Highly anticipated NFP report was released at 12:30 pm GMT and showed the US economy unexpectedly added 261 k jobs in October, compared to upwardly revised 315k gain in September (from 263k) and well above market expectations of 200k.

The jobless rate rose to 3.7% from 3.5% last month and above market estimates of 3.6%.

Closely watched wage growth fell to 4.7% YoY, after 5.0% increase in September and in line with market expectations of a 4.7% YoY.

Today's reading signals that the labour market is still tight therefor Fed will remain committed to bringing down inflation with more rate hikes.

Following the data release, swaps have already started pricing in hikes to 5.25% in June 2023! Source: Bloomberg

Following the data release, swaps have already started pricing in hikes to 5.25% in June 2023! Source: Bloomberg

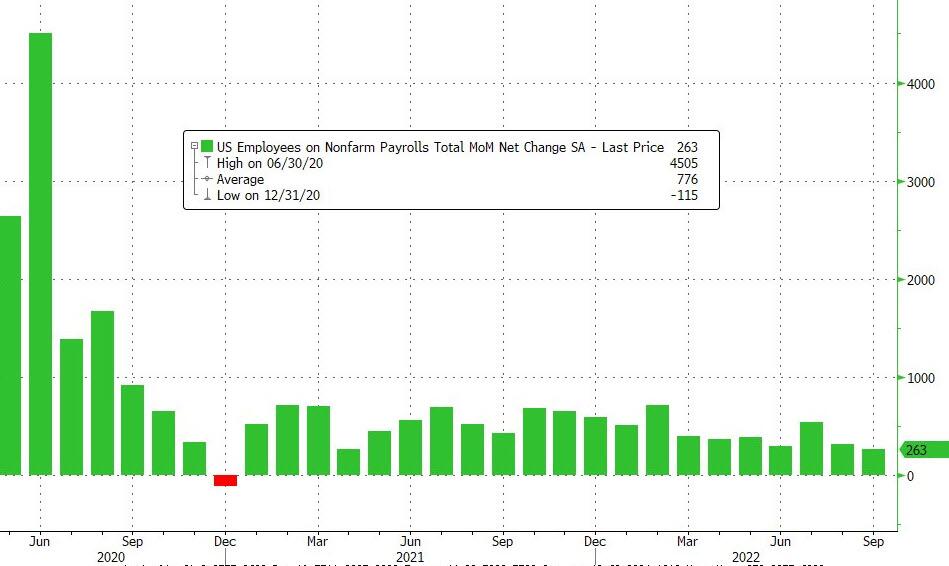

The US economy added unecpectedly 261K jobs last month, above market forecasts of 200K. Nevertheless it is the weakest reading since December of 2020. Source: Bloomberg

The US economy added unecpectedly 261K jobs last month, above market forecasts of 200K. Nevertheless it is the weakest reading since December of 2020. Source: Bloomberg

Commenting on the report, Bloomberg chief economist Anna Wong wrote “the jobs report for October sends mixed signals about the labor market, with one survey showing robust job gains while another shows a big jump in unemployment. Filtering the noise in the data, our takeaway is that the labor market is still very tight and much adjustment still needs to occur before unemployment is close to a neutral level. We expect that the Fed will ultimately have to raise rates to 5% next year.”

Simultaneously to the release of US data, the Canadian labour report for October was released.

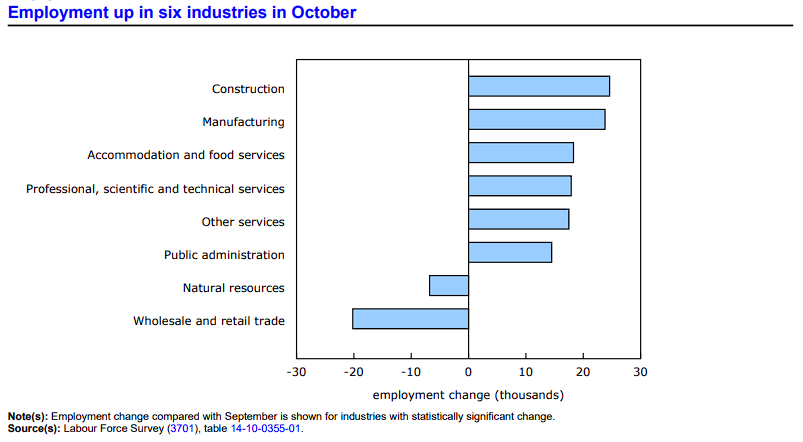

The Canadian economy added 108.3K jobs in October, easily beating analysts estimates of 10K job gain. Employment rose in several industries, led by manufacturing, construction, and accommodation and food services. At the same time, it fell in wholesale and retail trade, as well as in natural resources. The unemployment rate in Canada was at 5.2 % in October, unchanged from the prior month and below analysts projections of 5.3%.

Source: Labour Force Survey

Source: Labour Force Survey

USDCAD initially currency pair rose after data relese however sellers manage to quickly regain control and price is heading towards upward trendline. Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Economic calendar: ADP Labor market report and ISM services 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.