Bitcoin is retreating back above $95,000 and data from Bloomberg, this week, suggests a significant slowdown in buying activity in ETFs. Yesterday, they accumulated BTC worth 'only' $91 million, and this entire week saw a net outflow of about $300 million, while long-term investors are making steady distributions and selling off BTC reserves at a rate of as much as $2 billion per day, according to on-chain data from Glassnode. Such an environment suggests for potentially more selling pressure, with insufficient demand, and could signal a potential correction in BTC prices.

- On the other hand, however, a potential defense of the area around $91,000 could indicate another upward impulse above the $100,000 level. The financial media was circulated yesterday with the news that Scott Atkins, former SEC member is likely to become chairman of the Securities and Exchange Commission. Atkins himself has long been and is associated with the blockchain industry, but the market 'didn't celebrate' these reports for too long, and Bitcoin price is gradually cooling down now, after yesterday's rebound.

- This, too, could indicate more selling activity and a prevailing belief in profit-taking, after record highs this year. However, looking at the scale of BTC sales by long-term addresses, they have currently sold off about 550,000 BTC which is a much smaller number than the about 930,000 sold this spring; which may suggest that there is still room for growth, and that so-called 'HODLers' addresses are less likely to part with Bitcoin before Donald Trump's presidency, in January.

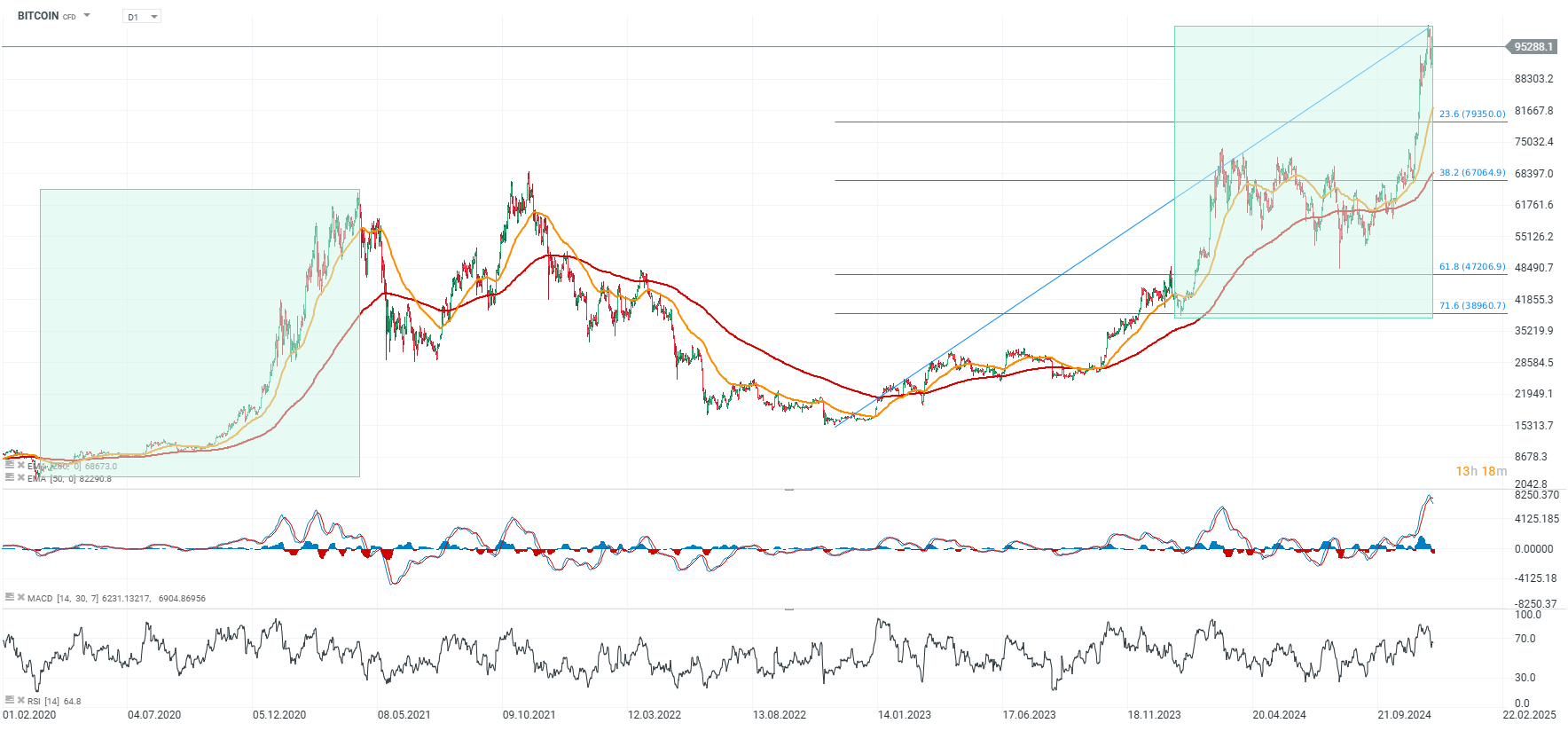

Bitcoin chart (D1, H1)

Looking at the cryptocurrency's chart on both the daily and hourly intervals, we see that the $80k level could prove crucial, looking at the 23.6 Fibo retracement of the entire 2022 upward wave and the 61.8 Fibo retracement of the surge after Trump's victory. A pullback from $99.5k to $80k would also be consistent with similar corrections in previous Bitcoin cycles.

Source: xStation5

Source: xStation5

Net inflows into Bitcoin and Ethereum ETFs

_49d9895aaf.png)

Source: Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finance L.P. , XTB Research

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈

Jane Street: Legendary market maker in the court

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.