Chinese index futures initially retreated following the release of weaker-than-expected economic data, but buyers are attempting to limit further declines, buoyed by the optimistic tone in global markets and expectations of stronger central-level support for China’s economy. Notably, while the data fell short of forecasts (and unemployment rose), retail sales still appear relatively solid.

- In July, China’s retail sales increased 3.7% y/y, below the forecast of 4.6% and the previous 4.8%. Industrial production rose 5.7% y/y, missing expectations of 6% and down from 6.8% in June. The unemployment rate climbed to 5.2%, up from 5% in June and above the forecast of 5.1%. Fixed-asset investment in urban areas grew 1.6% y/y, compared with an expected 2.6% and 2.7% in June.

- Recently reported results from JD.com were not enough to sustain optimism around the Chinese e-commerce giant, while Alibaba will release its earnings today, just a few hours before the U.S. market open. Hedge fund Bridgewater Associates, linked to Ray Dalio, sold all its Chinese equity holdings and positions in two Chinese ETFs—worth around USD 1.5 billion—in Q2.

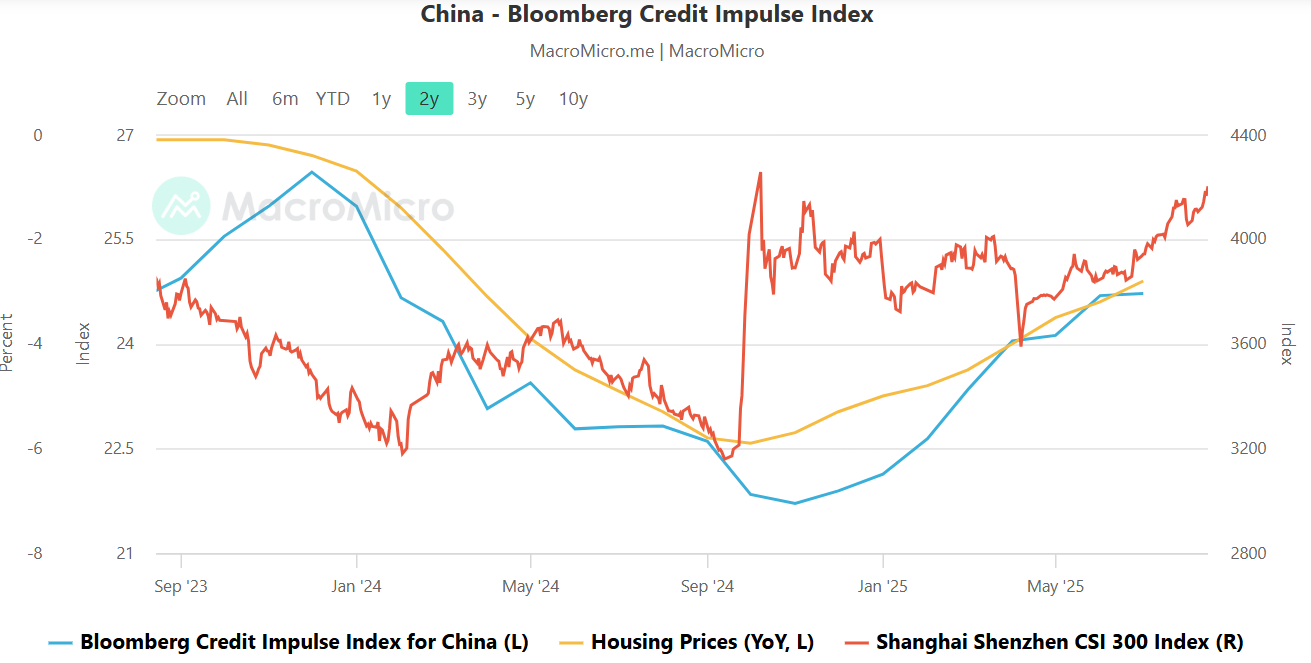

China’s credit impulse has been rising since roughly November 2024, supporting demand for Chinese assets and indicating the potential for a more sustained improvement in domestic economic conditions.

Source: MicroMacro, Bloomberg Finance L.P.

CHN.cash Index (Daily Interval)

Hang Seng futures (CHN.cash) are attempting to halt declines after selling pressure emerged around the 9,300 level, an area that has repeatedly triggered selling in the past. Chinese indices recently recorded their best weekly close in seven months.

Source: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.