The Hang Seng Index closed nearly 3% higher today, and the mainland CSI rose 1%, after China's central bank announced the detailed size of the SFISF lending facility. The gains in China were not huge today, however, with HK.cash currently trading at an 'almost symbolic' 1% gain. The magnitude of the rebound was all the more modest today when one realizes that the Shenzhen-based SZSE Composite index, was on track for an 8% decline, the biggest since May 1997 i.e. 27 years, and today recorded another 0.8% decline.

- The market's attention is now focused on China's Ministry of Finance press conference scheduled for Saturday, in which China will present details of its fiscal stimulus plan. The theme of the press conference is “intensifying countercyclical fiscal policy adjustment to promote high economic growth.”

- Market consensus is for a minimum of 2 to 3 trillion yuan (about $300-400 billion), as part of a broad stimulus package according to Switzerland's Julius Baer; the bank expects more 'stimulus' related announcements in the coming weeks

- China's central bank, the People's Bank of China (PBOC), today announced the creation of a swap facility for securities, funds and insurance companies (SFISF), with an initial allocation of 500 billion yuan, (equivalent to about $71 billion US dollars).

- The initiative aims to support primarily the stock market, by getting institutions to abandon bonds and increase allocations in indices. While the announcement that such an initiative would take place was admittedly made almost two weeks ago, today's decision shows that the PBoC is really determined to act quickly, creating a loan facility for financial institutions, insurers and funds, to buy stocks.

The big picture is to improve liquidity conditions in the Chinese market and support a range of equity investments by providing government bonds to institutions. The mechanism allows securities institutions to leverage bonds and resell them to raise capital, which can then be channeled into stock purchases. Not surprisingly, investors took its creation as good news, improving sentiment around Chinese indices. The question is, will it be for long?

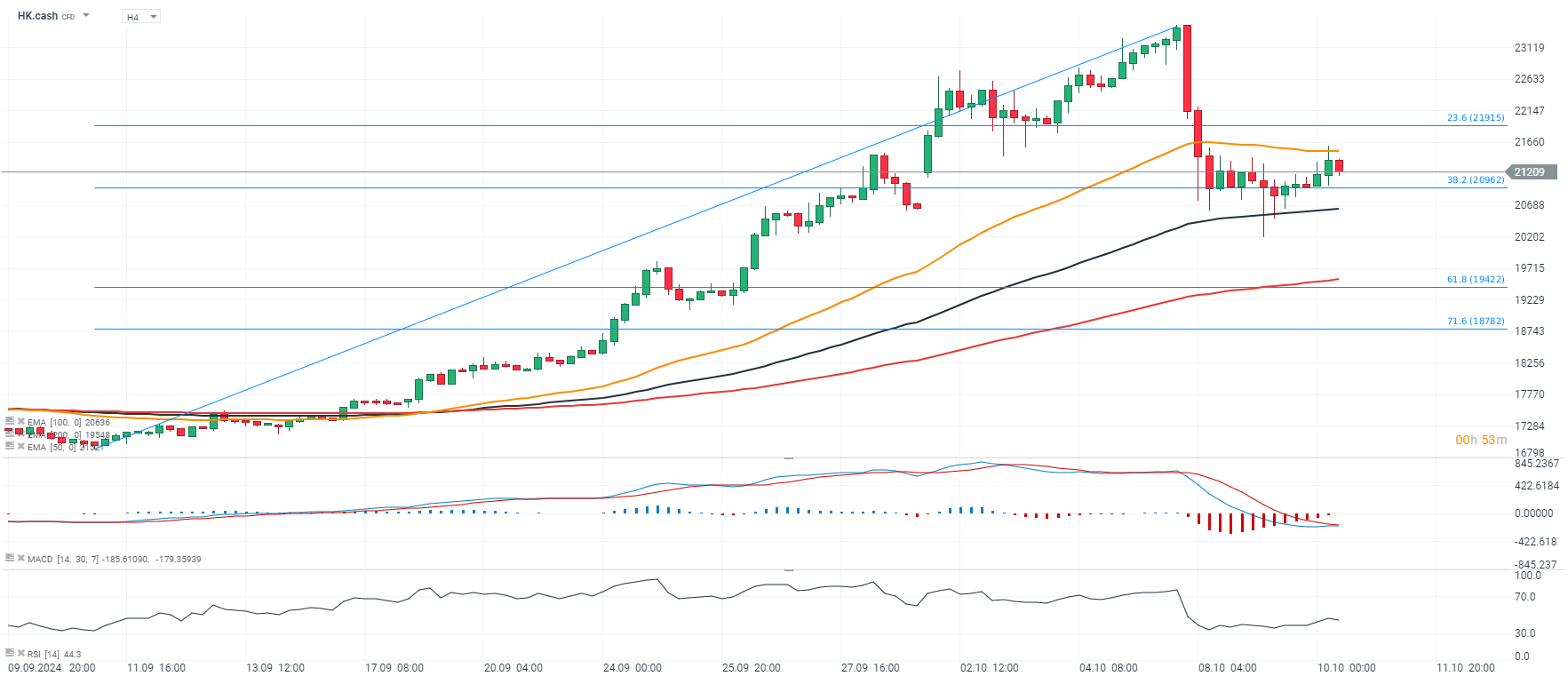

HK.cash chart (H4 interval)

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.