Ethereum has gained almost 20% since yesterday, briefly surpassing the $3700 level following news about the possible acceptance of a spot ETF by the SEC this week.

The price of the second-largest cryptocurrency rose from $3070 to $3700 within a few hours. At the time of publication, the price is consolidating between $3600 and $3700. Such a sharp increase was possible because the market had priced in very low chances of the SEC accepting spot ETFs on Ethereum. Recently, the SEC has not been cooperating at the best level according to those involved in the process. Just last week, the official stance was as follows:

“According to two people familiar with the matter, who asked not to be named to discuss private conversations, some fund companies expect rejection because their private dialogue with the SEC was not as robust as it was before the approval of spot-Bitcoin ETFs in January.”

However, everything changed yesterday with reports that the SEC requested updates to the 19b-4 applications on an accelerated basis. At the same time, Bloomberg analysts increased their expectations for the approval of these applications to 75% from 25%, citing the SEC's change in attitude and the growing political value ahead of the upcoming elections.

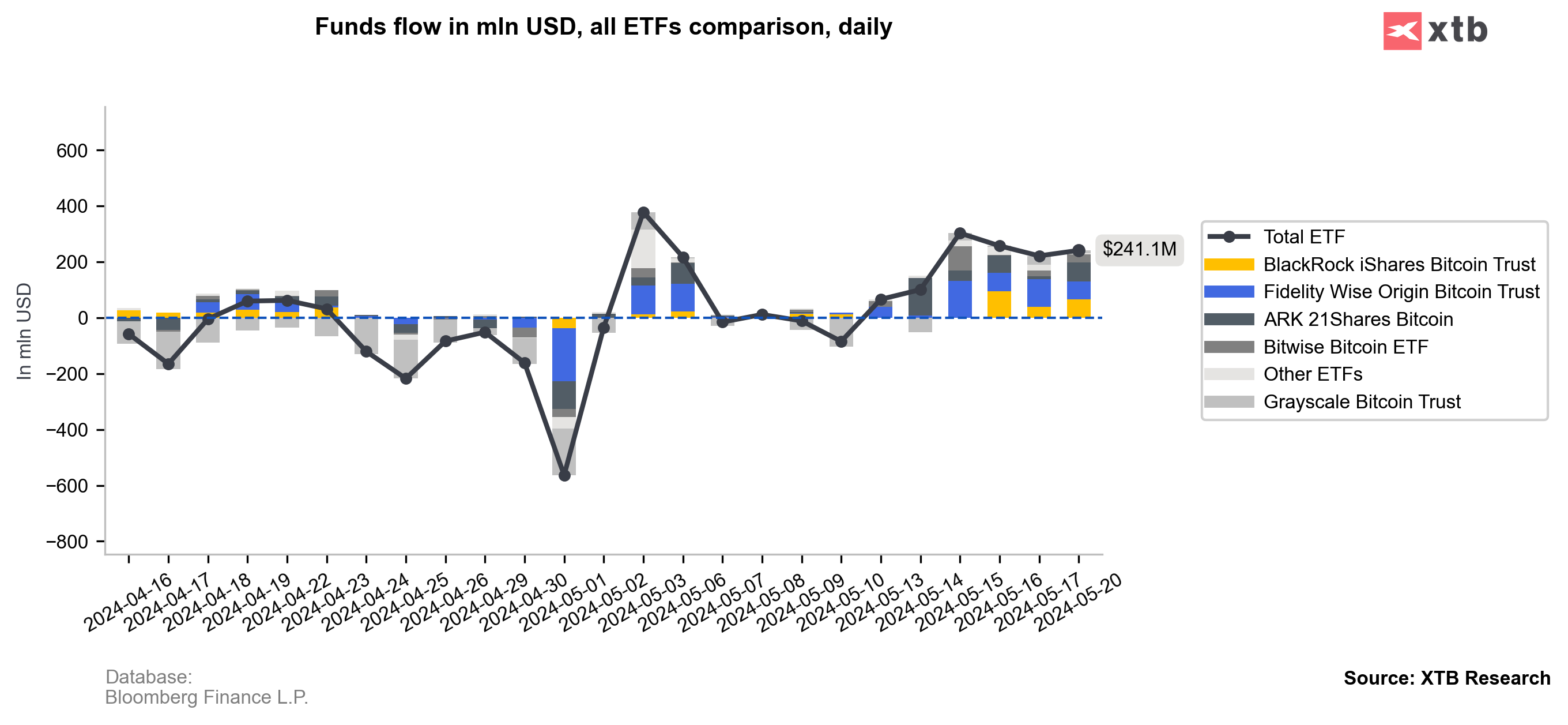

Another catalyst for improved sentiment in the cryptocurrency market are inflows into Bitcoin ETFs, which have been at record highs since the start of last week. Combined with slashed post-halving supply, this is certainly an important upside stimulus.

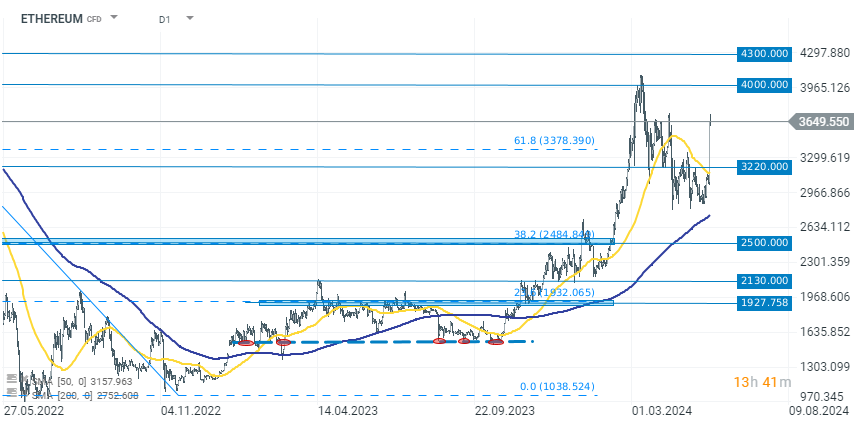

Ethereum (D1 interval)

As a result of these events, we observed a dynamic increase in Ethereum, which led the market's gains. However, the improving sentiment also supported smaller projects and Bitcoin, which returned above $70000 and $71000 respectively. The second half of this week could be extremely important for market sentiment in the coming weeks. Firstly, the final deadline for SEC approval of the applications by VanEck and ARK 21Shares is on May 23 and 24, respectively. Secondly, Nvidia, which currently sets trends in the AI and tech sectors, will publish its quarterly report on Wednesday. These will undoubtedly be two very strong impulses for movement in both directions.

Source: xStation 5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.