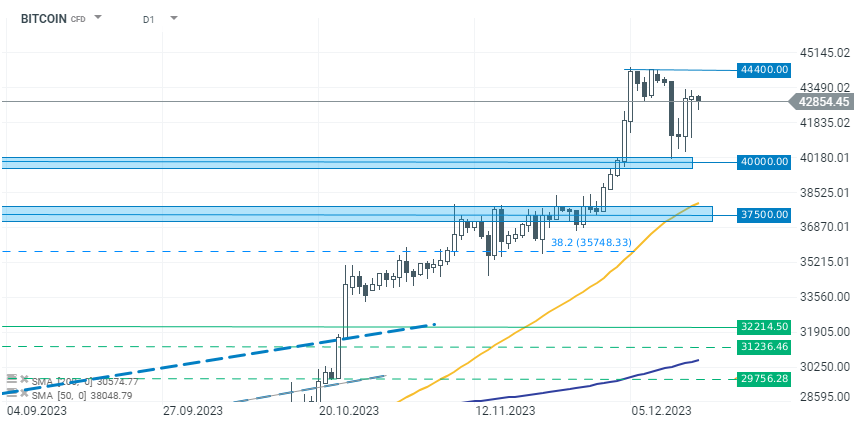

Cryptocurrencies have returned to growth mid-week, buoyed by positive sentiments on Wall Street. Bitcoin, after testing the support level at 40,000 USD, rebounded above 41,000 USD on the same day. Subsequently, following the dovish reception of Fed Chairman Jerome Powell's speech by the markets, Bitcoin surged in another wave of growth, returning to the 42,000-43,000 USD range.

The rise is also fueled by positive reports on the progress of work on spot ETFs for Bitcoin. This week, BlackRock proposed a structural change, allowing authorized participants (APs) to create new shares using cash instead of cryptocurrency. This modification paves the way for Wall Street banks such as JPMorgan and Goldman Sachs, which cannot directly hold cryptocurrencies, to invest in them. This change could significantly increase the liquidity of ETF shares, as it enables investment by mega banks on Wall Street.

Cryptocurrency market investors are becoming more eager as the final deadline for the acceptance of many ETF applications approaches, set to occur in early January. Speculations related to the acceptance of ETFs and positive moods in global financial markets are supporting growth in the cryptocurrency market. The lower limit remains at the 40,000 USD level, while resistance is around the recent local highs of 44,400 USD. Source: xStation 5

Morning Wrap (10.12.2025)

Crypto news: Bitcoin rebounds above $90k amid optimism on Wall Street📈

Bitcoin loses 3% 📉Technical bearish flag pattern?

Morning wrap (03.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.