Gold, as well as other precious metals, are trading lower today. Fed Chair Powell repeated his suggestions during a weekend interview that the March meeting may be too soon for the first rate cut. Money markets are now pricing in just 18% chance of a 25 basis point rate cut at March 20, 2024 meeting, down from over 50% chance priced in a week ago. Pricing for a rate cut for May 1, 2024 meeting stands above 70%. Delayed in market pricing for the beginning of Fed rate cut cycle is providing support for the US dollar, with EURUSD dropping to 1.0760 area today - the lowest level since December 12, 2023. This, in turn, puts pressure on gold prices.

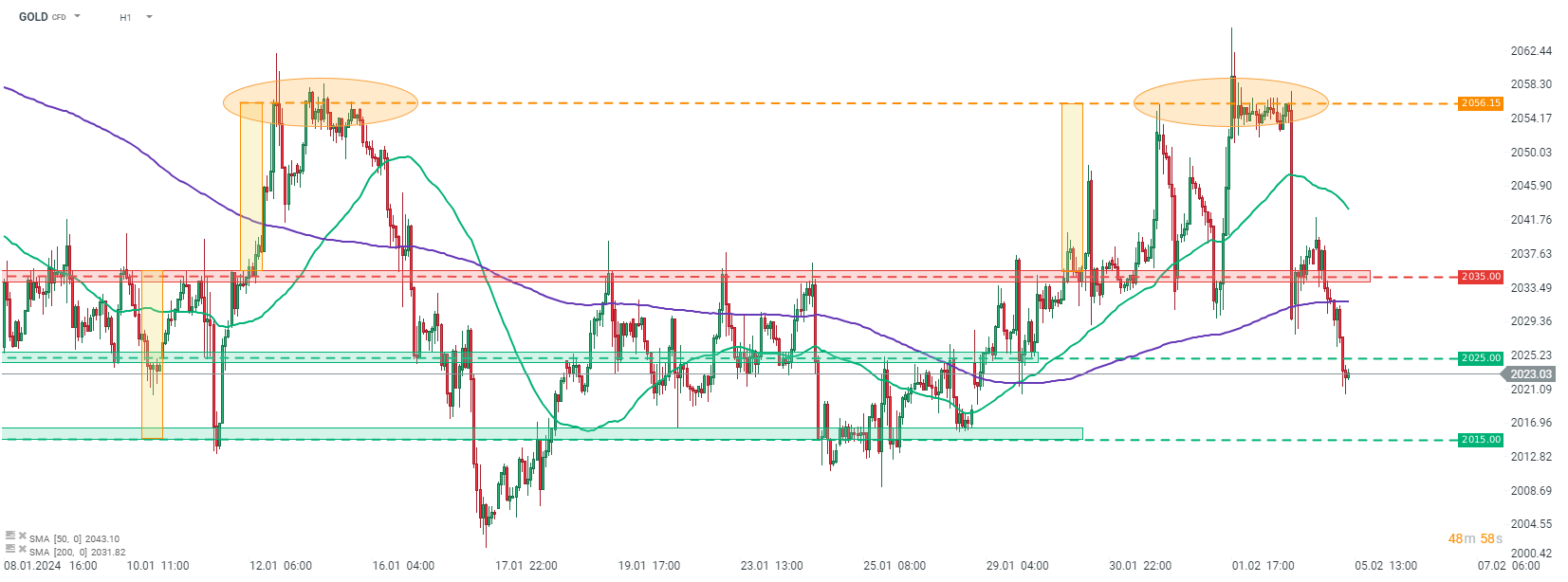

Taking a look at GOLD chart at H1 interval, we can see that price broke above the upper limit of the $2,015 - 2,036 trading range last week and managed to reach the textbook target of the breakout in the $2,056 per ounce area. However, bulls failed to extend the advance beyond this area and price started to pull back. Situation is very similar to the one from January 12-15, 2024 (orange circle), which was followed by a quick pullback back into the aforementioned trading range and even beyond it. Having said that, the next support zone to watch on GOLD can be found in the $2,015 area, but a move below it cannot be ruled out if the current sentiment lasts.

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.