Futures on Arabica Coffee (COFFEE) on ICE are trading nearly 2.5% higher today, making them the best-performing agricultural commodity. The primary driver of this rally is a significant drop in coffee inventories at the Intercontinental Exchange (ICE).

- This sharp decline in ICE stocks is fueled in part by the 50% U.S. tariff on imports from Brazil, which is tightening the coffee market. According to ICE data, coffee inventories have fallen to their lowest level in 17.5 months, standing at 601,717 bags as of Tuesday, September 23. A decline has also been recorded in Robusta coffee, with stocks hitting their lowest level in nearly two months.

- In the short term, the coffee rally has extended to Robusta, driven by forecasts of heavy rains in Vietnam’s Central Highlands, expected to last until the end of the month and potentially damaging beans entering their final development phase before harvest.

- On the other hand, Brazil’s meteorological agency Somar Meteorologia reported that rains in Minas Gerais are set to continue through the week. Should these rains persist longer, Arabica prices could face technical resistance, despite falling ICE inventories.

Last week, coffee futures pulled back to one-month lows on forecasts of increased rainfall in Brazil’s key Minas Gerais region. However, the latest ICE data has reignited buying interest and speculative demand in coffee.

COFFEE Chart (Daily Interval – D1)

From a technical perspective, prices have broken above the 50-day EMA on the daily chart after recently testing the 200-day EMA (red line), following a sharp decline from the 420 to 350 area. The price has now moved beyond the 61.8% Fibonacci retracement of the downward wave that began earlier this year, with a potentially important supply test ahead near the 390 zone.

Source: xStation5

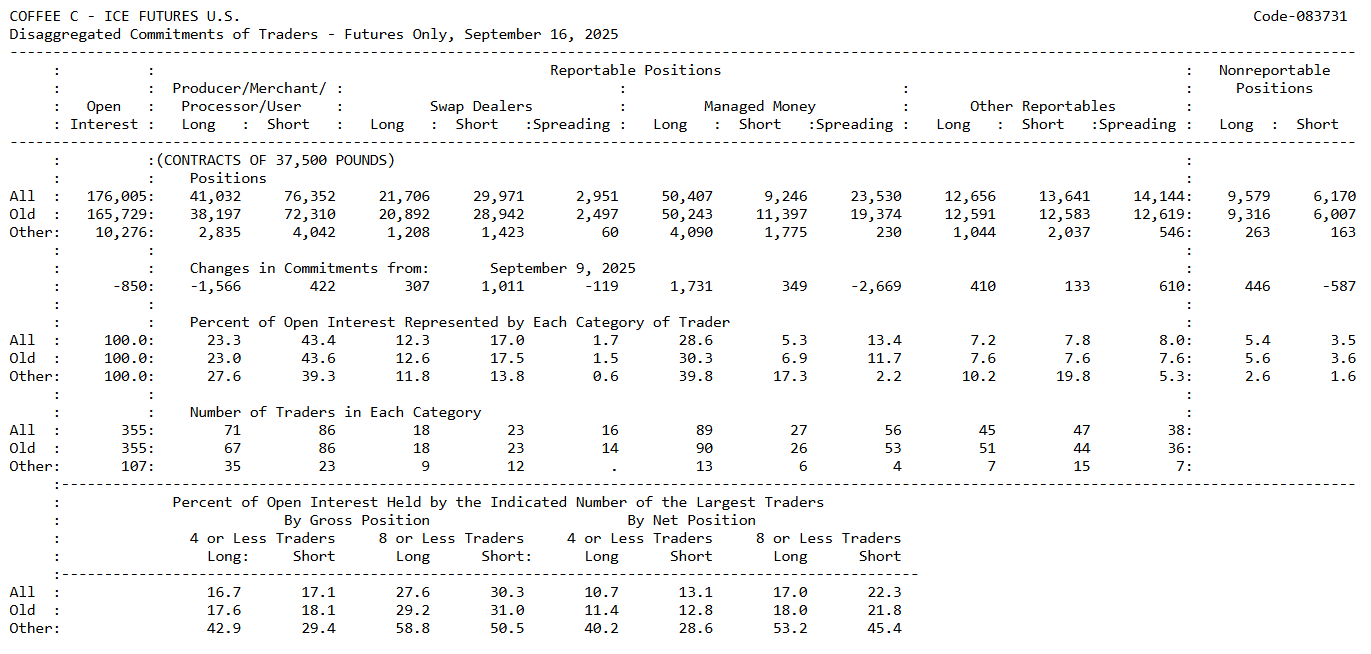

CFTC Commitment of Traders (CoT) Report

The latest CFTC report on the coffee market (as of September 16) highlighted notable differences in positioning between large speculators (managed money) and commercials (producers, exporters, processors).

Commercials:

-

Hold more short positions (76,352 contracts) than long positions (41,032 contracts).

-

This is a classic setup, with producers and traders hedging future harvest sales.

-

Net positioning is strongly on the short side, reflecting hedging against potential price declines.

Managed Money:

-

Hold 50,407 long contracts versus only 9,246 short contracts.

-

Additionally, 23,530 contracts are listed as “spreading” (neutral strategies).

-

Net positioning remains heavily long, with a ratio of about 5:1 longs vs. shorts.

-

Compared with the previous week, managed money increased their longs by +1,731 contracts.

In summary:

-

Commercials are playing defensively, using higher prices to hedge against risks of falling prices—normal behavior for producers.

-

Speculative funds clearly expect further price increases, maintaining a strong long bias.

-

However, if producers continue aggressive hedging, it could undermine the foundations for future sharp rallies.

Source: CFTC

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.