-

Silver hit new historical highs above $53/oz but experienced extreme intraday volatility (including a 6% correction), underscoring heightened risk in the market.

-

The rally is fueled by a short-squeeze and extremely low liquidity (silver borrowing rates reached 30%), compounded by the market’s small size and lack of central bank support.

-

Analyst targets remain highly bullish (BofA at $65/oz for 2026), while the technical outlook suggests the uptrend could continue toward $60/oz, with key support at $50/oz.

-

Silver hit new historical highs above $53/oz but experienced extreme intraday volatility (including a 6% correction), underscoring heightened risk in the market.

-

The rally is fueled by a short-squeeze and extremely low liquidity (silver borrowing rates reached 30%), compounded by the market’s small size and lack of central bank support.

-

Analyst targets remain highly bullish (BofA at $65/oz for 2026), while the technical outlook suggests the uptrend could continue toward $60/oz, with key support at $50/oz.

Silver is currently experiencing extreme volatility, indicating that the market sentiment is no longer uniformly bullish. Earlier in the Asian session, the price surged to new historical highs. Some analysts suggest that the price has only now decisively broken the all-time high set in January 1980. Although the futures contract price at that time closed below the $50 mark, some metrics place the daily historical peak near $52.8 per ounce.

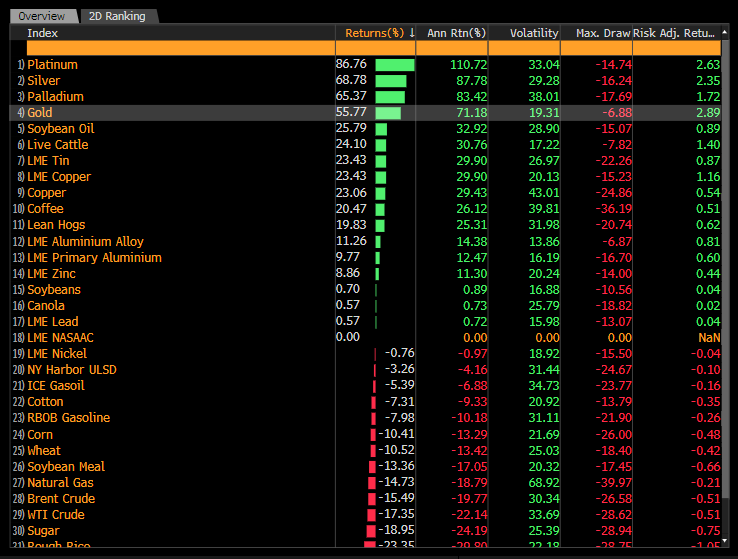

Today, the price initially surpassed the $53 per ounce level before undergoing a 6% correction just prior to the European market open. Moments after the European start, the price rebounded, settling near the $52 per ounce level, close to yesterday’s close. Silver remains one of the most volatile metals, reacting significantly more forcefully than gold during both upward surges and drawdowns. Year-to-date, silver's price gain is approaching 80%.

Silver's performance this year is eclipsed only by platinum. Source: Bloomberg Finance LP

Liquidity and Risk Assessment

Market consensus points to very low liquidity in the silver market. Rates for borrowing silver for one month have surged to 30%, leading to a noticeable squeeze on short positions. The silver market itself is five times smaller than the gold market and lacks the solid demand component provided by central banks, which gold benefits from. Consequently, should a significant market correction occur, expectations are for a decline of at least ten percentage points.

Bank of America's latest forecast projects a silver price of $65 per ounce next year, alongside a $5,000 price target for gold. Goldman Sachs anticipates further silver gains but also highlights a potential return of silver inventory to the London exchange following strong US stock builds in recent months.

Technical Outlook

Technically, the silver price is not yet as extremely overextended from its moving averages as it was in the 2011 rally. Moreover, the magnitude of the 2011 movement suggests that the current uptrend could continue towards $60 per ounce. Such a level would be justified if gold were trading at $4,200 and the gold-to-silver ratio were to fall towards 70. Technical support is currently found near the $50 per ounce level, while the nearest resistance lies just below $55 per ounce.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.