Tensions in the Middle East are on the rise

United States conducted a pre-emptive strike aimed at high-profile Iranian officials at the airport in Baghdad, Iraq. Qassam Soleimani, one of the top Iranian commanders, was killed in a missile attack. Soleimani is said to be responsible for numerous terrorist attacks that took place in the Middle East and it is rumoured that he was preparing strikes on high-profile US officials. Iran vowed to retaliate. Crude price is surging today with Brent trading nearly 4% higher. However, did fundamental situation change? What could Iran do and how could it affect the oil market?

Strait of Hormuz is the key chokepoint for the oil market

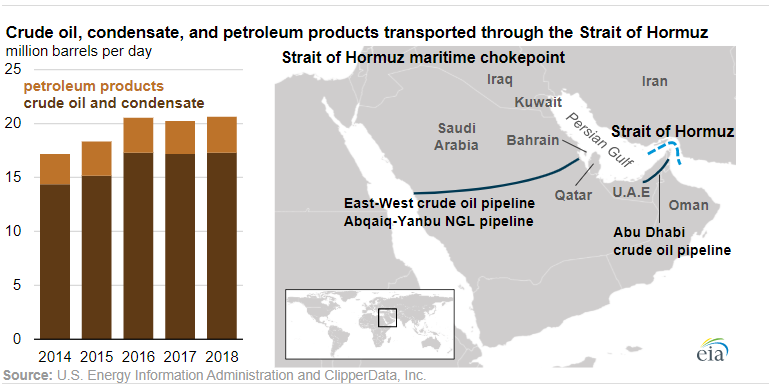

Around 21 million barrels of oil pass through the Strait of Hormuz each day - around a fifth of the global demand. Should the Strait become paralyzed by geopolitics, oil prices could experience volatile swings. Let us remind that when Saudi refineries were attacked, around 4 million barrels of output were lost. In response, oil jumped as much as 15% in just a single day! The Strait is used by some of the biggest oil producers like Saudi Arabia, Iraq, Kuwait and the United Arab Emirates. Having said that, blockage of the Strait could paralyse the global oil market.

Over 21 million barrels of oil pass through the Strait of Hormuz each day. Alternate shipping routes exist but they would be insufficient to stabilize the market in case the Strait of Hormuz is paralyzed. Source: EIA

Over 21 million barrels of oil pass through the Strait of Hormuz each day. Alternate shipping routes exist but they would be insufficient to stabilize the market in case the Strait of Hormuz is paralyzed. Source: EIA

What can Iran do?

Iran could block the Strait of Hormuz, seize tankers or even attack them. Of course, such actions would see a quick response from third party countries and this could lead to an outright war in the Middle East. Iran has blocked the Strait numerous times in the 70s and has conducted attacks on tankers in the late 80s. Blockage of the Strait or outbreak of war would trigger massive price increases on the oil market.

Is it possible to ship oil via alternate routes?

Maritime transport is cheap, fast, effective and can be used to deliver goods to almost every part of the world. Land transport is also possible thanks to pipelines. However, transport capacity of all pipelines in countries that currently ship via Strait of Hormuz amounts to around 10 million barrels per day. Nevertheless, the vast majority of pipelines used by Iraq run through Saudi Arabia therefore it cannot be used to ship oil from both countries at the same time. Taking it into an account, transport capacity shrinks to 6.8 million barrels per day. It is not enough to substitute for the maritime transport. Having said that, should the Strait get blocked, one should expect stoppages in oil deliveries. In such a situation, crude price could jump above the $100 per barrel.

Iran may lose patience

United States can pressure Iran to leave the Strait of Hormuz open by threatening to impose additional sanctions. However, it should be noted that Iran lost many contractors due to the sanctions and its GDP has shrunk by around 10% last year. It means that Iran could lose it patience and trigger another “war” on the oil market. This is not a good information for the global economy as costs of transportation and energy would rise.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.