Bitcoin price slightly rebounds after earlier declines in the day. Over the weekend, we saw a sharp drop, particularly on Sunday when Bitcoin's price fell below $60,000 to $57,600.

Important events from the weekend:

-

Celsius sues Tether for $3.5B, alleging improper BTC collateral liquidation during bankruptcy, seeking Bitcoin returns and damages.

-

Former SEC official warns Morgan Stanley’s Bitcoin ETF push could trigger intense compliance scrutiny, calling it a death wish.

-

The SEC delays its decision on Hashdex's proposed Bitcoin and Ether ETF until Sept. 30, 2024, for further review.

-

Cboe re-filed its application to list options on spot Bitcoin ETFs, signaling potential SEC engagement, despite initial withdrawal.

-

Russia legalizes Bitcoin and crypto mining, allowing specified entities and individuals within energy limits to mine, boosting BRICS' digital currency plans.

-

XRP surged 26% as Ripple hailed a $125M SEC penalty as a “victory,” signaling no classification of XRP as a security, nearing lawsuit's end.

-

Franklin Templeton launches its blockchain-based money market fund, FOBXX, on Ethereum's Layer-2 Arbitrum, expanding retail access.

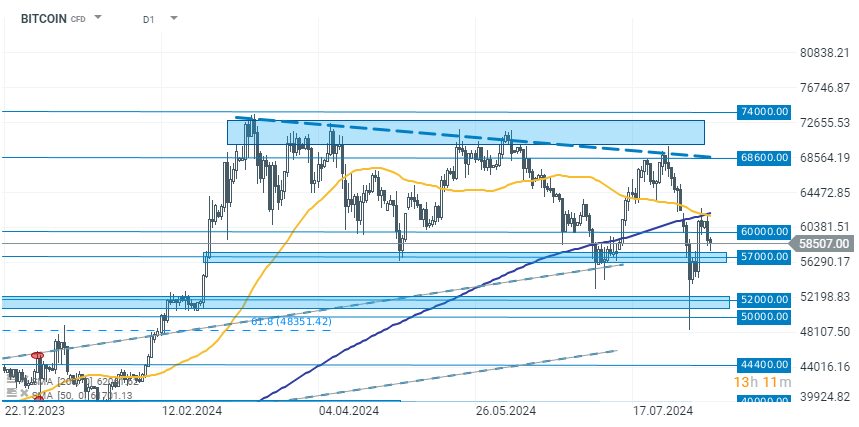

Bitcoin (D1 Interval)

Bitcoin's price is slightly recovering from earlier losses, and we currently see a price increase to around $58,700. Interestingly, much larger gains can be observed among smaller projects and Ethereum. Altcoin market capitalization gains 1.80%, while Ethereum is up 1.10%.

Based on technical analysis, after a strong recovery from earlier declines, Bitcoin's upward movement halted around the 200-day SMA at approximately $62,000. Over the weekend, we saw another drop to the support zone above $57,000. Currently, the key will be maintaining this level and returning above $60,000. If the bulls can hold this zone, we can expect further increases above $62,000. Otherwise, the most critical level to maintain will be the previously mentioned $57,000 support zone.

Source: xStation 5

BITCOIN: Is Kevin Warsh the final nail in the bulls’ coffin? 🔨

🚨Bitcoin slides 5% testing local lows near $84k level

Cosmic increases in precious metals, yen in turbo mode! 🚀

Crypto news: Bitcoin slips back to $87k 📉 Bear market signal?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.