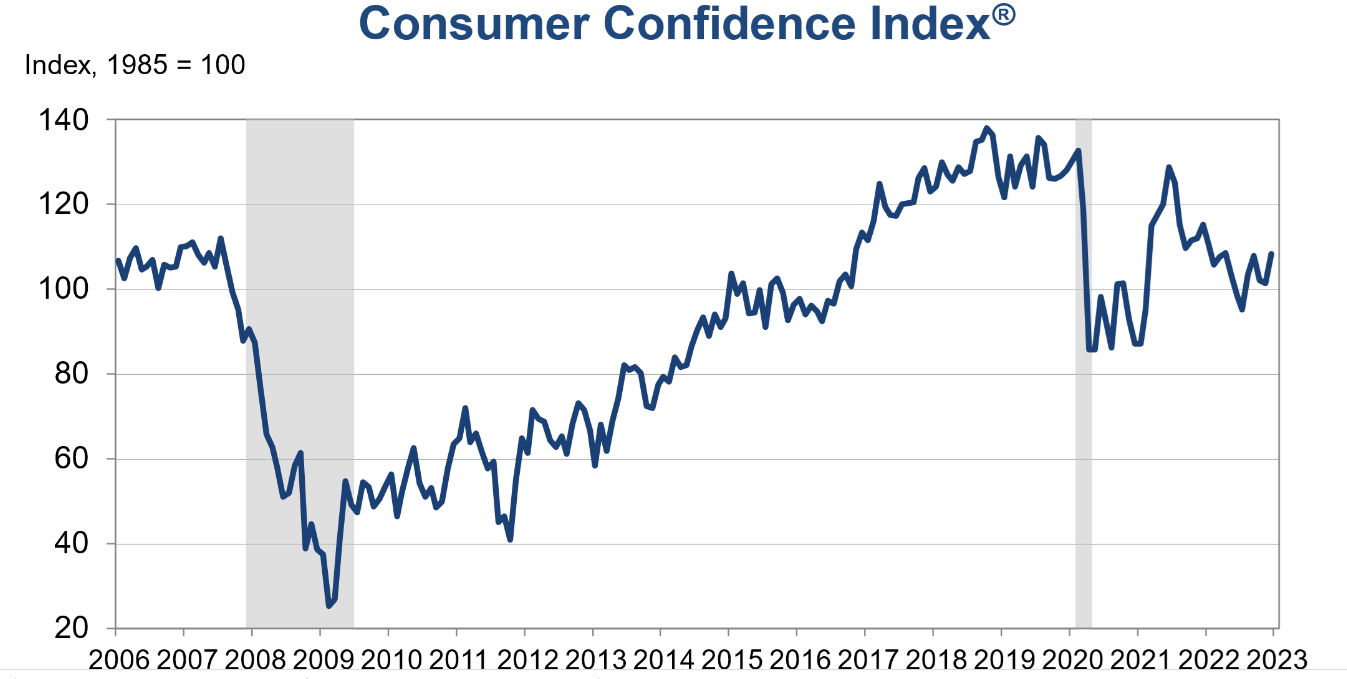

US Conference Board Consumer Confidence index increased to 108.3 in December, from the previous month's upwardly revised 101.4 (intialal reding 100.2) and compared to market expectations of 101.0.

- Present situation Index 147.2 in December versus 138.3 (revised from 137.4)

- Expectations index 82.4 vs 76.7 last month (revised from 75.4).

- 1 year inflation expectations 6.7% in December down from 7.1% in November

Source:conference-board.org

Source:conference-board.org

“Consumer confidence bounced back in December, reversing consecutive declines in October and November to reach its highest level since April 2022. The Present Situation and Expectations Indexes improved due to consumers’ more favorable view regarding the economy and jobs. Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus. Vacation intentions improved but plans to purchase homes and big-ticket appliances cooled further. This shift in consumers’ preference from big-ticket items to services will continue in 2023, as will headwinds from inflation and interest rate hikes” said Lynn Franco, director of economic indicators and surveys at The Conference Board.

Despite recession warnings and mass-layoffs respondents are surprisingly quite optimistic when it comes to short-term labor market outlook.

-

19.5% of consumers expect more jobs to be available, up from 18.5%.

-

18.3% anticipate fewer jobs, down from 21.2%.

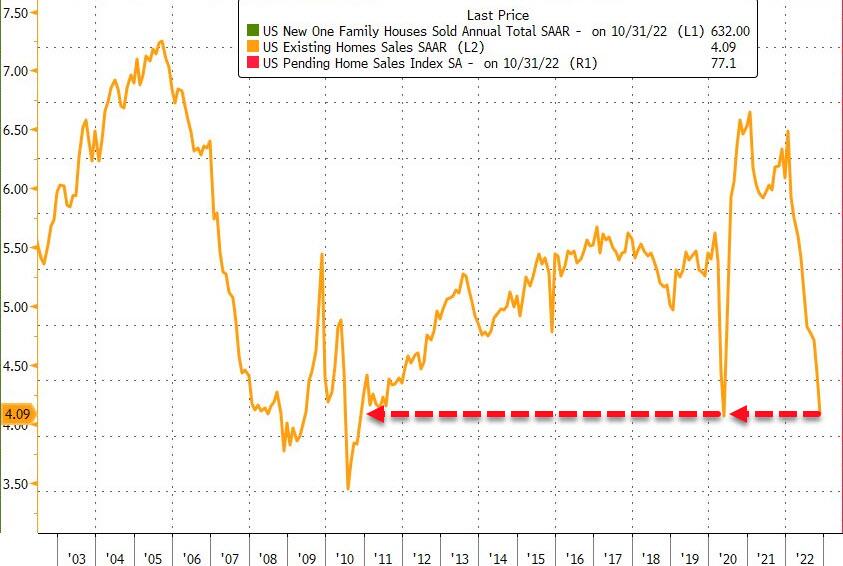

Simultaneously, existing home sales figures for November were released. Sales plunged more than expected to 4.09 million from 4.43 million in October, well below analysts’ estimates of 4.20 million. It is the tenth month of falling sales in a raw and the lowest level since May of 2020 as high mortgage rates weigh on affordability. The median existing-home sales price rose 3.5% year-on-year to $370,700. The inventory of unsold existing homes retreated for the fourth straight month to 1.14 million or the equivalent of 3.3 months' supply at the current monthly sales pace.

Existing home sales continue to move lower sharply, which is another recession warning signal. Source: Bloomberg via ZeroHedge

Existing home sales continue to move lower sharply, which is another recession warning signal. Source: Bloomberg via ZeroHedge

EURUSD bounced off the 1.0600 support after data release. Source:xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.