Today's inflation data in the USA exceeded expectations, triggering a necessary market correction. The data showed an average consumer price increase of 3.1% year-over-year and, excluding energy and food prices, a 3.9% year-over-year increase. Although these actual figures were 0.2 percentage points higher than the consensus, it's not as bad a report as it seems at first glance. A detailed analysis of inflation based on the latest data is invited.

Headline and core inflation

The market reacted immediately to the data. The US500 fell below 5000 points, and the US100 below 18000 points, spurred by inflation figures significantly exceeding expectations. It's important to note that the consensus on Monday before the publication indicated slightly higher data at 3.0% and 3.8%, respectively, but then dropped by 0.1 percentage points for each measure to 2.9% year-over-year and 3.7% year-over-year. Compared to the previous month's report, we see a further decline in CPI inflation from 3.4% in December, while core inflation remains at the same level.

Strong US economy drives inflation?

The main contribution to inflation was again the rental housing sector, part of service inflation. However, high prices are supported by a heated market. The US economy is in excellent condition, as confirmed by the latest GDP readings. Recent PMI data also indicate a rebound in business sentiment and improving prospects. Pressure on price increases is also added by high ISM readings for prices and employment.

Services weighing on inflation?

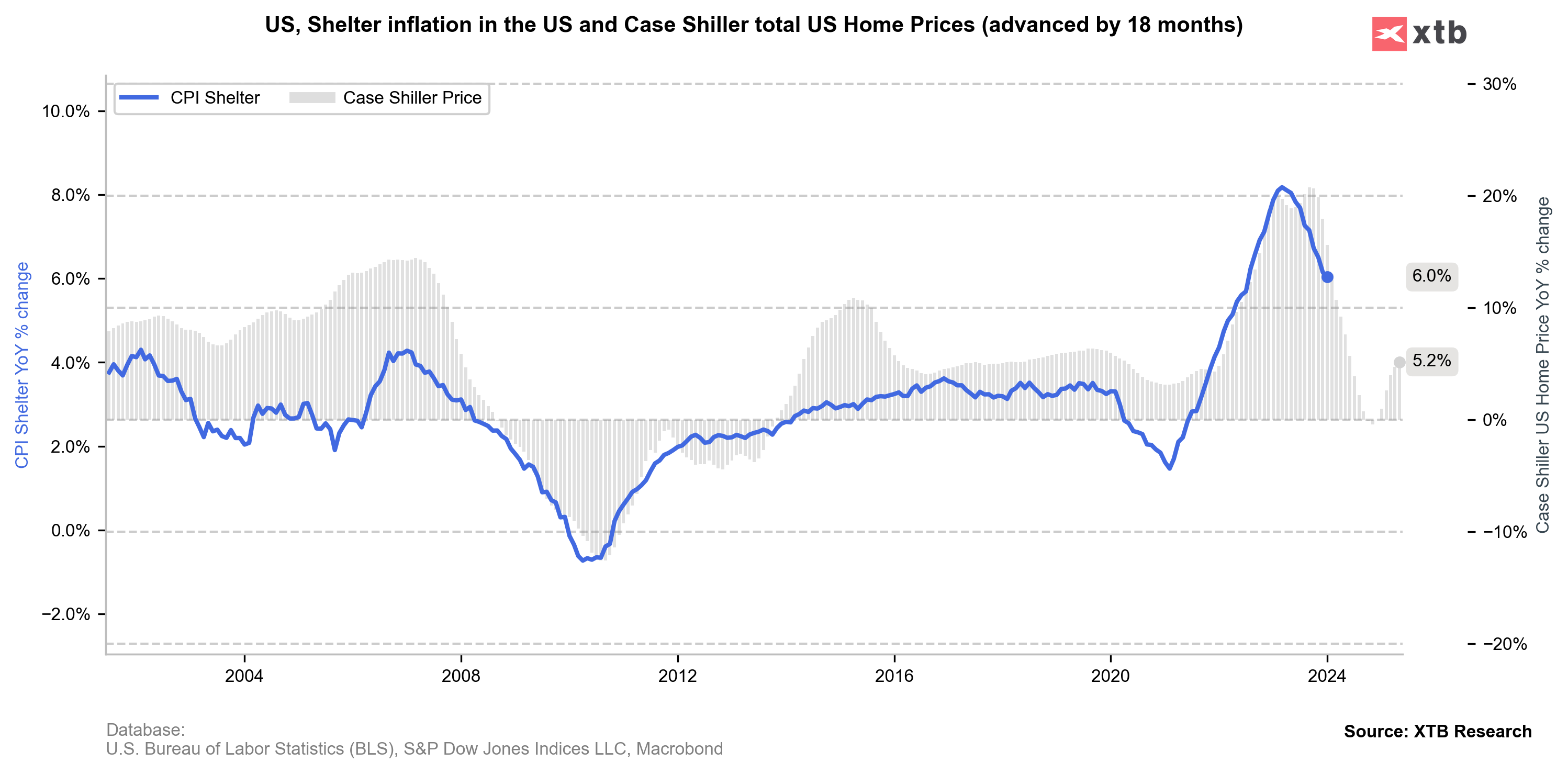

Persistent inflation in the services sector is an argument for the Federal Reserve to maintain interest rates for a longer period. Currently, rental housing prices weigh the most in the inflation basket.

However, looking at the correlation of the Shiller housing price index, we can assume that a downward trend for the rental market is inevitable. Unfortunately, we will have to wait a bit longer for this decline.

The positive news is that significant improvements are seen in other sectors, and the situation has practically returned to normal.

What do the Data Mean for the Fed?

At its last meeting, the Fed indicated that it wants to be sure about inflation before it starts lowering interest rates. The current data strongly argues for maintaining rates for longer, as reflected in current market expectations. After the publication, the dollar strengthened significantly, and bond yields also rose. Directly after the publication, expectations related to the first Fed rate cuts fell to just under 100 basis points in 2024, compared to 125 basis points before the report. Consequently, the first interest rate cut has been moved from June to July, and a potential May cut is now practically excluded. For a market overheated by recent rises, this is an ideal catalyst for at least a short-term correction. On the other hand, we are still waiting for a report from Nvidia, which could again stimulate high investor expectations and drive further rises in BigTech companies.

CPI OVERVIEW: Further Disinflation Puts Fed In Comfortable Position 🏦

BREAKING: US CPI below expectations! 🚨📉

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.