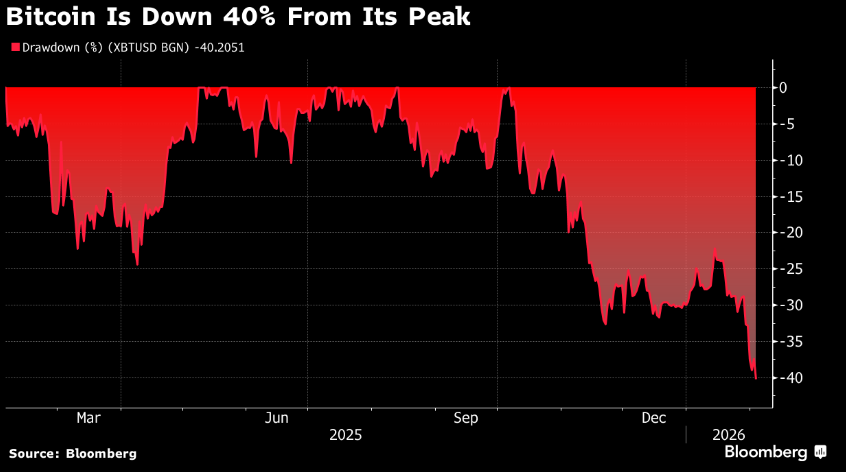

Bitcoin is deepening its losses amid an unprecedented crypto sell-off, sliding below the critical $70,000 threshold at a pivotal moment (currently down ~2.4% to $70,800). This sharp plunge is fueled by several factors, including the exhaustion of the "AI Trade," a "hawkish" pivot signaled by Kevin Warsh’s nomination as Fed Chair and the collapse of the "institutional safety net" amid accelerating ETF outflows.

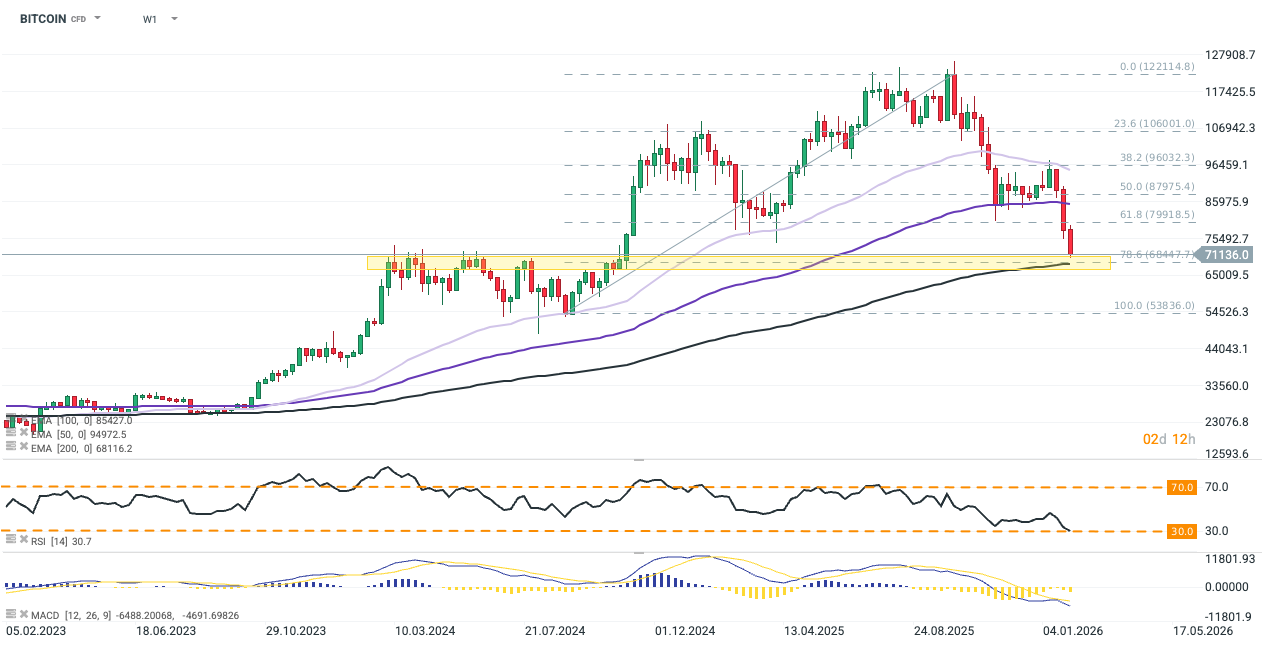

BITCOIN is in a strong downward phase, losing approximately 42% since its October peak. The price has broken through key support levels and is currently trading around $71,150, oscillating near the psychological barrier of $70,000. The MACD shows a strong bearish trend, with the histogram deep below the zero line. A sustained move below $70,000 could open the way to test the $68,000 level (yellow zone) or even long-term support at $54,000. Source: xStation5

The End of the "AI Trade" Damps Risk Appetite

Crypto is primarily weighed down by a global decline in risk appetite triggered by a sharp correction in tech stocks. Concerns over Microsoft’s CAPEX, disappointing AMD forecasts, and a $285 billion wipeout in Wall Street capitalization following Anthropic's debut of the Claude AI language model serve as catalysts for the crisis in the years-long AI trade. Investors have clearly grown weary of the "buy everything" trend and have shifted toward rotating capital into more certain winners of the AI race. The resulting panic over current valuations has effectively deepened the crypto declines that Bitcoin has recorded since October 2025.

Source: Bloomberg Finance LP

Warsh’s Nomination Signals Discipline

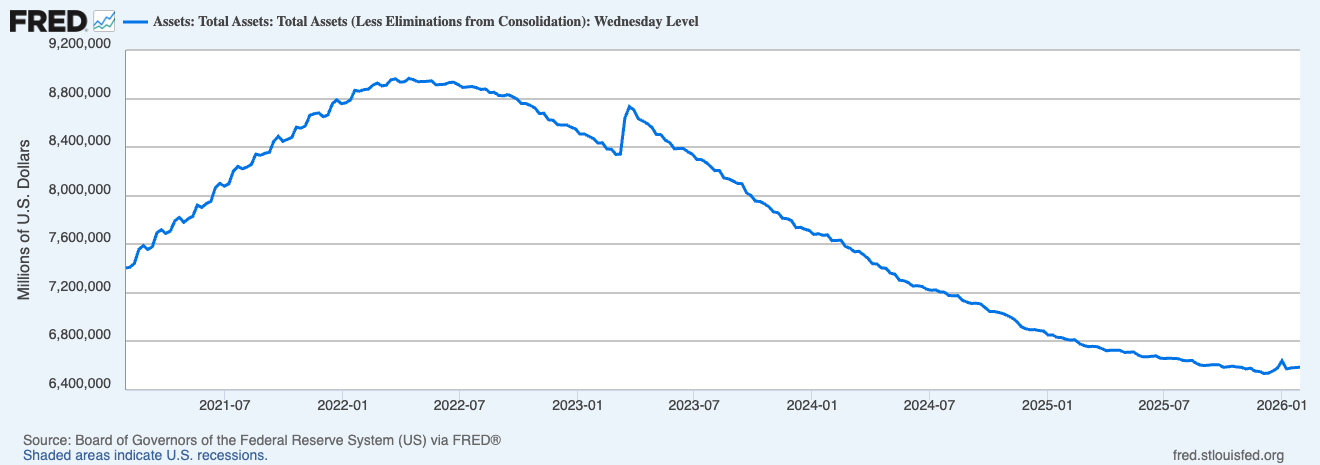

Alongside general sentiment, a primary fundamental driver of the bearish trend is the nomination of Kevin Warsh as the new Federal Reserve Chair. While Warsh has expressed pro-crypto views, acknowledging Bitcoin's place in many portfolios, the market has focused on his overall stance on "monetary discipline" and his criticism of the Fed's large balance sheet. With liquidity continuing to drop and real rates rising (as Warsh is perceived as "hawkish"), Bitcoin may become increasingly less attractive relative to the US dollar or Treasuries. On the other hand, it is worth noting Warsh's significant narrative shift regarding rates, specifically comments that falling inflation could occur in a low-rate environment if accompanied by appropriate productivity growth.

The Fed consistently reduced its balance sheet (total assets held) between 2023 and 2025, ending Quantitative Tightening (QT) at the end of last year. However, Kevin Warsh may lobby for further balance sheet reductions, potentially restricting liquidity. Source: Fed St. Louis

Institutional Foundations are Melting

U.S. Treasury Secretary Scott Bessent stated that the federal government lacks the authority to buy or bail out cryptocurrencies, signaling no systemic "safety net" for digital assets. His remarks cooled expectations for policy support, reinforced regulatory boundaries, and heightened the risk perception of cryptocurrencies. Investors have thus been forced to reassess the place of tokens in the financial system and ground their expectations regarding Bitcoin's potential institutionalization.

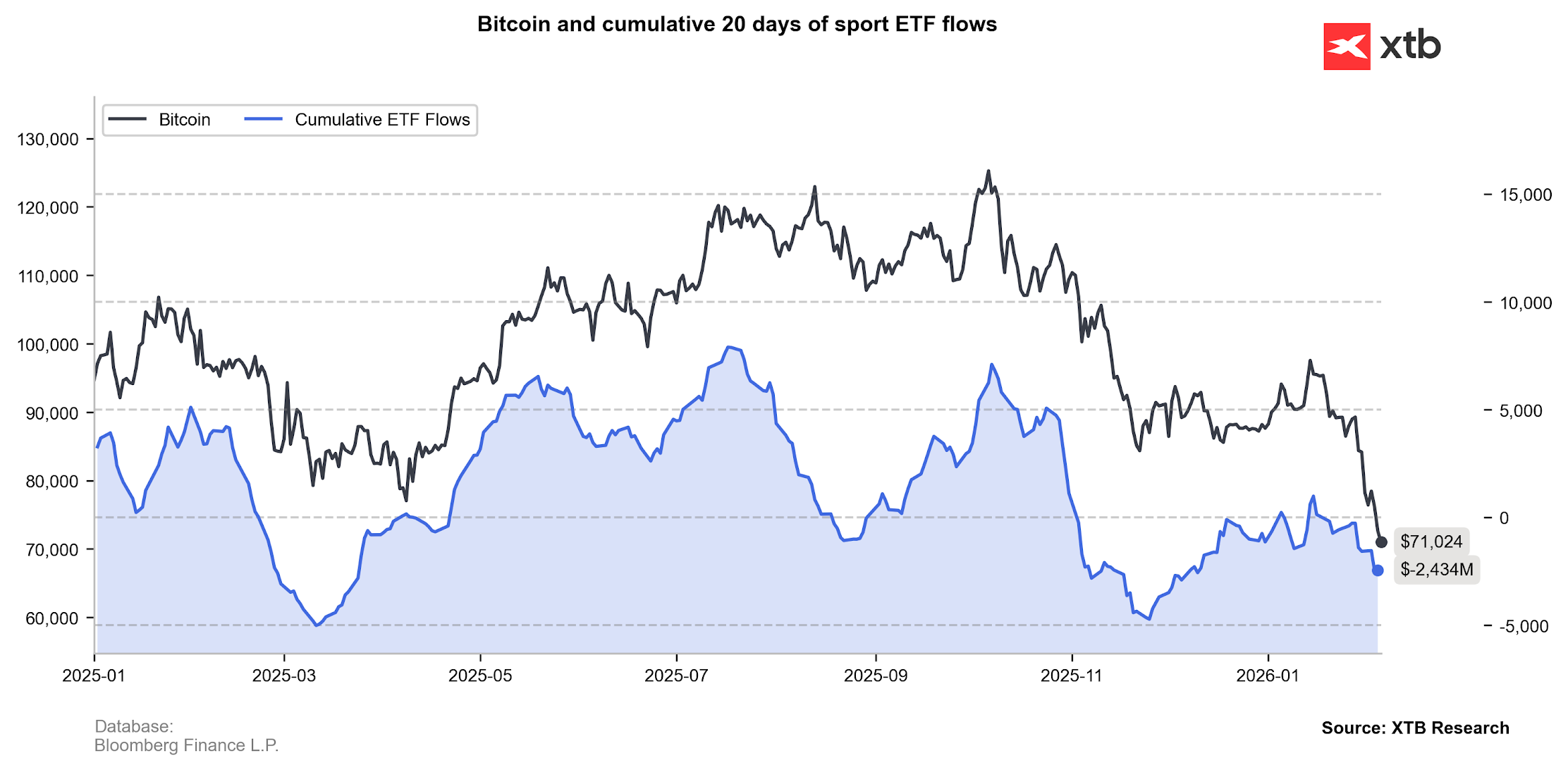

Furthermore, the "ETF bull run" trend is fading, with Bitcoin investment funds recording only outflows for some time. A key issue is the average price at which funds acquired the cryptocurrency, which in many cases is above the current valuation. This creates a genuine risk of forced liquidations, as risk managers, obligated to report using the mark-to-market method, may order sales to cut losses. Such a mechanism would fuel a self-fulfilling downward spiral, shattering the prevailing faith in Bitcoin as a stable foundation for corporate treasuries.

Source: XTB Research

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Chart of the day: US100 gains ahead of the Nvidia earnings 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.