- China Tightens Rare Earth Export Controls as Trade War Tensions with the U.S. Escalate

- Rare Earth Elements — The Strategic Resource of the 21st Century

- A Political Game for Technological Dominance

- China Tightens Rare Earth Export Controls as Trade War Tensions with the U.S. Escalate

- Rare Earth Elements — The Strategic Resource of the 21st Century

- A Political Game for Technological Dominance

China is imposing sweeping restrictions on the export of rare earth metals and related technologies, marking another escalation in its trade war with the United States. The new regulations, effective December 1, require export licenses even for products containing minimal amounts of these key materials. While Beijing frames the move as a measure to safeguard national security, it also puts additional pressure on global supply chains and the global tech market.

Rare earth metals consist of 17 chemical elements essential to modern technologies — from semiconductors and magnets for electric motors to batteries for electric vehicles. Although these materials are not particularly rare in nature, their extraction and processing are highly complex and expensive. China controls roughly 70% of global mining and up to 90% of processing capacity for these metals, giving it a dominant position in the market.

New Regulations — Beijing’s Response to U.S. Measures

According to China’s Ministry of Commerce, the new rules block the export of rare earths and technologies linked to semiconductor or military component production without proper approval. The restrictions also extend to equipment used in manufacturing batteries for electric vehicles. Beijing argues these steps prevent the use of such materials for military purposes but also clearly communicate its stance amid rising tensions with Washington.

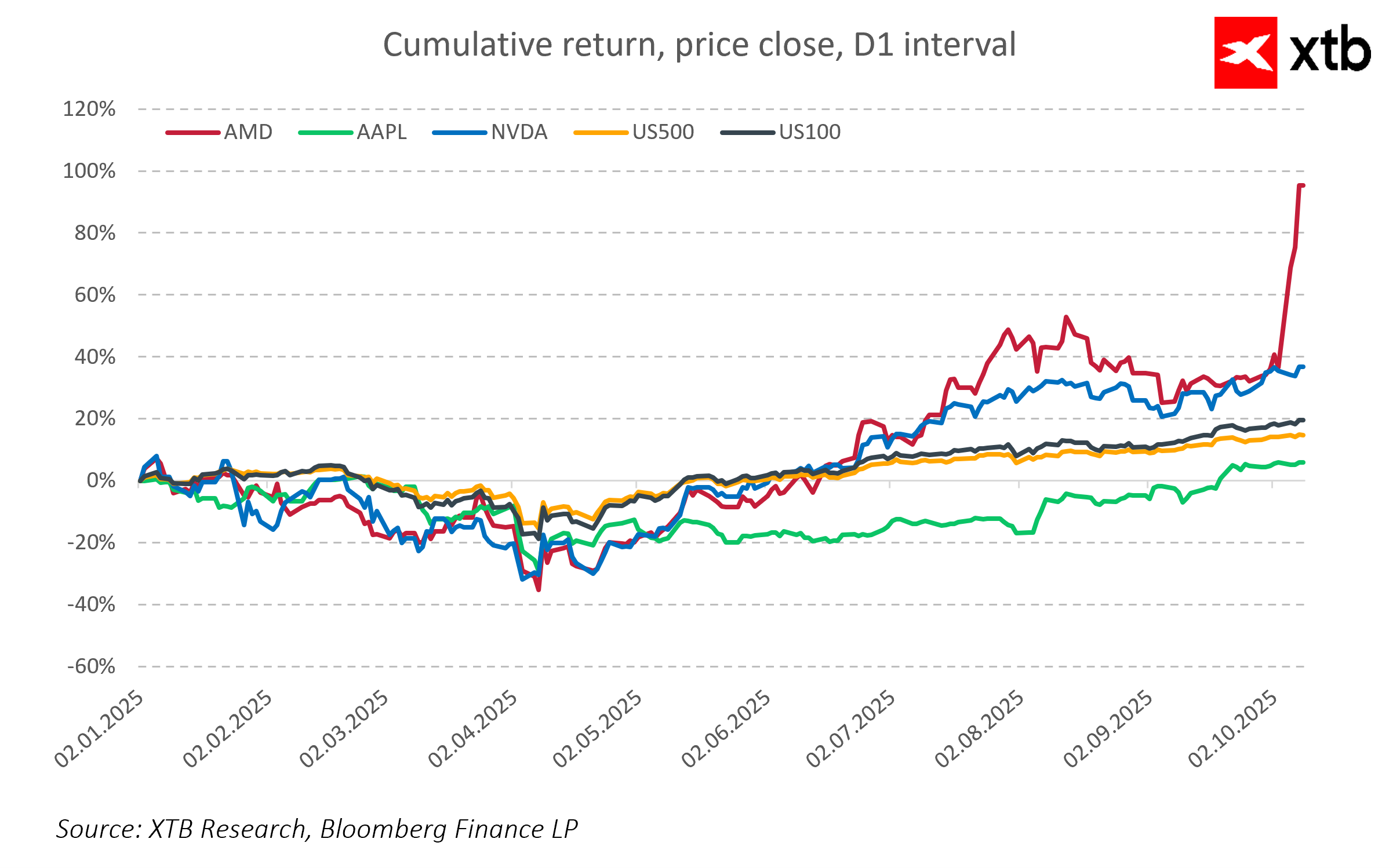

Experts say the measures are aimed at the U.S. technology sector — including companies such as Nvidia, AMD, and TSMC — which rely on rare earths to produce advanced chips and components used, among other things, in artificial intelligence and high‑end electronics.

Industry Impacts

-

Semiconductor Manufacturing: Companies like Nvidia, Apple, TSMC, Samsung, and SK Hynix depend on rare earths for chip production. The new rules may delay the expansion of fabs outside China and drive up production costs.

-

Automotive & Energy Sectors: These metals are critical for producing magnets used in electric motors and for manufacturing batteries. Export constraints may push component prices higher and delay vehicle rollouts as well as wind turbine projects.

-

National Security: The prohibitions on exports for military use underscore China’s concerns about these materials being deployed in technological and military competition—especially in AI and advanced weapon systems.

Beijing’s decision to tighten control over rare earth exports is not merely a trade policy move but a strategic maneuver in global technological rivalry. China is signaling that it holds powerful bargaining chips vis-à-vis the U.S., using its dominance over strategic raw materials as leverage.

In response to U.S. sanctions targeting China’s semiconductor industry—particularly around AI and advanced chips—Beijing is demonstrating that it can retaliate symmetrically by restricting access to materials vital for producing key technological components. This geopolitical play highlights how control over rare earths has become a central element of the trade war and broader strategic competition among world powers.

As a result, Western nations are being compelled to accelerate investment in supply chain diversification and development of domestic processing capabilities. However, building independence from China’s monopoly will take time and substantial capital — posing short‑term risks to the stability of global supply chains.

China’s tightening of rare earth export rules signals a pivotal shift in global technological and economic competition. Companies and governments worldwide must brace for potential disruptions to supply chains and increased state control over strategic resources. The long-term imperative will be diversifying supply sources and advancing alternative technologies to reduce global dependency on China—ultimately boosting resilience in sectors critical to security and economic growth.

Companies like Nvidia and AMD, which have experienced massive growth in recent years, could now face significant challenges. The new export restrictions on rare earth metals may disrupt their supply chains, causing production delays and increased costs. This development is already stirring fears in the market, potentially impacting investor confidence and the future outlook for these tech giants.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.