OPEC+ failed to reach an agreement on the future output level last week. Talks were initially scheduled for Thursday but after no progress was made, they were extended onto Friday. However, no agreement was reached on Friday either and negotiations are set to resume today at 2:00 pm BST in Vienna, Austria.

A proposal to increase daily output by 400k on a monthly basis, starting from August, seem to have broad support but disagreements surfaced when it came to distribution of this agreement. The United Arab Emirates wants an adjustment to the baseline output, a move that will allow it to pump more. Energy Minister of Saudi Arabia called for UAE to prioritize compromise and rationality.

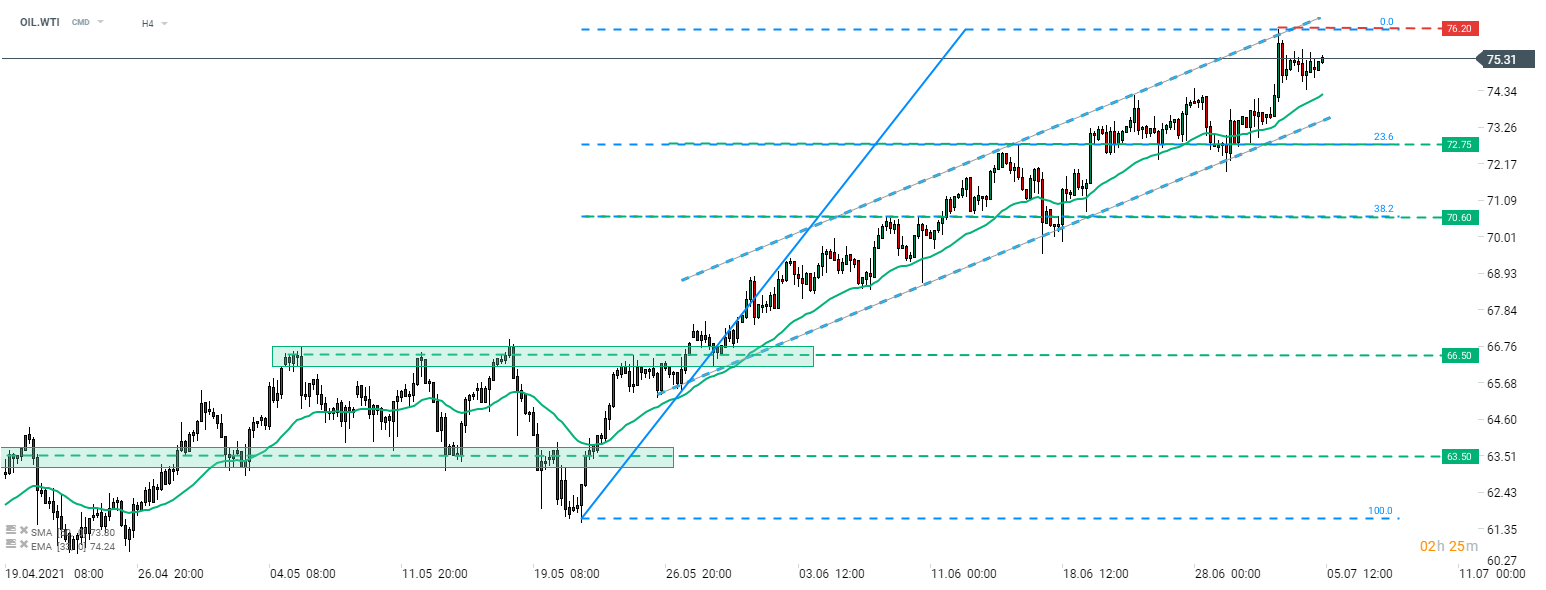

While output increase in general does not look to be in danger, investors seem to have become somewhat worried. Bull run on the oil market was halted and crude has traded sideways since Thursday afternoon. OIL WTI trades near the midpoint of a steep upward channel. Lower limit of the channel at around $73.75 is a near-term support to watch. In case a bigger downward move occurs, 23.6% and 38.2% retracements can be the next targets for bulls.

Traders should keep in mind that due to the US holiday, trading hours on OIL.WTI have been shortened today. OIL.WTI will trade until 6:00p m BST.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.