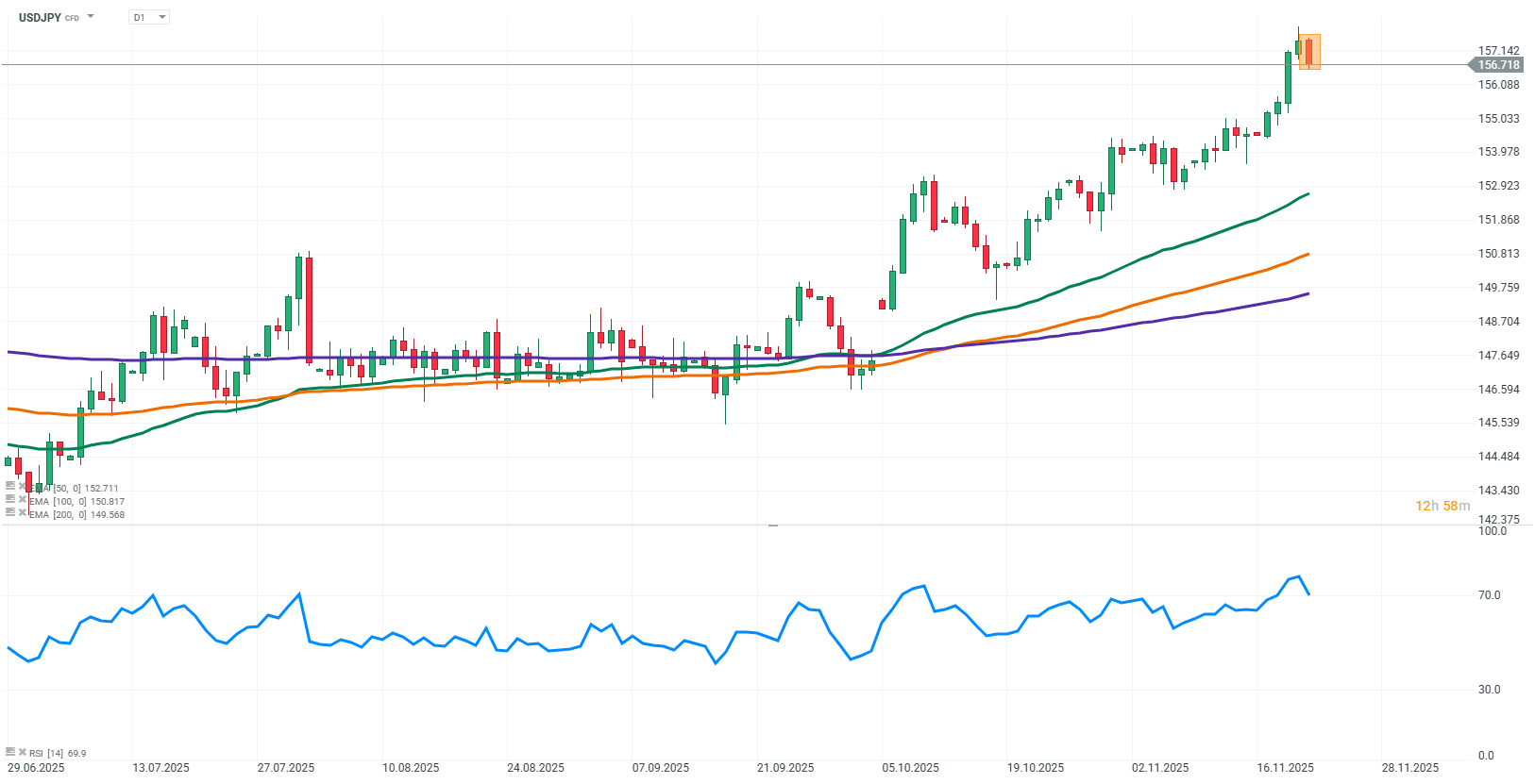

The USD/JPY exchange rate is currently around 156.7. Today's trading is influenced by a complex mix of fundamental factors, where a strong dollar competes with potential interventions from Japan. The difference in monetary policy between the US and Japan still favors the dollar, but the risk of actions by the BOJ and the Japanese government limits the pair's upside. The focus remains on US data, FOMC minutes, and Japan's recently approved fiscal package worth JPY 21.3 trillion, which could determine the next moves of the pair.

Source: xStation5

What’s driving USD/JPY today?

Monetary policy of the Fed and BOJ

The Fed maintains a hawkish stance, and the market interprets the FOMC minutes as a signal that US interest rates will remain relatively high. The Bank of Japan continues its ultra-loose policy, refraining from rapid normalization, which limits potential yen strength. These differences in monetary approaches create a structural advantage for the dollar.

Summary:

The Fed remains hawkish, BOJ keeps a loose policy. The interest rate advantage favors the dollar.

Risk of intervention and Japanese government policy

The Japanese government has repeatedly highlighted the need to stabilize the yen, but so far has limited itself to statements. A government representative emphasized that sudden moves in the FX market require attention and possible stabilization. The lack of concrete actions combined with the BOJ's ultra-loose stance creates tensions and keeps investors cautious about the yen.

Summary:

The government monitors the yen, BOJ remains passive. Markets interpret this as a sign of currency weakness.

Japan’s fiscal package

The recently approved fiscal package worth JPY 21.3 trillion has triggered mixed reactions in the market. Some of the funds are aimed at easing inflationary pressures, but the new bond issuance could increase the burden on the debt market, which, together with rising yields, supports the yen in the short term.

Summary:

The fiscal package raises debt market risk and temporarily supports the yen.

US macroeconomic data

Strong US labor market data, including NFP, wages, and the unemployment rate, strengthens the dollar. The market interprets these figures as confirmation that the Fed will maintain high rates. Japanese macro data currently have limited impact because the BOJ reacts slowly and does not change policy in the short term.

Summary:

US data drive USD/JPY, while Japanese data have little influence.

Interest rate differential

The wide gap between high US rates and low Japanese rates continues to work against the yen. Markets benefit from the dollar's advantage and still use the yen in funding strategies, maintaining the structure of the dollar's superiority.

Summary:

The large interest rate differential favors the dollar. The yen remains weak in funding.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.