Cryptocurrencies opened Monday’s trading session with sharp declines, as a wave of sell-offs triggered nearly $1.7 billion in liquidations. The U.S. dollar index is down more than 0.2% today, but this has not translated into a rebound in Bitcoin’s price. Unlike gold—which is up over 1% to above $3,700 per ounce—Bitcoin has failed to follow the same upward trend.

Despite the lack of direct causes for this move, the “blame” can be placed on a heightened appetite for hedging against potential downturns, which has outweighed bullish bets—even in the face of a Federal Reserve rate cut and broad gains on Wall Street. Today’s cryptocurrency decline may also serve as a warning signal for the equity market. Data from Deribit signals stronger demand on hedging near $110k due to the negative dealers' gamma.

Bitcoin Under Pressure

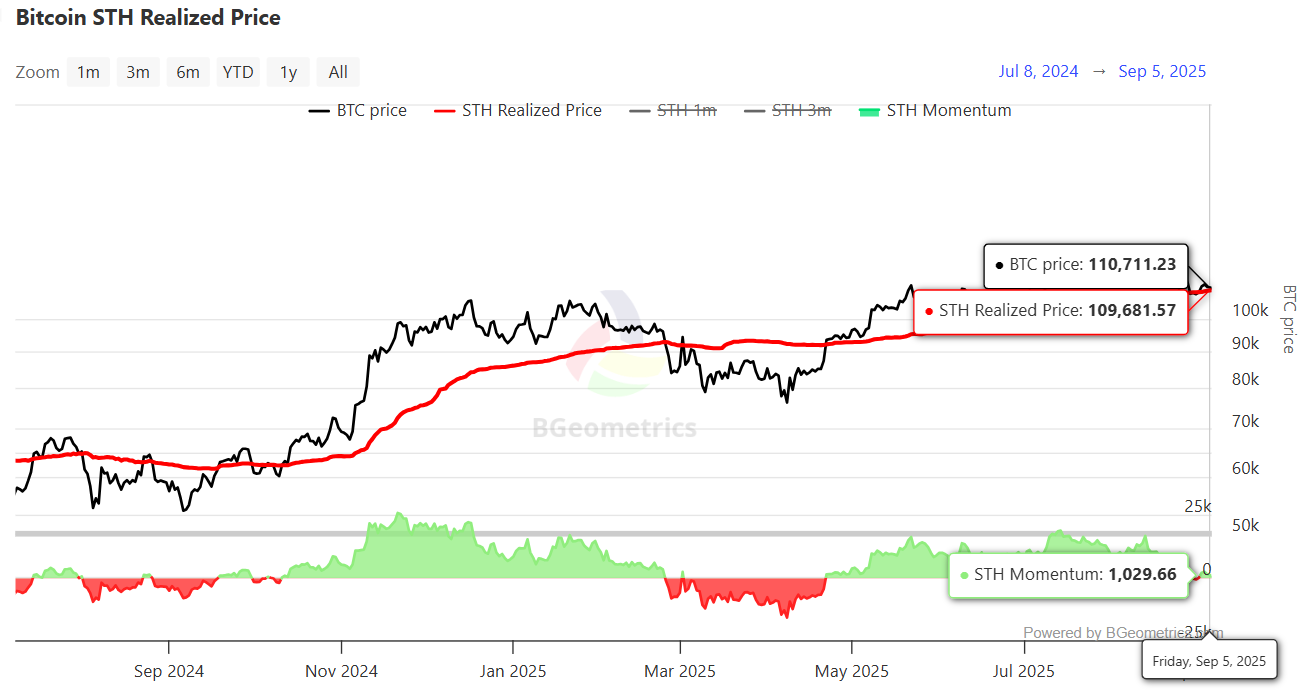

Bitcoin’s price has once again fallen back toward the average entry level of short-term investors. The key “balance” level for the market appears to be around $110,000. A drop below this threshold could trigger liquidations among short-term investors withdrawing funds from BTC, as well as a surge in demand for hedging.

Source: BGeometrics

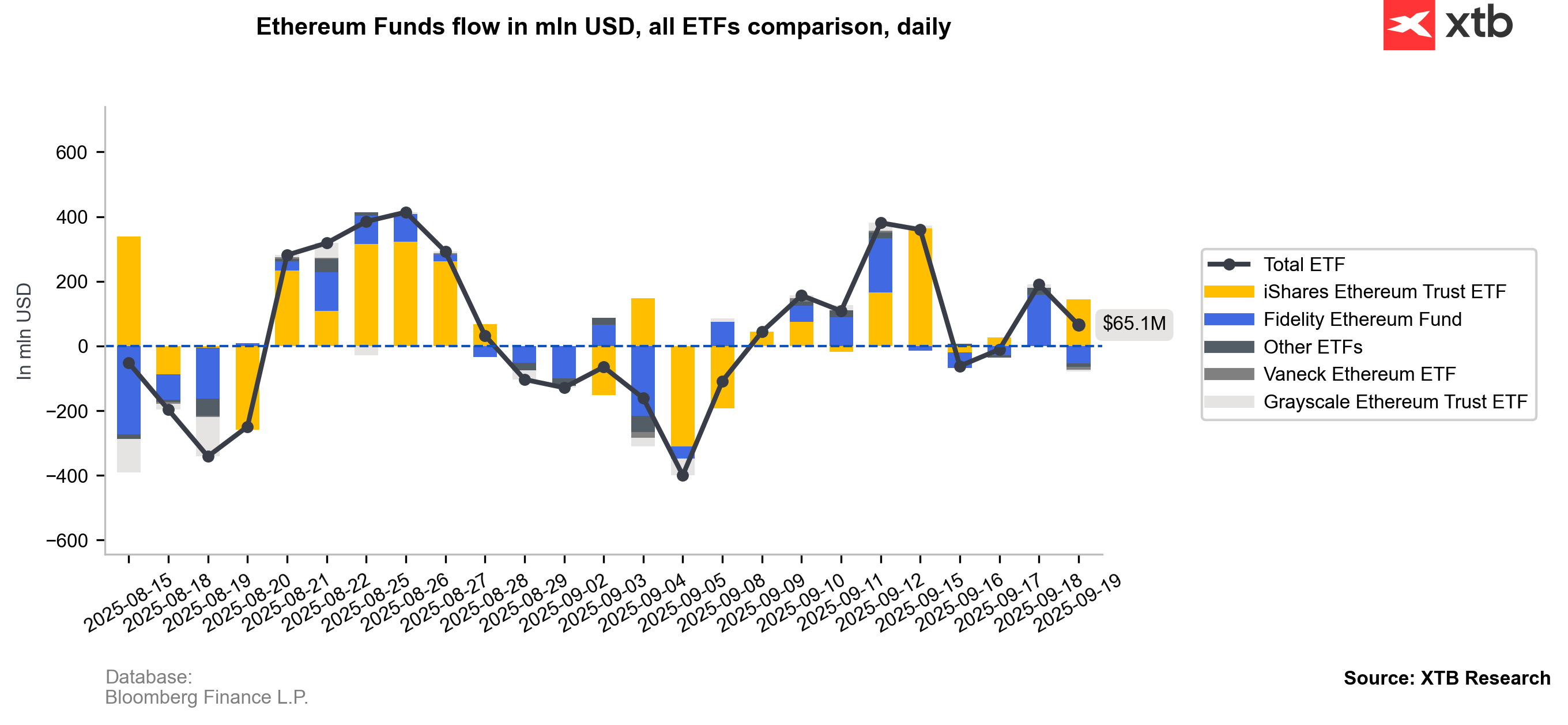

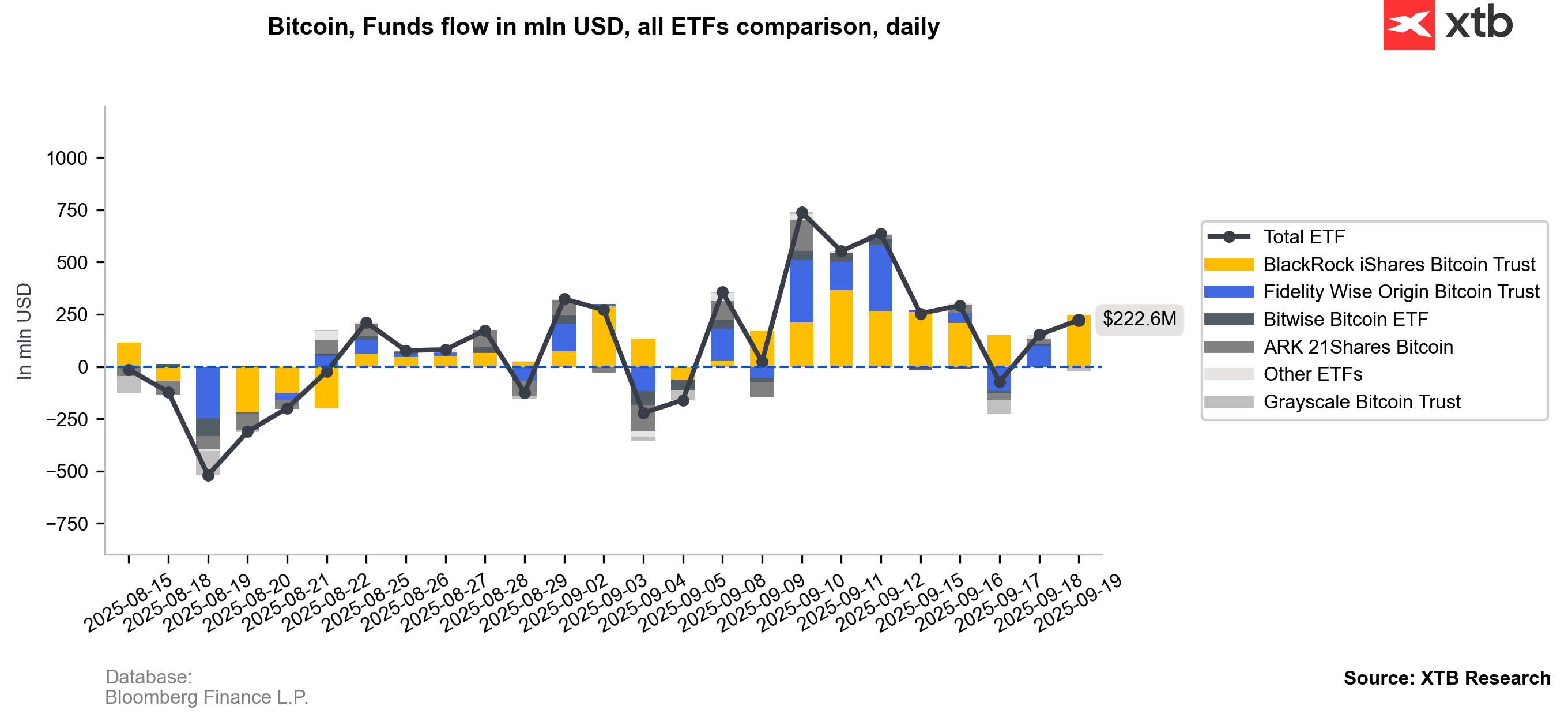

ETF Inflows Gradually Returning

Although U.S. exchange-traded funds have seen positive inflows, neither Bitcoin nor Ethereum has managed to climb to new highs. Last Thursday and Friday, following the Fed’s decision, Ethereum attracted over $130 million in inflows, while Bitcoin saw more than $300 million.

Source: Bloomberg Finance L.P, XTB Research

Source: Bloomberg Finance L.P, XTB Research

Source: Bloomberg Finance L.P, XTB Research

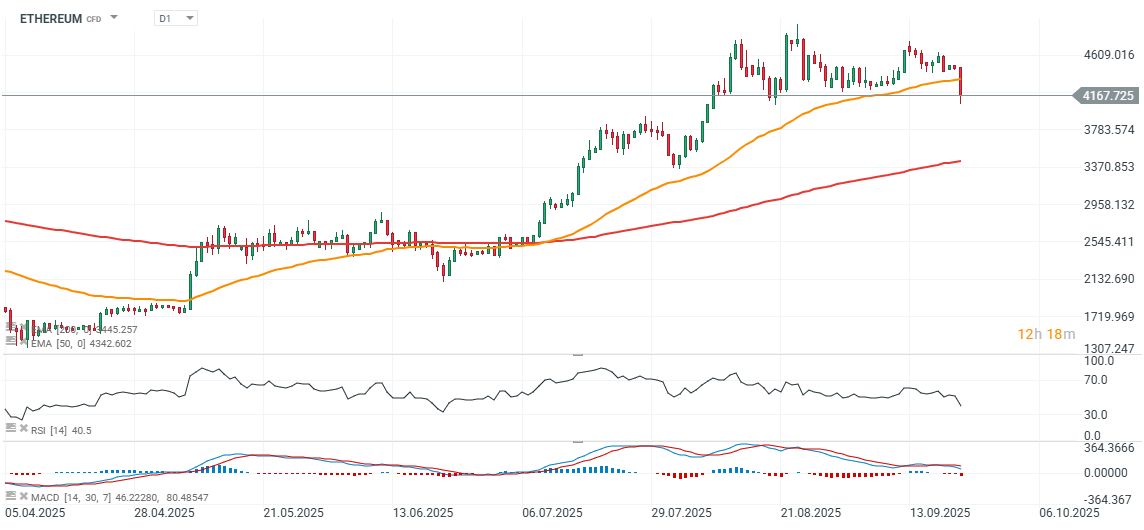

Charts (Bitcoin, Ethereum, D1 Interval)

Bitcoin pulled back to around $112,000, with key Fibonacci retracement support located near $111,000. This further reinforces the $110,000 zone as crucial for determining future momentum. A move back above $115,000 could prove highly significant from a price action perspective.

Source: xStation5

Ethereum, meanwhile, has once again tested its local lows from August 21, dropping to $4,100 per ETH.

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.