- Cocoa Prices Plunge: The commodity is down over 10% this week and nearly 30% in three months, reverting prices to early 2024 levels.

- Supply Outlook Improves: The sharp correction is driven by better-than-expected port arrivals and producer plans to raise farmer prices, signaling higher future output.

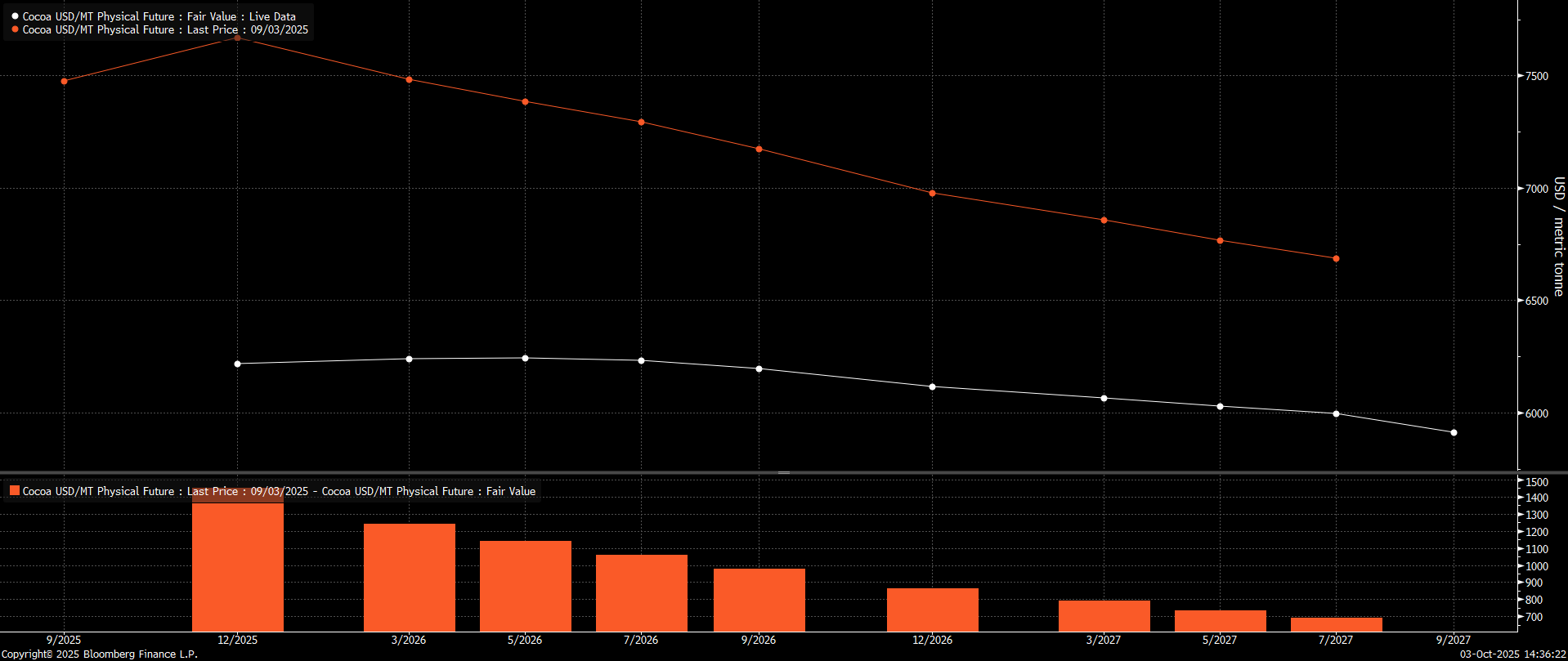

- Forward Curve Flattens: The near-flat forward curve indicates increased market confidence in supply continuity, despite the price appearing technically undervalued.

- Cocoa Prices Plunge: The commodity is down over 10% this week and nearly 30% in three months, reverting prices to early 2024 levels.

- Supply Outlook Improves: The sharp correction is driven by better-than-expected port arrivals and producer plans to raise farmer prices, signaling higher future output.

- Forward Curve Flattens: The near-flat forward curve indicates increased market confidence in supply continuity, despite the price appearing technically undervalued.

Cocoa prices are down more than 4% today, marking the third day of the month and simultaneously the third day of the official 2025/2026 main season. Since the start of this week, the decline has exceeded 10%. Over the last three months (excluding rolling costs), prices have plummeted by almost 30%, establishing cocoa as the worst-performing commodity globally in the recent period. Prices have reverted to levels last seen at the beginning of 2024, and the forward curve is near flat, signaling increased market certainty regarding supply.

Cocoa is the worst-performing commodity over the last 3 months. Source: Bloomberg Finance LP

The first crucial port arrival data for Côte d'Ivoire is expected on Monday, and early reports suggest these figures will be significantly better than initially anticipated. Furthermore, arrivals in recent weeks have been several times higher than a year ago, underscoring a marked improvement in the cocoa market's supply dynamics. Moreover, both Ghana and Côte d'Ivoire are expected to raise the prices paid to farmers. This will not only improve future production prospects due to potential investments but may also encourage growers to favor official sales channels over illegal ones to secure higher prices.

The price of cocoa is already two standard deviations below the 1-year mean, indicating significant undervaluation. Nevertheless, historical data shows that in 2017, when the rate of decline was similar, the price deviated up to three times from the mean. Source: Bloomberg Finance LP, XTB

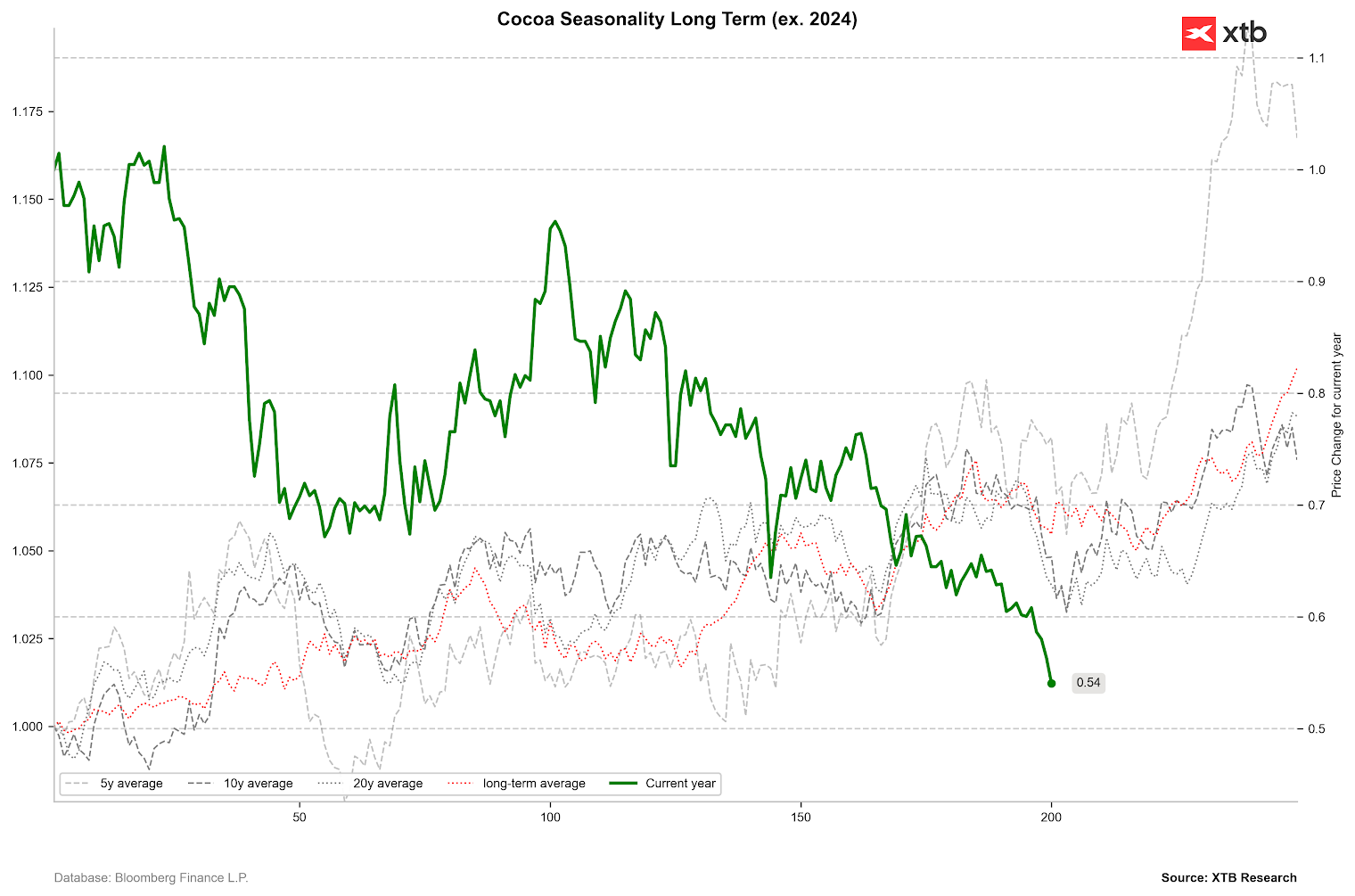

Seasonality suggests that cocoa prices typically declined around September and October, yet a subsequent rebound was frequently observed. However, if the harvest season proves robust, prices may not necessarily rise in line with historical averages.

Seasonality in cocoa price change. Source: Bloomberg Finance LP, XTB

The cocoa forward curve is nearly flat compared to its shape just a month ago. This signifies substantial investor confidence regarding supply continuity. Concurrently, liquidity in the futures market remains extremely low.

Cocoa forward curve is nearly flat. Source: Bloomberg Finance LP

Cocoa forward curve is nearly flat. Source: Bloomberg Finance LPCocoa prices were testing $7,000 per tonne at the start of the week but are now approaching the $6,000 level.

Cocoa prices are approaching the $6,000 per tonne level. Source: xStation5

Cocoa prices are approaching the $6,000 per tonne level. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.