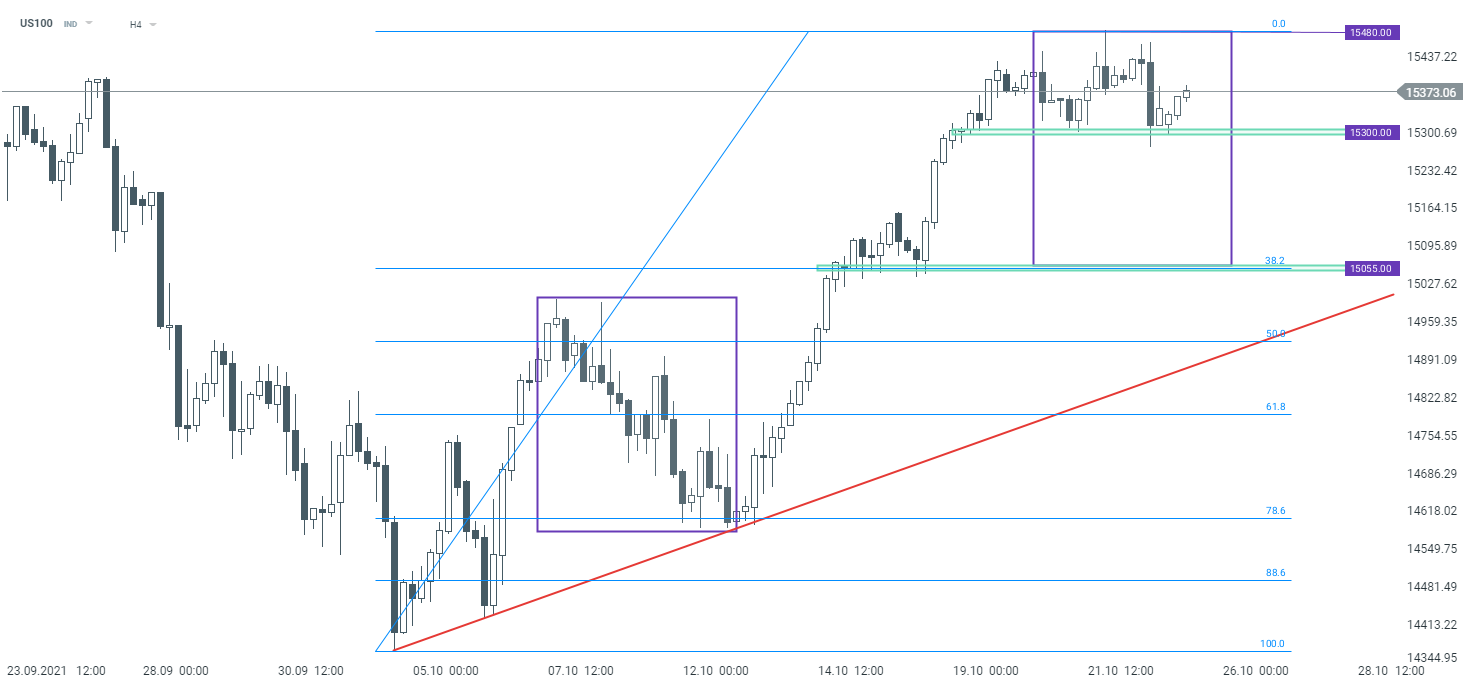

US equity indices continued to recover from September's correction last week. While S&P 500 and Dow Jones managed to reach fresh record highs, Nasdaq-100 (US100) lagged behind. US tech index halted advance in the 15,400 pts area and has traded sideways since. However, US100 is expected to become more active this week, thanks to earnings releases from top US tech companies scheduled for the coming days. Facebook will report earnings today after the close of the session, followed by Microsoft and Alphabet tomorrow in the evening. Reports from Apple and Amazon on Thursday will wrap up earnings season for US mega-caps. Chip shortages will be a key for Apple while ad demand will be in the spotlight during Facebook and Alphabet releases.

US mega-caps have a track record of beating earnings expectations. However, will it be enough to revive the recovery move on the US100? The index has been trading in the 15,300-15,480 pts range recently. Should earnings reports from US tech stocks disappoint, the index may find itself under pressure. A break below the lower limit of the range would pave the way for a drop towards the 15,055 pts area, where the lower limit of a market geometry can be found.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.