Today 'stimulus' measures announced by PBoC on conference in Beijing are improving sentiments around cyclical-driven assets such as container shipping stocks such as Maersk (MAERSKB.DK), Hapag-Lloyd (HLAG.DE), ZIM (ZIM.US) and dry bulk operators such as Star Bulk Carriers (SBLK.US), which gains almost 4% in US pre-market. Improving sentiments around the second-largest world economy are driving some 'sleeping' assets.

- Today, we can also see rising Brent Crude (OIL) and industrial metals, such as copper, aluminum and zinc. Also, mining companies such as Antafogasta (ANTO.UK), Rio Tinto (RIO.UK) and Anglo-American (AAL.UK) are rising today, dominating British FTSE Index.

- People Bank of China announced cutting rates and multiple policies oriented on consumers and stock market, sending the world money managers signal, that China is determinate to achieve GDP growth and strengthen demand across the national economy.

Also, announced aggressively monetary policy easing in US Federal Reserve and European Central Bank rate cuts improved sentiments around procyclical maritime operators stocks.

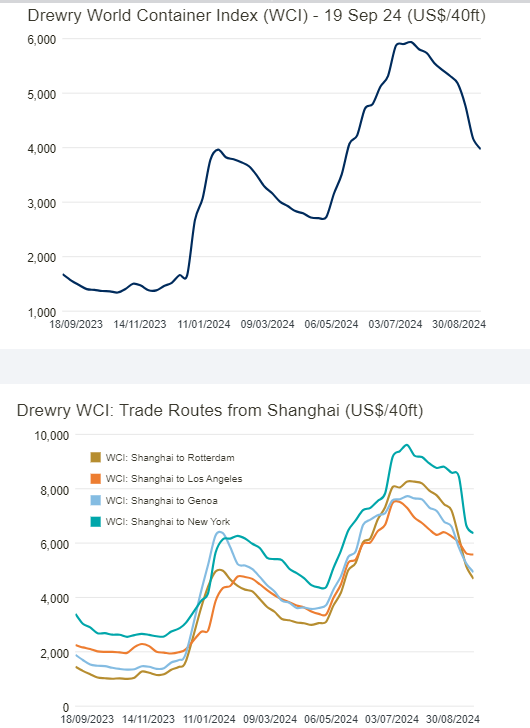

Shipping prices for standard 40 ft container dropped, however shipping sector didn't react to that, because lower rates were impact especially by lower oil prices and easing geopolitical tensions; this year WCI rally wasn't driven by strengthening demand; rather by solid conditions in developed economies and risk factors. Source: Drewry

MAERSKB.DK

Maersk stock price rises today above EMA200, located at 11284 DKK. Next important resistance zone is located now at 12607 DKK, at 61.8 Fibonacci retracement of the upward wave since 2020.

Source: xStation5

Source: xStation5

Gaming companies with huge discounts 🚨 Will Project Genie end the traditional era of gaming ❓

Lockheed Martin earnings: The peak of global tensions and valuations

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

Apple’s Record Quarter: iPhone, Services, and ‘Invisible’ AI. Is a Return to the Throne Imminent?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.