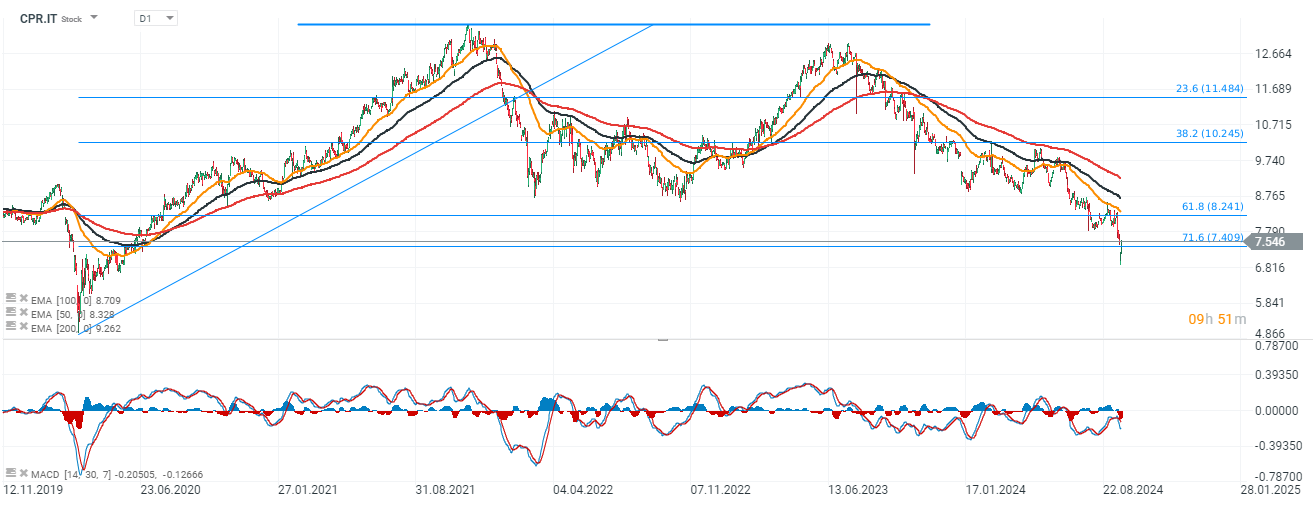

Italian-based Campari Group (CPR.IT), opearting in beverage industry (producer of spirits, wines, famous Aperol, Campari and even non-alcoholic apéritifs) rebounding almost 8% after sell-off initiated by CEO Fantacchitotti resign (unsuccessful cadence), US interest rate cuts, and better sentiments across the European (also Italian) stock market. Investors now see higher odds for the company to create value for shareholders.

- Matteo Fantacchiotti, has stepped down abruptly after less than half a year in his position, unofficially due to 'personal reasons'. Fantacchiotti brought to the company experience Carlsberg, succeeding 17-year cadence of Bob Kunze-Concewitz.

- Now Kunze-Concewitz is probably coming back with a possible role of Campari CEO. The firm announced that its Chief Financial Officer, Paolo Marchesini, and General Counsel, Fabio Di Fede, would jointly take over as interim co-CEOs.

- Campari has a very weak yer with weak half-year financial earnings from July, which lead to stock market dump. The sharp drop in shares occurred also, after a discussion on the U.S. spirits industry on September 13, when Campari addressed weak demand trends. The company made its largest acquisition to date, purchasing Courvoisier Cognac

- for $1.32 billion. This deal occurred amid slowing consumer demand in the cognac market. At the time, Kunze-Concewitz downplayed concerns, stating that the slump was temporary and medium- to long-term outlook will be optimistic. Now, the company faces new challenges and as a new CEO with the companies Board will have to address it.

Source: xStation5

Source: xStation5

Daily summary: Markets recover optimism at the end of the week

US OPEN: Investors exercise caution in the face of uncertainty.

Oklo shares surged in a true “atomic open” on today’s session

Rio Tinto and Glencore shake up the mining market🚨 Giants negotiate merger 🤝

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.