The Bitcoin halving event took place overnight from Friday to Saturday. Despite many speculations, during the event itself, there were no significant movements in the cryptocurrency market. On one hand, this was due to the weekend, during which liquidity in the cryptocurrency market is limited. On the other hand, the event itself does not have a major impact on the price in the short term.

Halving means that the rewards for each newly mined block are halved. Only in the long term should the halving of supply positively affect the BTC price. It is also worth noting the Altcoin sector, which has evidently performed better since the halving. The total capitalization of smaller projects grew from $630 billion to $675 billion, an increase of over 7.00%.

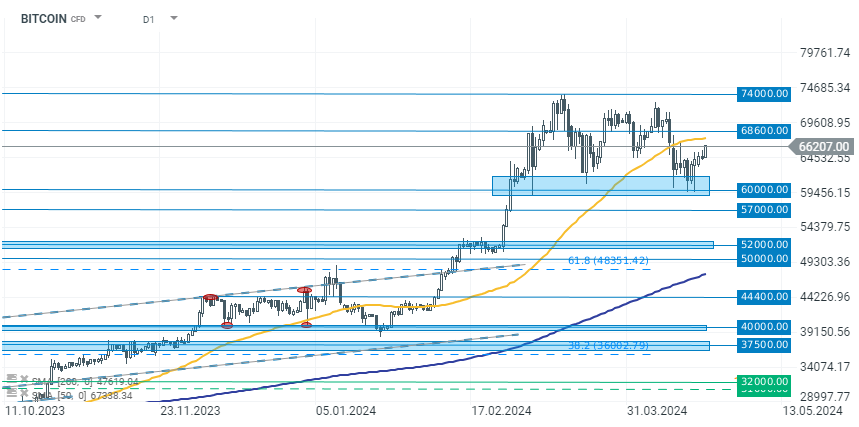

Bitcoin (D1 interval)

Nevertheless, since the halving, investors in the cryptocurrency market have been in better spirits. The price of Bitcoin has been calmly and slowly rising from around $64k to nearly $66k currently. Today, BTC is recording close to a 2.0% increase. Bitcoin defended support last week around the $60k level and remains in a fairly wide consolidation channel between $60k-$72k. Any movement outside this zone could signify the start of a new trend. However, recent days suggest that bulls will likely want to retest levels above $70k. Otherwise, maintaining the support level around $60k will be crucial.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.