FOMC minutes released yesterday turned out to be a rather hawkish release. As expected, FOMC minutes strongly suggested that the balance sheet reduction should start in May. According to the document, Fed members see a $60 billion monthly cap on Treasuries and $35 billion monthly cap on mortgage-backed securities as an appropriate pace of balance sheet run-off. One interesting takeaway from yesterday's minutes release is that reportedly many Fed members want a 50 basis point rate hike in March, instead of a 25 basis point rate hike. If so, it shows that expectations of many Fed members were not too far off market expectations. Note that interest rate derivatives are currently pricing in around 210 basis points increase in US rates by the end of 2022.

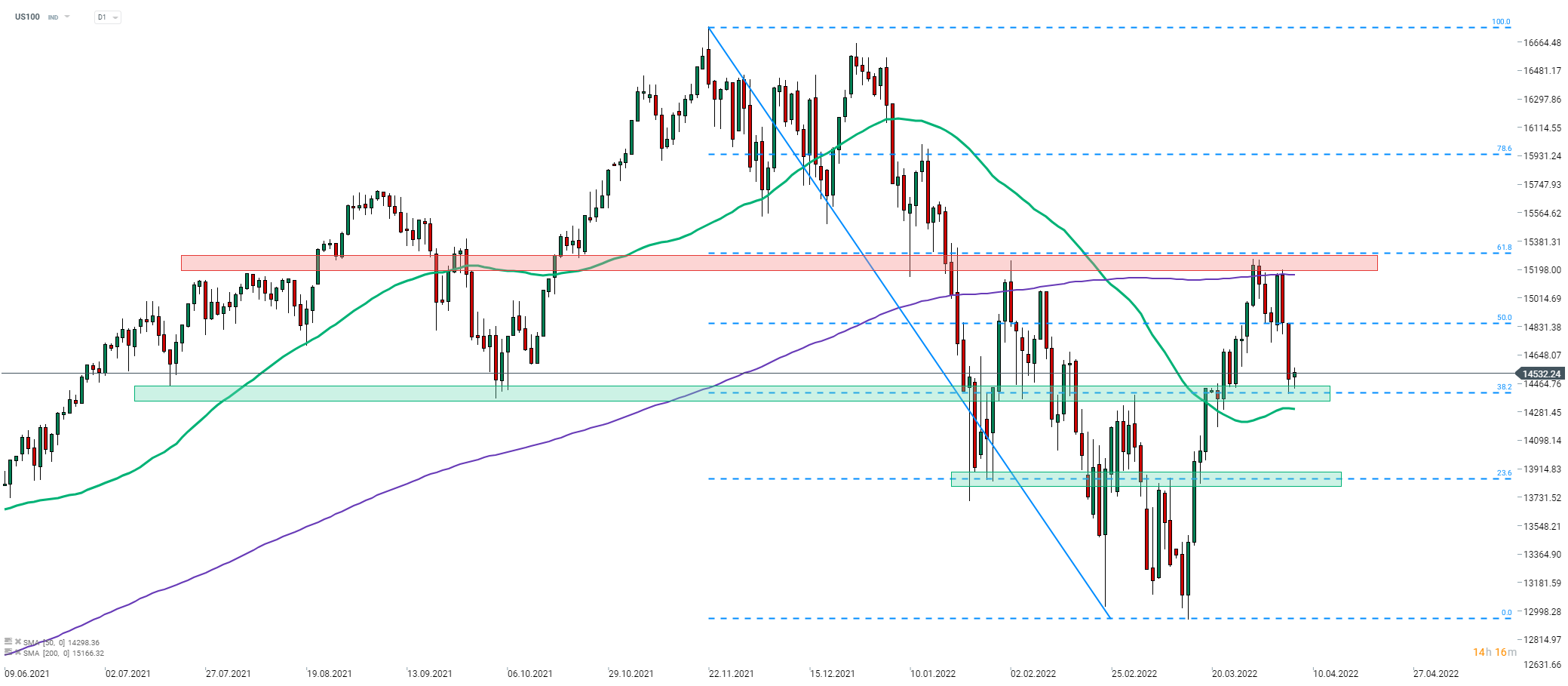

A strong hawkish message sent by FOMC minutes exerted some pressure on indices. Tech sector, which is viewed to be the most vulnerable to changes in the level of rates, took an outsized hit. Taking a look at Nasdaq-100 (US100) chart at D1 interval, we can see that the index turned lower after painting a double top pattern near the 200-session moving average (purple line). Index plunged to 38.2% retracement of a drop launched in November 2021 (14,400 pts) and thus the realized reached the textbook range of a breakout from the aforementioned pattern. A lot will now depend on the reaction of the index to the 14,400 pts area. In case of a drop below it, traders should focus on the next support at 23.6% retracement as test and recovery from this area would paint a right arm of an inverse head and shoulder pattern with neckline at 61.8% retracement.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.