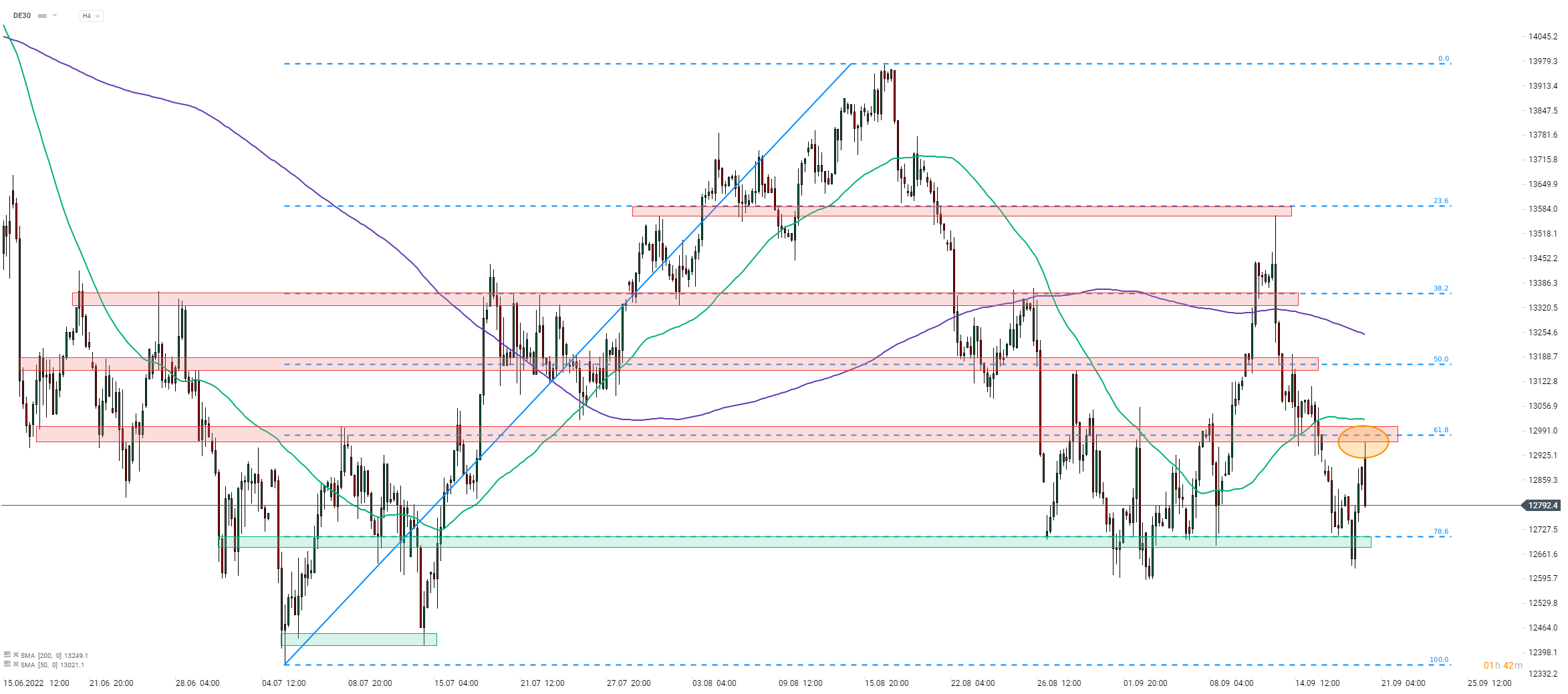

European indices halted recent downward move, triggered after the disappointing US CPI report last week, and managed to regain some ground at the beginning of a new week. However, this rebound looks to have halted today with the majority of blue chips indices from the Western Europe trading mixed. Taking a look at the DE30 chart at H4 interval, we can see that the German index turned lower today following a failed test of the resistance zone, marked with 61.8% retracement of the upward move launched in early-July 2022. The index is trading more than 150 points off a daily high already and should the ongoing pullback deepen, a test of the support zone marked with 78.6% retracement (12,700 pts area).

There are two main reasons behind sluggish performance of stock markets and neither of them is a new one. Firstly, the global economy is slowing. Secondly, central banks are tightening policy in order to combat inflation, what threatens to transform a slowdown into a recession. Riksbank went ahead of the curve today with a 100 basis point rate hike, signaling that it expects interest rates to raise further in the next 6 months. However, a key factor for risk-sentiment is upcoming Fed meeting (Wednesday, 7:00 pm BST), that may also result in a 100 bp rate move, although this is not the base case scenario.

Source: xStation5

Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.