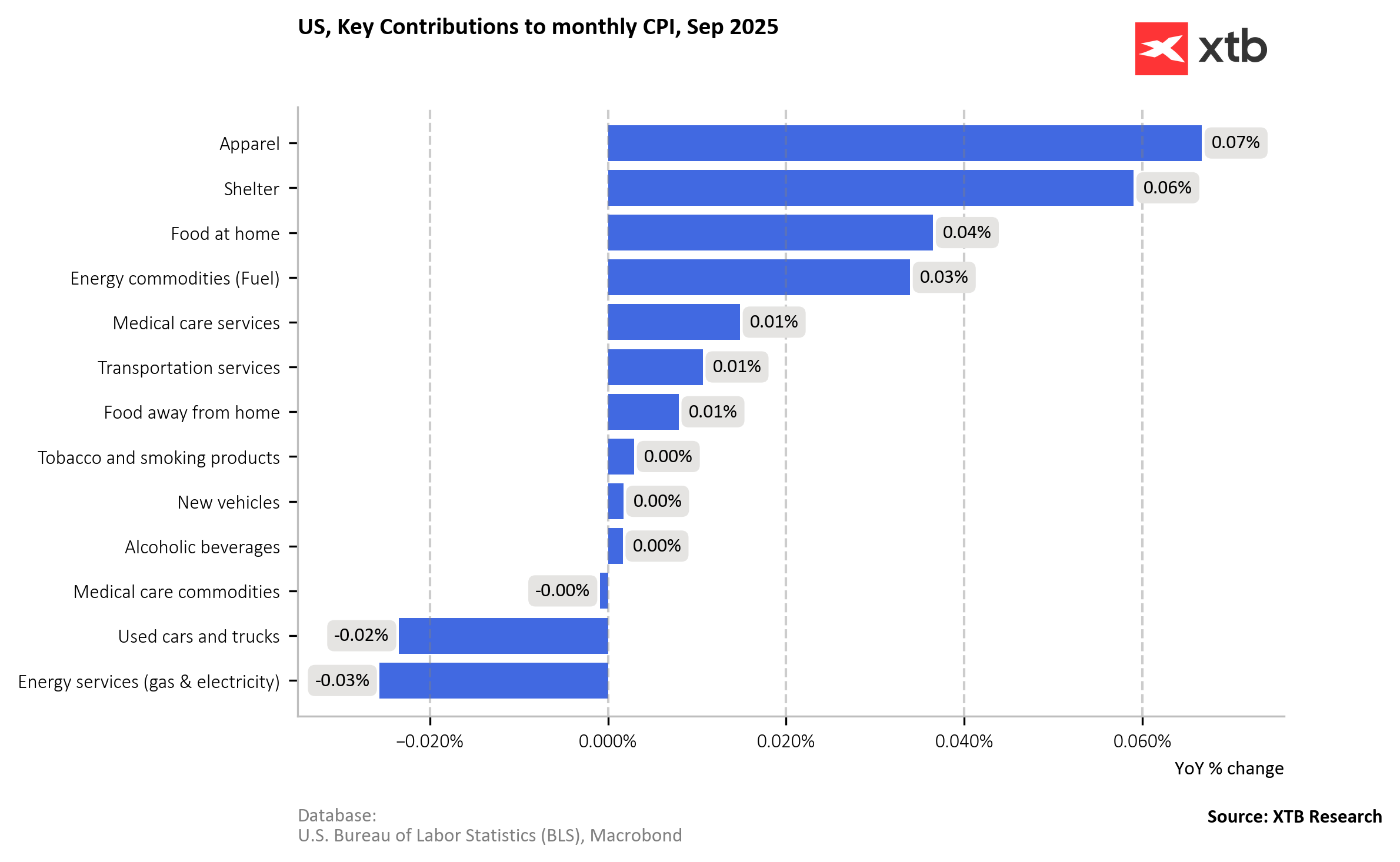

Despite the drop in oil prices, fuels contributed to September's dynamics. This is possibly due to factors such as refinery margins and seasonally higher prices at stations.

At the same time, the apparel category came out surprisingly high.

On the other hand, electricity decreased month-on-month and acted in a disinflationary manner. This is interesting in the context of ongoing debate in the US related to the electricity prices rising due to high usage by data centers.

Finally, housing, or "shelter" inflation, remains the largest and most persistent contributor to CPI, although the growth rate in this category is gradually slowing.

This mix suggests further flattening of price pressure in most goods, while inertia persists in housing related services. The power market, fuel and tariffs may still react with a delay, but for now, CPI shows relief subcomponent in this regard.

This has far-reaching implications for monetary policy. Lower than expected means increased expectations that FED will resume QE policy sooner than expected. Pricing in further rate cuts and repurchase of the debt by the Fed is crucial for the current market.

Even more so now due to "heightened concerns about shutdown" pressure on the economy.

Markets reacted swiftly, Euro appreciated to the dollar after the CPI reading by approximately 0.3%, although market quickly corrected substantial part of this gain.

Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.